If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it. Back in March, while “it” was very obvious, even the New York Times put it the right way for once. The first part, anyway. The extraordinary actions of the Federal Reserve on Monday morning can be boiled down to two sentences: There is a rapidly developing shortage of dollars across the economy. And the Fed will do anything it needs to, on any scale imaginable,

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, bonds, currencies, Deflation, dollar shortage, economy, eurodollar system, Featured, Federal Reserve/Monetary Policy, fight to safety, global dollar shortage, inflation, jay powell, Markets, Money, money printing, newsletter, tic, U.S. Treasuries, Yield Curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

If there’s been one small measure of progress, and a needed one, it has been the mainstream finally pushing commentary into the right category. Back in ’08, during the worst of GFC1 you’d hear it all described as “flight to safety.” That, however, didn’t correctly connote the real nature of what was behind the global economy’s dramatic wreckage. Flight to safety, whether Treasuries or dollars, wasn’t it. Back in March, while “it” was very obvious, even the New York Times put it the right way for once. The first part, anyway.

Shortage of dollars. Not flight to safety. Shortage of dollars. And this was only one example. |

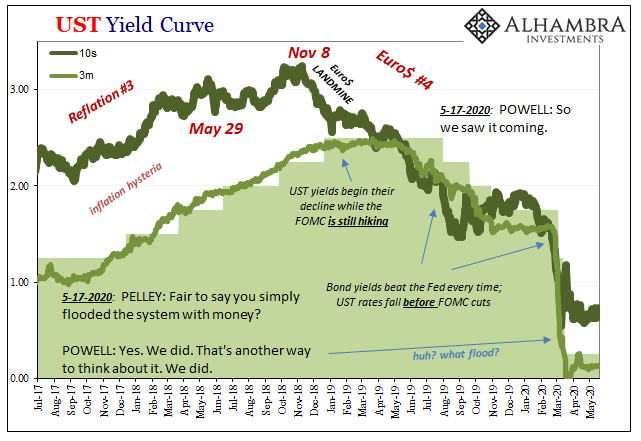

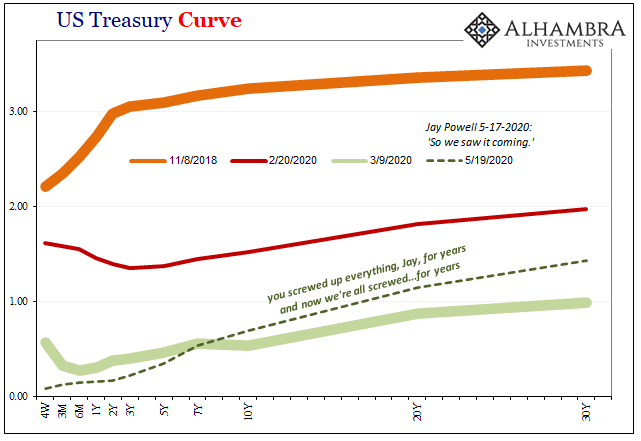

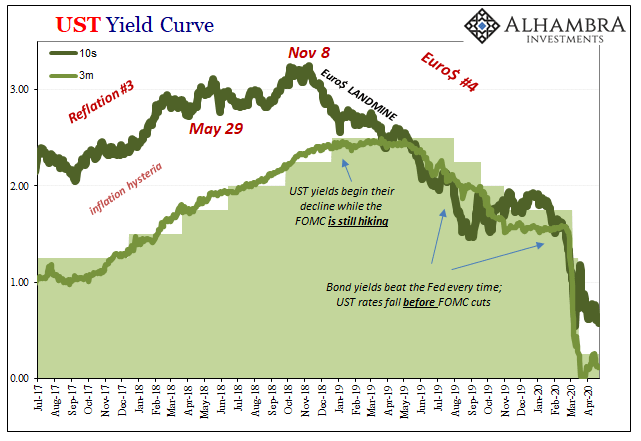

UST Yield Curve, 2017-2020 |

| A dollar shortage globally explains the rising dollar as well as bond yields, the two most prominent examples of what used to be associated exclusively with flight to safety (just wait until the NYT realizes March 2020 wasn’t the first or only time bond yields dropped and the dollar rising, and what those must mean given the whole shortage part!) There hadn’t been massive flight to safety to get away from subprime mortgages.

Getting closer on the first still leaves big problems, obviously, with the vastly more important second, the last part of the above paragraph: “the Fed will do anything it needs to.” Recognizing it as a dollar shortage as we do, now what? And no, the Fed can only try to convince you that it can meet this monetary deficiency, counting on the NYT and all media to assist, but, again, bond yields and a stubbornly high dollar say otherwise. The Federal Reserve isn’t a dollar central bank, it is a domestic banking authority that plays a central bank on TV. |

