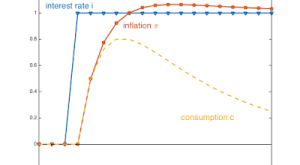

On his blog, John Cochrane offers a stripped down model and some intuition for why inflation would rise after an increase in the interest rate. The model features the usual Euler (IS) equation and a Mickey Mouse Phillips curve—inflation is proportional to consumption (or output). The intuition: During the time of high real interest rates — when the nominal rate has risen, but inflation has not yet caught up — consumption must grow faster [the Euler equation, DN]. … Since more consumption...

Read More »Condorcet vs Trump

In the New York Times, Eric Maskin and Amartya Sen explain Condorcet’s system for electing candidates who truly command majority support. In this system, a voter has the opportunity to rank candidates. Maskin and Sen’s fictitious example of the American primaries illustrates the difference between a plurality system (as used in the primaries) and a majority system a la Condorcet (where the winner is the one who defeats any other candidate in pairwise comparison). They also point out that...

Read More »IMFx

Last year, the IMF has joined the MOOC movement. On edX, the online education platform founded by Harvard University and MIT, the IMF contributes a set of “IMFx” courses developed by its Institute for Capacity Development. Courses cover Debt sustainability analysis; Energy subsidy reform; and soon Financial programming and policies (analysis and program design) as well as Macroeconomic forecasting.

Read More »GDP: Imperfectly Measured, Often Abused

The Economist recounts the reasons why the quality of GDP measurement is lacking and why GDP measures cannot answer all the questions they are used to address.

Read More »Banks Without Debt

In his blog, John Cochrane points to SoFi, a FinTech company, as proof that banking services can be delivered by institutions without the traditional characteristics of a bank. SoFi finances loans by selling equity. The loans are securitized and the cash is reinvested in loans. As John points out: A “bank” (in the economic, not legal sense) can finance loans, raising money essentially all from equity and no conventional debt. And it can offer competitive borrowing rates — the supposedly...

Read More »Charles Wyplosz on the Euro Area Crises

In his slides, Charles Wyplosz presents a narrative that emphasizes vulnerabilities and institutional failures.

Read More »Views on the Fiscal Theory of the Price Level

A conference at the University of Chicago’s Becker Friedman Institute addressed the status of the Fiscal Theory of the Price Level and the theory’s implications for current policy. Slides and papers are available on the conference website. Given that the conference was meant to resuscitate research on the FTPL and that the participants were selected accordingly, many contributions appear rather mainstream. Chris Sims worries about indeterminacy of the price level if monetary policy is...

Read More »Taxing the Rich

In Taxing the Rich: A History of Fiscal Fairness in the United States and Europe, Kenneth Scheme and David Stasavage explore the intellectual and political debates surrounding the taxation of the wealthy while also providing the most detailed examination to date of when taxes have been levied against the rich and when they haven’t. Fairness in debates about taxing the rich has depended on different views of what it means to treat people as equals and whether taxing the rich advances or...

Read More »In Switzerland, New Bank Notes Render Old Notes Invalid

In the NZZ, Thomas Fuster reports about a consequence of the introduction of new banknotes in Switzerland: Old notes become invalid after a transition period of 20 years. Nach der Emission des letzten Notenwerts einer neuen Serie kündigt die Schweizerische Nationalbank (SNB) jeweils den Rückruf der alten Serie an. Danach können die Banknoten zwar noch während zwanzig Jahren bei den Kassenstellen oder Agenturen der Nationalbank zum Nennwert umgetauscht werden. In der Folge sind die Noten...

Read More »Nevada Shell Companies, Elliott and Argentina—Some Unforeseen Consequences

In an earlier post (April 2015) I wrote: The Economist reports about Nevada shell companies. In its eternal struggle against the Republic of Argentina, Elliott Management is inquiring about several shell companies in the state. They are suspected to own funds that might have been stolen from the Republic. The hedge fund reasons that it is entitled to those funds because they belong to Argentina, and Argentina owes 2 billion dollars to Elliott according to earlier court rulings. Elliott sued...

Read More » Dirk Niepelt

Dirk Niepelt