Neue Zürcher Zeitung, June 16, 2016. PDF, HTML. Ökonomenstimme, June 17, 2016. HTML. Vollgeld seems attractive because it decouples the supply of money from intermediation. By enabling everyone to use legal tender for electronic payments, electronic base money would satisfy a need. Vollgeld would prevent bank runs, at least partly; render deposit insurance unnecessary and reduce moral hazard; could help stabilize the credit cycle; and would redistribute seignorage to the central bank. But...

Read More »Science and the Senate

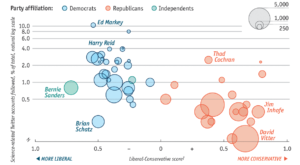

The Economist’s Graphic Detail reports about research documenting that While the Senate’s interest in science is generally quite low, Senate Democrats are three times more likely than Republicans to follow science-related Twitter accounts like NASA or the National Oceanic and Atmospheric Administration. Interest in science, the authors conclude, “may now primarily be a ‘Democrat’ value”.

Read More »Covered Interest Parity and the Risk-Taking Channel

In a speech, Hyun Song Shin points out that CIP increasingly fails to hold: the Dollar interest rate implied by FX swaps vis-a-vis the Euro, Yen, Pound or Swiss Franc is “too high.” Moreover, the deviation is negatively correlated with the Dollar’s spot exchange rate: When the Dollar appreciates, the deviation from CIP widens. Shin argues that bank behavior explains the deviation: … the US dollar is used widely throughout the global banking system, even when neither the lender nor the...

Read More »Iceland on the Way Back to an Open Capital Account

In the NZZ, Rudolf Hermann reports about Iceland’s recent steps towards removing capital controls. The article also reviews the financial crisis in Iceland. See also a previous post on capital account liberalization in Iceland and another one on the legal dispute between Iceland and the UK and the Netherlands.

Read More »Greek Debt Sustainability

The IMF’s debt sustainability analysis paints a bleak picture … about previous IMF assessments and about the prospects for Greece.

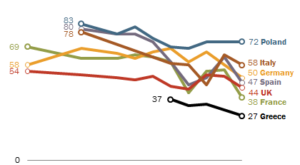

Read More »Skeptical Europeans

According to a Pew Research Center survey, Poles and Hungarians hold the most favorable view of the European Union. In most countries, attitudes have become more skeptical.

Read More »Immigration and the Brexit Debate

From The Economist’s Graphic detail:

Read More »Sovereign Debt in Bank Balance Sheets

In the FT, Martin Arnold reports about estimates by Fitch according to which European banks would have to raise up to €170bn of extra capital or sell almost €500bn of sovereign debt if regulators push ahead with plans to break the “doom loop” tying lenders to their governments … The European Commission and the European Central Bank support steps in that direction while some European governments oppose them.

Read More »Financial Transaction Tax—Stalled

In the FT, Jim Brunsden reports that the European Commission’s 2013 proposal to install a financial transaction tax has not made much progress. At least nine countries have to sign up. The report highlights that key differences remain on how to craft exemptions from the tax, including the problem of how to shield transactions in other non-participating EU countries such as Britain. Other splits concern how to protect market-making activities by banks, and also what carveouts should apply...

Read More »New Questions about Greece’s Indebtedness

On the FT’s Alphaville blog, Matthew Klein reports about discrepancies between IMF and Greek (and EU) assessments of Greek net indebtedness. The IMF appears to report lower Greek financial asset holdings than the Greek Central Bank. Matthew Klein quotes the Greek Central Bank: We would like to clarify that the Bank of Greece compiles its financial accounts, from which data on the general government’s net debt are derived, according to European standards. The Bank of Greece’s data are...

Read More » Dirk Niepelt

Dirk Niepelt