Pessimism regarding a Phase One trade deal has intensified; further muddying the waters are recent US Congressional actions FOMC minutes contained no surprises; regional Fed manufacturing surveys for November continue South Africa is expected to cut rates by 25 bp to 6.25% Korea reported trade data for the first twenty days of November; Indonesia kept rates steady at 5.0%, as expected The dollar is mostly weaker against the majors in very narrow ranges as markets...

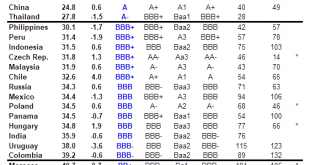

Read More »EM Sovereign Rating Model For Q4 2019

We have produced the following Emerging Markets (EM) ratings model to assess relative sovereign risk. An EM country’s score directly reflects its creditworthiness and underlying ability to service its external debt obligations. Each score is determined by a weighted compilation of fifteen economic and political indicators, which include external debt/GDP, short-term debt/reserves, import cover, current account/GDP, GDP growth, and budget balance. These scores...

Read More »Freedom Means a Right to Discriminate

Should employers have the right to discriminate in hiring on the basis of obesity? The Washington State Supreme Court recently ruled that “it is illegal for employers in Washington to refuse to hire qualified potential employees because the employer perceives them to be obese.” That follows guidelines released by the New York City Commission on Human Rights stating that discrimination against people based on their hairstyle will now be considered a form of racial...

Read More »FX Daily, November 21: Markets Hear What it Wants from China’s Chief Negotiator, but HK maybe New Obstacle

Swiss Franc The Euro has risen by 0.14% to 1.0984 EUR/CHF and USD/CHF, November 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The strongest signs to date that even phase one of a US-China trade deal is proving elusive helped spur the risk-off mood that had already been emerging. The S&P 500 fell by the most in a month (~-0.40%) yesterday, closing the gap from last week we had noted was the risk, and...

Read More »OECD rechnet für 2020 mit höherem Wachstum in der Schweiz

Vor allem der Einfluss internationaler Sportereignisse wird das Wachstum des Bruttoinlandprodukts (BIP) im kommenden Jahr ankurbeln, erklärte die OECD. Entsprechend werde es 2021 wieder auf 1,0 Prozent zurückfallen. Für das laufende Jahr erwartet die OECD eine Zunahme des BIP um 0,8 Prozent. Das Wachstum werde in Summe also moderat bleiben, resümierte die Organisation. Denn das düstere globale Umfeld und anhaltende Handelsstreitigkeiten würden den Export und die...

Read More »USD/CHF Technical Analysis: 5-week-old triangle can limit declines below 200-bar SMA

USD/CHF fails to extend uptick beyond 200-bar SMA, 50% Fibonacci retracement. The symmetrical triangle continues to favor sideways momentum. While failure to break 200-bar SMA and 50% Fibonacci retracement speaks loudly of the USD/CHF pair’s weakness, a month-old symmetrical triangle could restrict pair’s near-term moves. The quote takes the rounds to 0.9910 by the press time of the pre-European session on Thursday. Given the quote’s latest slip beneath key technical...

Read More »Factory lays off workers amid gloomy manufacturing outlook

Mikron’s factory in Agno, canton Ticino, has been hit by reduced demand from the automotive industry. (© Keystone / Christian Beutler) Swiss precision machine maker Mikron has laid off 25 workers, citing weak demand for its products from the global car industry. The news reflects pessimistic sentiment from Swiss manufacturers and the wider economy. Mikron announced on Tuesday that it would have to reduce headcount at a plant in southern Switzerland from its present...

Read More »UBS unveils Year Ahead outlook for 2020 and a ‘decade of transformation’

Zurich, 20 November 2019 – Stark political choices make the 2020 outlook more difficult to predict, but innovation driven by technology and sustainability will present new winners and losers over the decade ahead, according to UBS Global Wealth Management (GWM)’s new Year Ahead outlook. UBS GWM’s core recommendations for the year are: quality and dividend-paying stocks, as well as domestic and consumer-focused firms that are less exposed to trade and business...

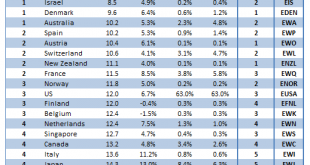

Read More »DM Equity Allocation Model For Q4 2019

Global equity markets continue to power higher US-China trade tensions have eased MSCI World made a new all-time high today near 2290 and is up 23% YTD Our 1-rated grouping (outperformers) for Q4 2019 consists of Ireland, Sweden, Israel, Denmark, and Australia Our 5-rated grouping (underperformers) for Q4 2019 consists of the UK, Hong Kong, Greece, Germany, and Portugal Since our last update on August 21, our proprietary DM equity portfolio has risen 6.7%, slightly...

Read More »CNBC is careful to admit that owning GLD is not owning gold

Chris Powell of GATA writes today about how he finds it interesting that CNBC are careful to admit that owning the GLD ETF is not the same thing as owning physical gold, a theme that has run strongly throughout our market commentaries for many years. He writes… Two cheers for today’s CNBC report celebrating the 15th anniversary of the gold exchange-traded fund GLD, since the report does not pretend that owning GLD is the same as owning the monetary metal itself....

Read More » SNB & CHF

SNB & CHF