USD/CHF fails to hold onto recovery gains from multi-month lows. Doubts over Iran/Iraq’s capacity to retaliate the US might have shuffled the risk tone. Comments from the NY Fed, GT headlines add to the greenback’s weakness. USD/CHF refrains from extending the recent recovery while trading around 0.9700 during the pre-European session on Monday. The pair seems to portray the recent risk reshuffle and the US catalysts while stepping back from the weekly top. Risk reshuffle… Although the US and Iran are flashing signs as if they’re heading to the war, catalysts show that there are limited signs of it. First among them is France, Germany and the UK’s push for de-escalation of risks. Secondly, the Washington Post doubts the Iraqi PM’s ability to push the US out as

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF fails to hold onto recovery gains from multi-month lows.

- Doubts over Iran/Iraq’s capacity to retaliate the US might have shuffled the risk tone.

- Comments from the NY Fed, GT headlines add to the greenback’s weakness.

USD/CHF refrains from extending the recent recovery while trading around 0.9700 during the pre-European session on Monday. The pair seems to portray the recent risk reshuffle and the US catalysts while stepping back from the weekly top.

Risk reshuffle…

Although the US and Iran are flashing signs as if they’re heading to the war, catalysts show that there are limited signs of it. First among them is France, Germany and the UK’s push for de-escalation of risks. Secondly, the Washington Post doubts the Iraqi PM’s ability to push the US out as Abdul Mahdi is a caretaker PM and is not legally authorized to sign the bill into law. Third, the US President isn’t backing down and is considered to be having a great force than Iran and hence Iranian government might re-think before going on to war with the world’s largest economy.

With this, the US 10-year treasury yields are taking rounds to a monthly low near 1.77% whereas S&P 500 Futures refrain from further declines below 3,220.

Elsewhere, the US Federal Reserve (Fed) Bank of New York President John Williams recently emphasized the need to stick to a 2% inflation target. This signals a continuation of the Fed’s negative interest rate policy and weighs on the greenback. Further, China’s Global Times (GT) came out with the news that the US debt problem is out of control while citing the Federal government’s outstanding public debt that recently surpassed $23 trillion for the first time in history.

Looking forward, political headlines will keep the driver’s seat as only a few second-tier data, like the US Markit Services and Composite PMIs are up for publishing.

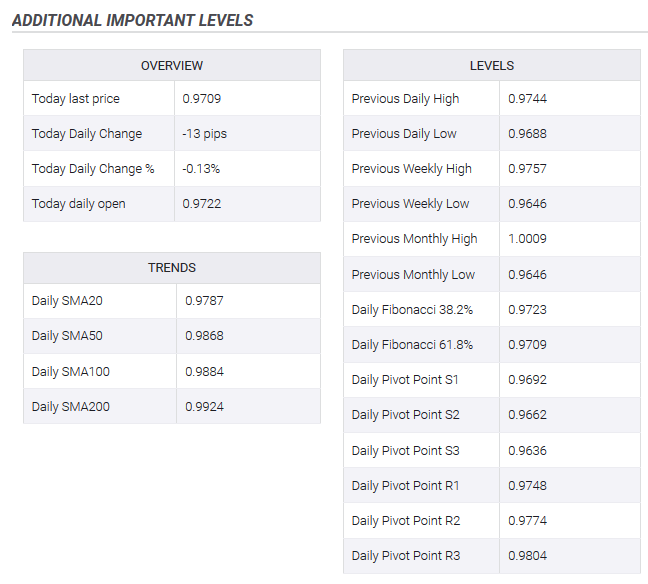

Technical AnalysisA descending trend line since late-November, near 0.9760, act as immediate upside barrier whereas the year 2019 low near 0.9650 limits the pair’s near-term declines. |

Additional important levels - Click to enlarge |

Tags: Featured,newsletter,USD/CHF