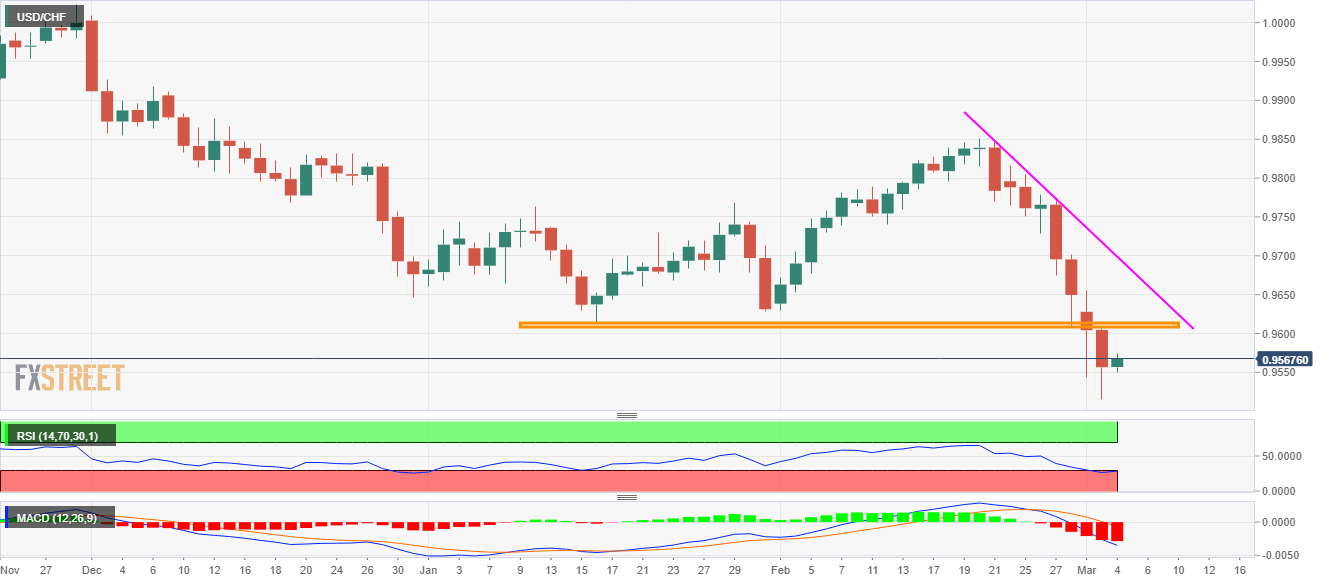

USD/CHF bounces off 23-month low amid oversold RSI. January/February bottoms could restrict immediate upside. An eight-day-old falling trend line adds to the resistance. February 2018 top seems to be on the Bears’ radar. USD/CHF recovers 0.11% from the lowest since September 2018 amid the pre-Europe session on Wednesday. With the RSI conditions oversold, the quote seems to extend the pullback towards the lows marked during January and February months of the current year. However, it’s further is less likely considering bearish MACD. If at all the buyers refrain to respect MACD and dominate past-0.9615 resistance, a short-term falling trend line from February 21, currently at 0.9700, will be important. It should, however, be noted that the pair’s sustained

Topics:

Anil Panchal considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

USD/CHF recovers 0.11% from the lowest since September 2018 amid the pre-Europe session on Wednesday. With the RSI conditions oversold, the quote seems to extend the pullback towards the lows marked during January and February months of the current year. However, it’s further is less likely considering bearish MACD. If at all the buyers refrain to respect MACD and dominate past-0.9615 resistance, a short-term falling trend line from February 21, currently at 0.9700, will be important. It should, however, be noted that the pair’s sustained trading past-0.9700 enables it to challenge the yearly top surrounding 0.9850. Alternatively, a daily closing below Tuesday’s low of 0.9515 may take a rest near 0.9500 round-figure prior to declining further towards February 2018 high near 0.9470. |

USD/CHF daily chart(see more posts on USD/CHF, ) |

Trend: Bearish

Tags: Featured,newsletter