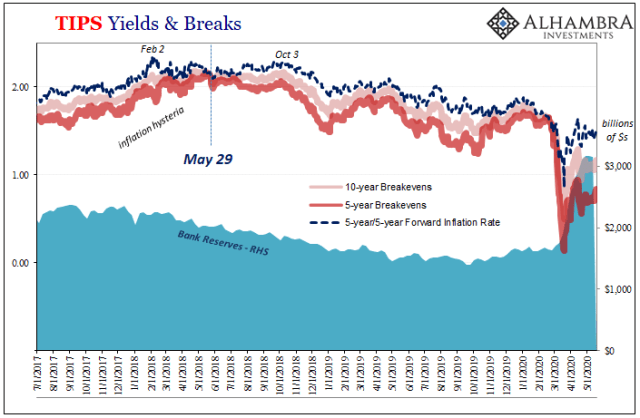

TIPS Yields & Breaks, 2017-2020 |

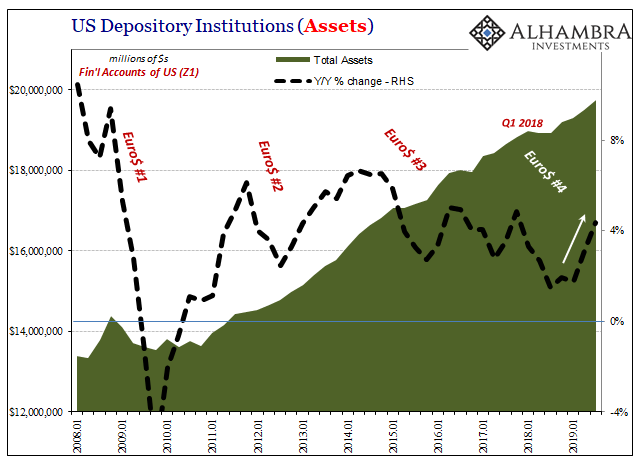

| The idea that bank reserves are inert and therefore not useful money is very difficult for most people to accept – in the financial services business first and foremost. Historical ignorance and economic illiteracy are the primary reasons, not that I blame anyone but Economists. They’ve tightly controlled both the educational and media components at all levels for a very long time so it’s not surprising that the public has been led to only believe Economists are a special kind of awesome; central bankers most of all.

If they say they are printing money, who’s to argue for the mountain of evidence stating otherwise? While the media has gone nuts with inflation stories, inflation itself remains conspicuously absent everywhere else. Some have said the Fed’s “on any scale imaginable” balance sheet actions must be in the stock market. Nope. Again psychology. Not printing, signaling to fund managers the fairy tale. Where is all that “money printing?” It must be somewhere because everyone says it has to be (just as “everyone” used to say flight to safety, so go figure when it comes to what everyone says). You can see it right on the Fed’s balance sheet. Big numbers. |

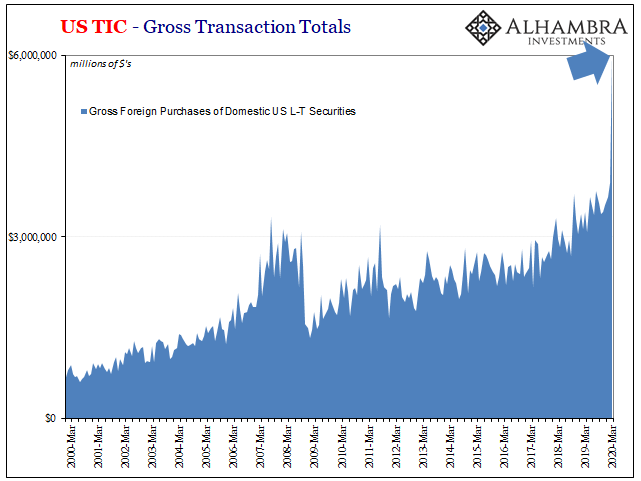

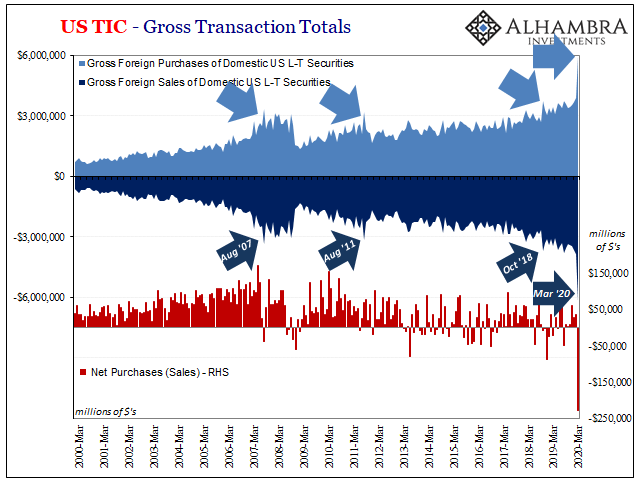

US TIC - Gross Transaction Totals, 2000-2020 |

| How about volume, especially FX volume? This idea has been gaining currency (pun intended) in recent weeks. Rather than heed all the evidence about the Federal Reserve and its pitiful puppet show display (especially the performance on Sunday) there will be any number of attempts to somehow tie something that looks like it could be money printing back to the central bank.

