Swiss Franc The Euro has fallen by 0.06% to 1.0851 EUR/CHF and USD/CHF, January 6(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The global capital markets have yet to stabilize amid heightened geopolitical tension. Even though the US stock market finished last week off its lows, the sell-off continued in the Asia Pacific region. Japan’s markets re-opened after an extended holiday, and the yen, at three-month...

Read More »USD/CHF stalls three-day winning streak amid broad USD pullback

USD/CHF fails to hold onto recovery gains from multi-month lows. Doubts over Iran/Iraq’s capacity to retaliate the US might have shuffled the risk tone. Comments from the NY Fed, GT headlines add to the greenback’s weakness. USD/CHF refrains from extending the recent recovery while trading around 0.9700 during the pre-European session on Monday. The pair seems to portray the recent risk reshuffle and the US catalysts while stepping back from the weekly top. Risk...

Read More »FX Weekly Preview: High-Frequency Data may Underscore Four Thematic Points

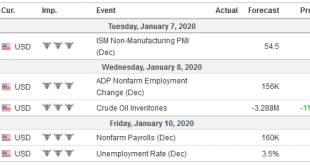

Full liquidity returns to the markets gradually in the coming days, and the week ahead culminates with the US December employment report. The highlights include the service and composite PMI readings, and December eurozone and China’s CPI. The UK reports December PMIs, November GDP, and industrial output figures. While the economic reports may pose some headline risk, the course of events suggests investors will look past the data. How the economies perform in Q1 20...

Read More »Swatch offers compromise in watch movements deadlock

Swatch CEO Nick Hayek has offered an olive branch to the competition commission. (Keystone / Salvatore Di Nolfi) Switzerland’s largest watch maker, Swatch, says it will limit the number of movements it makes for the industry in a bid to end a long-running stand-off with the anti-trust regulator. At the end of last year, the Competition Commission (Comco) temporarily suspended deliveries of watch movements from Swatch’s ETA unit to big rivals from January 1, 2020....

Read More »Is This “The Top”?

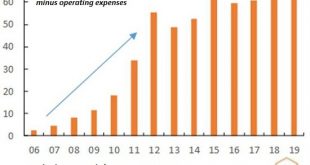

Parabolic moves end when the confidence that the parabolic move can’t end becomes the consensus. The consensus seems to be that the stock market is on its way to much higher levels, and soon. The near-term targets for the S&P 500 (SPX, currently around 3,235) range from 3,500 to 4,000, with longer-term targets reaching “the sky’s the limit.” The consensus reasoning goes like this: — Central banks can print a lot more money — Stocks rise when central banks...

Read More »EM Preview for the Week Ahead

While the global economic backdrop remains favorable for EM, rising geopolitical risks will be a growing headwind. The EM VIX surged above 18% Friday as Iran tensions escalated, the highest since early December. With these tensions likely to persist, EM may remain under some pressure for the time being. High oil prices are positive for the exporters in Latin America and the Middle East but negative for the importers in Asia and Eastern Europe. AMERICAS Chile reports...

Read More »Why Paternalists Keep Calling Us “Irrational”

Some economists, such as the 2017 Nobel Laureate Richard Thaler and his colleague Cass Sunstein, have proposed an unusual justification for government interference with people’s choices. They do not intend, they say, to override the preferences that people have. They don’t want to tell people what they “should” want, according to an external standard that people don’t accept. They claim, however, that accepting the actual preferences people have still leaves room for...

Read More »Facebook’s Libra has failed, says Switzerland’s president

© Engdao Wichitpunya | Dreamstime.com Facebook’s plan to launch its digital currency Libra is unlikely to succeed Ueli Maurer, Switzerland’s president, told SRF. Maurer doesn’t think central banks will accept the basket of currencies underpinning the cryptocurrency. “The project, in this form, has thus failed” he said. Plans for the digital currency, which is to be issued and governed by the Geneva-based Libra Association and requires Swiss regulatory approval, have...

Read More »Why the Minimum Wage Is so Bad for Young Workers

In today’s political discourse, the minimum wage is frequently mentioned by the more progressive members of Congress. On a basic level, raising the minimum wage appears to be a sympathetic policy for low-income wage earners. Often kept out of the conversation, however, are the downstream effects of this proposal. The consensus among economists has always been that a price floor on “low-skilled labor” leads to unemployment “among the very people minimum wage...

Read More »Revolutionary idea to store green power for the grid

The first commercial prototype from Energy Vault is 60 metres tall and will be built next year. (Energy Vault) Stacking blocks of concrete with a crane to store energy and use the force of gravity to keep producing electricity when renewable sources are lacking: simple but revolutionary, the battery solution proposed by the Ticino start-up Energy Vault is attracting investors and customers from around the world. What do we do when there is no sun or wind? Energy...

Read More » SNB & CHF

SNB & CHF