We have just reached a new bear market due to the fears of the coronavirus pandemic. The chances are that this is your first bear market. And the chances are that you are freaking out. Today, I want to cover how to invest in a bear market and what to do when a bear market strikes. But first of all, you should focus on your health with this coronavirus. I hope you and your family are healthy! Money is useless if we are not in good health to enjoy it! Make sure you...

Read More »Government Is No Match for the Coronavirus

The coronavirus is reminding everyone that you cannot rely on government and that ultimately it is the private sector that will provide the solutions. Many nonmedical government officials and members of the media are predicting massive cases of COVID-19 and death, when in fact no one can predict the outcome. What we do know is that government has created a full-blown national panic, when at this point the normal flu season is far more deadly. Decentralization is...

Read More »FX Daily, March 19: ECB’s Bazooka Support Bonds but not the Euro

Swiss Franc The Euro has fallen by 0.32% to 1.0531 EUR/CHF and USD/CHF, March 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: It is not just that the dollar soared while stocks and bonds continued to plunge. The dollar’s strength is, in effect, a powerful short-covering rally. It was used to fund a great part of the global circuit of capital. The circuit of capital is in reverse now, and the funding currency...

Read More »Kauf von Omega Healthcare Investors – Im Aktien Crash fröhlich Einkaufen ? ?

Es geht weiter bergab im Depot und am Aktienmarkt. Ich kaufe regelmässig nach, komme was wolle. Ich nutze die Gelegenheit, um Omega Healthcare Investors günstig aufzustocken und habe mir 100 Aktien gekauft. Jetzt besitze ich insgesamt 200 Stück. Hier geht’s übrigens zum letzten Aktien Kauf Swiss Re. Kauf von Omega Healthcare Investors Ich lasse mich von der Marktlage nicht von meiner Strategie abbringen. Ich möchte langfristig regelmässig nachkaufen. Ich kaufe...

Read More »112th Annual Report Swiss National Bank 2019

The 2019 Annual Report of the Swiss National Bank is published on the SNB website. Download PDF Related posts: Swiss National Bank expects annual profit of 49 billion francs 2019-10-22 – Swiss National Bank opens SNB Forum for interested expert audience The Swiss National Bank reports a profit of CHF 51.5 billion for the first three quarters of 2019 Swiss National Bank expects profit of CHF49 billion for 2019...

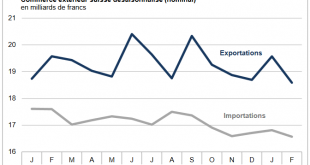

Read More »Swiss Trade Balance February 2020: decline in foreign trade

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »USD/CHF Price Analysis: Follows rising channel on H4 ahead of SNB

USD/CHF stays positive near a three-week high. The resistance line of an eight-day-old rising trend channel limits the immediate upside. 200-bar SMA offers immediate support, SNB in the spotlight. USD/CHF pulls back from the resistance line of a short-term rising trend channel while taking rounds to 0.9695, up 0.16%, during the early Thursday. In addition to the channel’s resistance, nearly overbought RSI conditions also challenge the pair’s further upside. However,...

Read More »USD/CHF Price Analysis: Dollar trading in fresh March’s highs, challenging 0.9750 level

USD/CHF is reversing up sharply from the 2020 lows. The level to beat for bulls is the 0.9750 resistance. USD/CHF daily chart USD/CHF is rebounding sharply from 2020 lows while nearing the 100 SMA on the daily chart. The demand for the greenback is dring the currency pair towards the 2020 highs. USD/CHF daily chart(see more posts on USD/CHF, ). USD/CHF four-hour chart The spot spiked to the upside while reaching new March’s highs while trading above the main...

Read More »The Global Repricing of Assets Can’t Be Stopped

All bubbles pop, period. The financial elites are pushing a narrative that asset prices, sales and profits will all return to January 2020 levels as soon as the Covid-19 pandemic fades. Get real, baby. Nothing is going back to January 2020 levels. Rather than the “V-shaped recovery” expected by Goldman Sachs et al., the crash in asset prices will eventually gather momentum. Why? It’s simple: for 20 years we’ve over-invested in speculative bubbles and squandered...

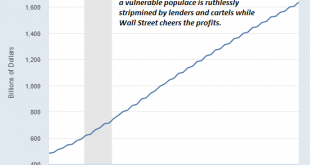

Read More »Financialization: Why the Financial Sector Now Rules the Global Economy

To read or watch the news in today’s world is to be confronted with a wide array of stories about financial organization and financial institutions. News about central banks, interest rates, and debt appear to be everywhere. But it was not always the case that the financial sector and financial institutions were considered so important. Public policy in general was not always designed with a focus toward propping up banks, keeping interest rates low, and ensuring an...

Read More » SNB & CHF

SNB & CHF