Volume means activity, and if there’s more volume then there’s more activity which does sound like it might possibly be related to increased monetary availability. Right? Sticking within the realm of FX, let’s use TIC – what is TIC if not the volume of gross transactions between foreigners and US participants, mostly its banks, in the trading of US$ assets? Dollar supply definitely applies in this space. Sure, enough, the March update from Treasury was a doozy. I already went through the bank data, huge spike, so here we’ll take on the other part. As you can see above, total gross purchase transactions were just above $6 trillion – a level that was almost twice the prior record. |

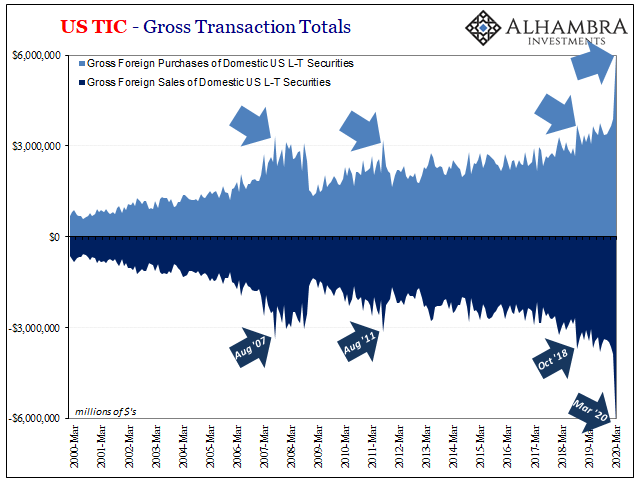

US TIC - Gross Transaction Totals, 2000-2020 |

| While we might be satisfied to see such an amazing bump and attribute it to the Fed’s “on any scale imaginable” we first have to make sure there aren’t other possible, maybe more logical explanations. There are several reasons why foreigners would be purchasing an epic amount of US assets. On the one hand, maybe they do have a lot more dollars.

On the other, maybe it’s because so many other foreigners have been left in a perilous state with so few. What I mean is:Just as the gross level of purchases was nearly twice the prior record, so, too, was March’s level of gross sales. In this case, foreigners were buying at this amazing pace because other foreigners (and domestic counterparties) were selling even faster. Volume, at least purchase volume, entirely misleading and not attributable to “money printing.” How do we know for sure? Easy. Take a look when the gross (on both sides) spikes. The months where activity ramps up to the highest extremes are most definitely not the months you associate with inflationary currency. |

US TIC - Gross Transaction Totals, 2000-2020 |

| Furious anything is most often a sign of distress and disorder. Counterintuitively, for the mainstream version, when foreigners sell the most US$ assets – primary Treasuries – it’s when the price of Treasuries like the dollar is skyrocketing. Yields falling. The stuff they used to call flight to safety.

In fact, the selling of UST’s in this context actually helps you understand how it’s global dollar shortage even though the Fed was QE-ing itself right through the whole mess. This kind of distress and disorder is what had forced Jay Powell and his group from their slumber and into equally furious use of smoke and mirrors. But, since smoke and mirrors don’t do much for a monetary system short of useful dollars, the Fed prints a ton of what its people say is money for show to the financial media but no dollars show up anywhere they’re needed. |

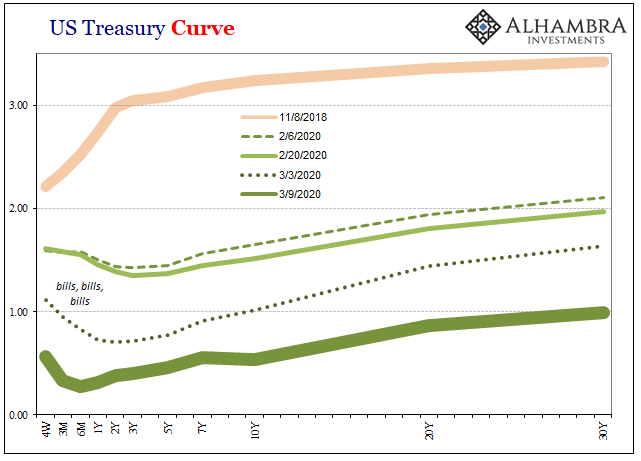

US Treasury Curve, 2018-2020 |

| In terms of TIC’s data, March 2020 was record-breaking in every major facet: record $6.03 trillion in gross purchases; record $6.26 trillion in gross sales; leaving the vastly more important net -$227.8 billion, almost three time the previous record worst month.

Absolutely massive dollar shortage. “The Fed will do anything it needs” to keep everyone from figuring out it isn’t a central bank, likewise how there’s no money in monetary policy. It’s days, however, are increasingly numbered. Some parts of the media have finally caught up to the fact that what’s behind all these messes isn’t flight to safety. And if all the things we used to connect with flight to safety – falling yields, rising dollar, obscene market volumes – are now properly classified as dollar shortage, then the last twelve years, not just March, look very different – explaining March perfectly. |

. |

Tags: Bonds,currencies,Deflation,dollar shortage,economy,eurodollar system,Featured,Federal Reserve/Monetary Policy,fight to safety,global dollar shortage,inflation,jay powell,Markets,money,money printing,newsletter,tic,U.S. Treasuries,Yield Curve