Crispin Odey I am writing in response to the comments you made in a letter to investors yesterday, which were widely reported. You have set the gold community afire, with claims that are not new and not true. So I shall attempt to douse the flames. As everyone knows, President Roosevelt outlawed the ownership of gold in 1933. Although gold was legalized in 1975, fears linger today that the governments may repeat this heinous act. There is no reason for this fear. In 1933, Roosevelt had two monetary policy goals to accomplish by banning gold. One was to stop the run on the banks. At that time, the dollar was redeemable. You brought a twenty dollar bill to a bank, and got a gold coin of just under one ounce. Redemptions forced the banks to sell bonds to raise the

Topics:

Keith Weiner considers the following as important: 6a.) Keith Weiner on Monetary Metals, 6a) Gold & Bitcoin, blog, debasement, Diocletian, Featured, gold confiscation, inflation, Interest rates, newsletter

This could be interesting, too:

Clemens Schneider writes Café Kyiv

Clemens Schneider writes Germaine de Stael

Clemens Schneider writes Museums-Empfehlung National Portrait Gallery

Clemens Schneider writes Entwicklungszusammenarbeit privatisieren

Crispin Odey

I am writing in response to the comments you made in a letter to investors yesterday, which were widely reported. You have set the gold community afire, with claims that are not new and not true. So I shall attempt to douse the flames.

As everyone knows, President Roosevelt outlawed the ownership of gold in 1933. Although gold was legalized in 1975, fears linger today that the governments may repeat this heinous act. There is no reason for this fear. In 1933, Roosevelt had two monetary policy goals to accomplish by banning gold.

One was to stop the run on the banks. At that time, the dollar was redeemable. You brought a twenty dollar bill to a bank, and got a gold coin of just under one ounce. Redemptions forced the banks to sell bonds to raise the gold. If redemptions happened fast enough, a bank might default on its obligation, and be declared bankrupt.

The other was to lower the interest rate. All this selling of bonds pushed bond prices down, and hence interest rates up (interest moving inverse to bond price).

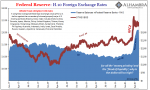

Today, the dollar is irredeemable and these two reasons are inapplicable. There are no runs on the banking system, and the Fed is having its way with interest rates.

You said:

“It is no surprise that people are buying gold. But the authorities may attempt at some point to de-monetise gold, making it illegal to own as a private individual. They will only do this if they feel the need to create a stable unit of account for world trade.”

Indeed, people are buying gold. With both fiscal and monetary policy now gone completely mad, they have good reason. But the government has no power to dictate what is money, any more than what is gravity. Money means the most marketable commodity, and the extinguisher of debt. The dollar is not a commodity, and being a credit, it cannot extinguish a debt. Money is gold, nothing else, as John Pierpont Morgan said.

Nor do they have the power to make their unit of account stable. Emperor Diocletian infamously imposed price controls. Even with the death penalty, it didn’t work. Banning gold ownership today would have no effect on prices for another reason. Prices have nothing to do with gold.

Anyways, falling interest rates put downward pressure on commodity and consumer prices (which can be counteracted by regulatory and tax burdens). Prices are now falling (despite rising regulatory burden) except for food, where the government has damaged supply chains.

Next:

“History is filled with examples where rulers have, in moments of crisis, resorted to debasing the coinage… I very much expect that the authorities will fight these prevailing trends for every inch of the way, but I also expect them to lose the fight.”

Debasement, as in the time of Diocletian, referred to reducing the gold content of a coin. People were supposed to trade the new coins, which are really worth less than the old ones, at the same value. They didn’t.

But today, there is no gold content. In that sense, the government’s paper (electronic) currency cannot be de-based. It has no “base” in the first place. The bond is paid only in dollars, and the dollar is backed only by bonds. It is self-referential, and hence its value is undefined.

An increase in the quantity of dollars is not like an increase in the quantity of debased gold coins. Dollars are credit. And borrowing more credit into existence is a different mechanism, a different cause with different effects. We are not awash with silver-coated bronze coins. We are drowning in debt.

Finally:

“Gold is the only escape from global monetising but the authorities hate gold doing well!”

Central bankers don’t think about gold. They worry all day about consumer prices, unemployment, and GDP. And to some extent, equities and properties. Greenspan and Volcker are the last two Fed Chairmen who came of age as professionals under the last vestiges of a gold standard. No one since then has a memory of it, and of course the Keynesian and Monetarist rubbish taught in economics schools says little about gold other than blaming it for the Great Depression.

But the tax authorities love when the price of gold goes up, for the same reason speculators do. With rising price comes profit-taking. People sell their gold, and the tax man takes his share.

If the government tried to confiscate gold, it would have no effect on bank solvency, interest rates, or consumer prices. No one can predict what politicians might do in the future. However, the old fears of gold confiscation are not based on solid reasoning.

© 2020 Monetary Metals

Tags: Blog,debasement,Diocletian,Featured,gold confiscation,inflation,Interest rates,newsletter