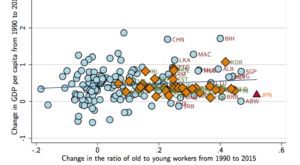

That’s what Daron Acemoglu and Pascual Restrepo document in an NBER working paper. Figure 2 [below] provides a glimpse of the relevant pattern by depicting the raw correlation between the change in GDP per capita between 1990 and 2015 and the change in the ratio of the population above 50 to the population between the ages of 20 and 49. … even when we control for initial GDP per capita, initial demographic composition and differential trends by region, there is no evidence of a negative...

Read More »Happiness

In the FAZ, molecular biologist and Tibetan monk Matthieu Ricard advises to find “happiness” (“Glück, innere Zufriedenheit”) by acquiring certain attitudes: Wir Buddhisten, aber auch Psychologen, verstehen unter Glücklichsein keinen für sich alleinstehenden Gefühlszustand, sondern eine Gruppe von menschlichen Eigenschaften. Dazu zählen innere Freiheit, emotionale Ausgeglichenheit, altruistische Liebe, Mitgefühl. Für mich kann Glück nicht eigennützig sein. Wer sich selbst die ganze Zeit...

Read More »BIS Research Review

In an Independent Review of BIS Research, Franklin Allen, Charles Bean and José De Gregorio conclude that … BIS research clearly ‘punches above its weight’ compared to its central bank peers. Finally, the relative performance of the BIS has clearly improved over the past five years, a tribute to the influence of the previous (Steve Cecchetti) and current (Claudio Borio and Hyun Shin) leadership … They recommend, among other points: The research programme should have a more clearly defined...

Read More »Redistribution at the EU Level

On VoxEU, Paolo Pasimeni and Stéphanie Riso argue that at the EU level, cross-border redistribution is limited: The EU budget accounts for roughly 1% of the EU’s GDP. Around 80% of it, on average, returns back to each country in the form of various allocated expenditures, and only a limited part is actually redistributed among countries. On average over the past 15 years, the redistribution operated by the budget at the level of the EU was equal to 0.2% of the Union’s GDP. As a matter of...

Read More »Macro Surprises and their Effects on the CHF

On VoxEU, Adrian Jäggi, Martin Schlegel and Attilio Zanetti report that the safe-haven currencies Swiss franc and Japanese yen react strongly to non-domestic macro surprises, and did so especially during the financial crisis. For European macro surprises, only German data influence safe-haven currencies.

Read More »California Fights Discrimination

To counteract discrimination against lesbian, gay, bisexual, and transgender people, the State of California prohibits state funded travel (for instance, by employees of the University of California) to states deemed to discriminate, including Kansas, Mississippi, North Carolina, and Tennessee.

Read More »“Ishmael”

In Daniel Quinn’s “Ishmael,” a gorilla offers his perspective on human civilization and the narratives surrounding it. Ishmael—the gorilla—characterizes the early agricultural revolution as the takeoff of the nowadays-dominant “Takers’” culture, a culture that does not only reject the hunter-gatherer and herder life of “Leaver” tribes but also finds it acceptable to eradicate the latter. The Takers reject the notion that man is part of a balanced, competitive and evolving natural system;...

Read More »How Derivatives Markets Responded to the De-Pegging of the Swiss Franc

In a Bank of England Financial Stability Paper, Olga Cielinska, Andreas Joseph, Ujwal Shreyas, John Tanner and Michalis Vasios analyze transactions on the Swiss Franc foreign exchange over-the-counter derivatives market around January 15, 2015, the day when the Swiss National Bank de-pegged the Swiss Franc. From the abstract: The removal of the floor led to extreme price moves in the forwards market, similar to those observed in the spot market, while trading in the Swiss franc options...

Read More »Historical Wealth and Income Data

The World Wealth and Income Database.

Read More »The Dossier

In the Tagesanzeiger, Felix Schaad offers a caricature with the title: “Donald Trump rejects the notion that he could be blackmailed.”

Read More » Dirk Niepelt

Dirk Niepelt