The US Vice Presidential debate was a comparatively cordial affair, though the impact on the election is likely to be limited; polls continue to move in favor of Biden, including in swing states The weak dollar narrative under a Democratic sweep continues to play out; the outlook for fiscal stimulus is as cloudy as ever; FOMC minutes contained no big surprises Weekly jobless claims will be reported; like last week, there will be a quirk to this week’s initial claims;...

Read More »Problems with Theories on the Black-White Wealth Gap

The wealth gap between white and black Americans is frequently discussed. Today it’s becoming popular to attribute disparities to black culture. Clearly all cultures are not equal, but can the subculture of some black American communities explain variations within the wealth gap? For instance, fifty people in an inner-city neighborhood may engage in maladaptive activities; however, their actions are atypical of the broader black community. Discussing this issue is...

Read More »Keith Weiner on an Economic Ray of Hope, Tho Bishop on Pence – Harris Debate

David Gornoski hosts A Neighbor's Choice LIVE 4-6pm EST. Comment below or call in at 727 587 1040.

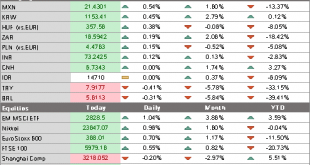

Read More »FX Daily, October 08: Markets Catch Collective Breath

Swiss Franc The Euro has fallen by 0.05% to 1.0781 EUR/CHF and USD/CHF, October 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 and NASDAQ closed at their highest levels in around a month yesterday, recouping Tuesday’s presidential tweet-driven drop. We thought the market overreacted to the end of the fiscal talks as many had already recognized that a stimulus agreement was unlikely before...

Read More »Swiss bank caught in Venezuelan money-laundering scandal

As a Swiss bank gets slapped for breaching money-laundering rules, this sculpture in Caracas pays homage to the oil workers of Petroleos de Venezuela SA (PDVSA). Keystone / Rayner Pena R The Swiss Financial Market Supervisory Authority (FINMA) has found that Banca Credinvest “seriously violated money-laundering regulations” in its handling of Venezuelan client relationships. On Tuesday the watchdog announced that it had ordered the Ticino-based bank to monitor all...

Read More »Is There Enough?

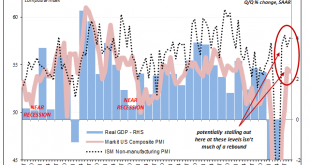

It’s just not fast enough. And with the labor market spitting out numbers across a broad economic cross-section that look increasingly tired suggesting an economy running out of momentum, there’s the added urgency of time. Late summer figures still aren’t close to where they need to be even though when you view them in isolation they can look tremendous. Start with PMI’s, a bunch of them from last week and early this week. Many are the highest in many months, years...

Read More »Is Silver about to “Pop” or “Drop”

The chart of silver at the moment shows that it is poised for a breakout move. It has failed on a number of occasions recently to close above resistance at $24.40. If we do see it closing above this level that could signal a quick move up to the next major resistance at $26.50. However it is also also finding support from the major upward trend line that has held since the March lows and a break below this could signal a retest of the recent lows (approx. $22.65)...

Read More »If the US Adopts Eurozone Policies, the Jobs Recovery Will Suffer

The best social policy is one that supports job creation and rising wages. Entitlements do not make a society more prosperous, and ultimately drive it to stagnation. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros. Original Article: “If the US Adopts Eurozone Policies, the Jobs Recovery Will Suffer“. You Might Also Like Walter Berns and the Cult of...

Read More »FX Daily, October 07: The Day After

Swiss Franc The Euro has risen by 0.18% to 1.0785 EUR/CHF and USD/CHF, October 07(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: President Trump’s tweet announced that negotiations with the House Democrat leadership had collapsed, and there will be no further talks until after the election. Many economists had been removing it from their Q4 GDP projections, but the market was caught wrongfooted. Risk came off....

Read More »EasyJet reduces fleet and cuts jobs in Switzerland

Easyjet Switzerland says it doesn’t expect a return to pre-Covid 19 business levels until 2023. Keystone / Georgios Kefalas Faced with lower demand and with no recovery expected anytime soon, EasyJet Switzerland is withdrawing two of its 12 planes stationed in Basel. Seventy jobs will be lost. Making the announcement on Tuesday, the airline company said it was consulting staff representatives on the fate of the jobs concerned. “EasyJet Switzerland has so far managed...

Read More » SNB & CHF

SNB & CHF