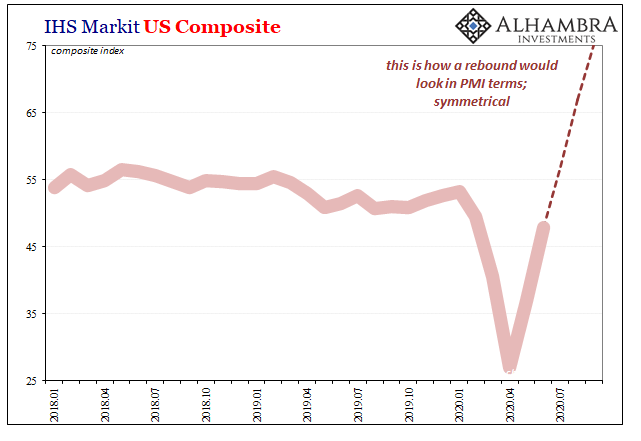

It’s just not fast enough. And with the labor market spitting out numbers across a broad economic cross-section that look increasingly tired suggesting an economy running out of momentum, there’s the added urgency of time. Late summer figures still aren’t close to where they need to be even though when you view them in isolation they can look tremendous. Start with PMI’s, a bunch of them from last week and early this week. Many are the highest in many months, years for quite a few. But matching up with early 2019 or late 2018, not even coming up as high as 2017, that’s actually trouble. And it would be that way even if following a normal downturn. After the one from Q2, it’s downright curious this absence of an unambiguously sharp upturn. IHS Markit US

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments

This could be interesting, too:

Joseph Y. Calhoun writes Weekly Market Pulse: Questions

Joseph Y. Calhoun writes Weekly Market Pulse: It’s An Uncertain World

Joseph Y. Calhoun writes Market Morsel: SLOOSing

Joseph Y. Calhoun writes Market Morsel: How “The Market” Is Really Doing

| It’s just not fast enough. And with the labor market spitting out numbers across a broad economic cross-section that look increasingly tired suggesting an economy running out of momentum, there’s the added urgency of time. Late summer figures still aren’t close to where they need to be even though when you view them in isolation they can look tremendous.

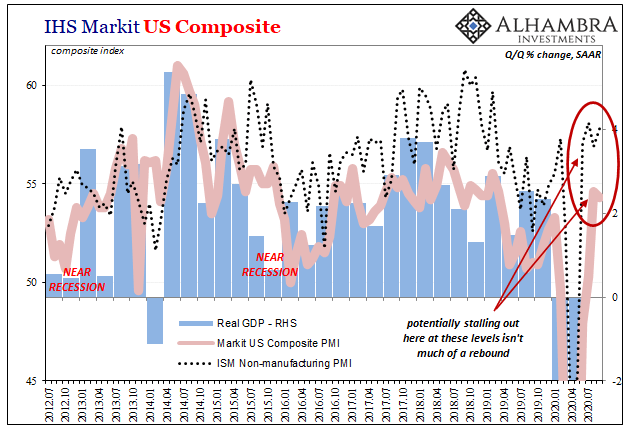

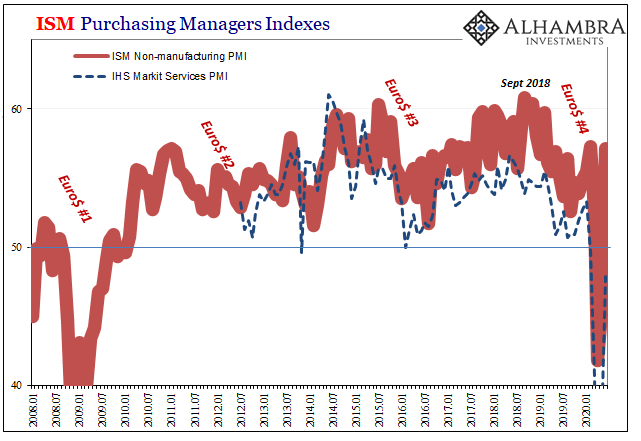

Start with PMI’s, a bunch of them from last week and early this week. Many are the highest in many months, years for quite a few. But matching up with early 2019 or late 2018, not even coming up as high as 2017, that’s actually trouble. And it would be that way even if following a normal downturn. After the one from Q2, it’s downright curious this absence of an unambiguously sharp upturn. |

IHS Markit US Composite, 2012-2020 |

| Take the best of the bunch relating to the US economy, the ISM’s Non-manufacturing index. The service sector was just slammed shut earlier this year, but now it’s been reopened for four months and more. Yet, the ISM’s estimate for it can only manage 57.8, or about the same territory as January and March 2019 – not exactly a couple of good months to be compared with.

The headlines scream how it’s best in a year and a half, but that’s totally misleading. Worse still, while the highest of the PMI’s this one was actually higher back in July; like a lot of other data, including pretty much all the most recent labor stats save the unemployment rate, they keep indicating something of a stall brewing since then. At around a level or rate that is way, way less than the economy needs. |

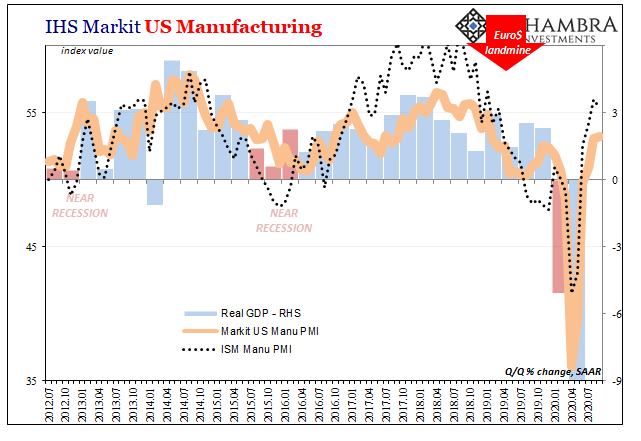

IHS Markit US Manufacturing, 2012-2020 |

| It only gets worse in manufacturing which should be flying upward after the massive crunch in between. Being stuck here unable to match even 2018 levels cries out serious deficiency.

Where are all the middle to high 60s for these things? 70s? Soft data, hard data; doesn’t matter. Turning to the latter, outside of BLS estimates and unemployment claims, let’s take a look at something like global trade. US exports continue to be seriously undermined by an entire global economy that’s obviously nowhere near V-like. Unadjusted, exports in August 2020 were still down 15% year-over-year. |

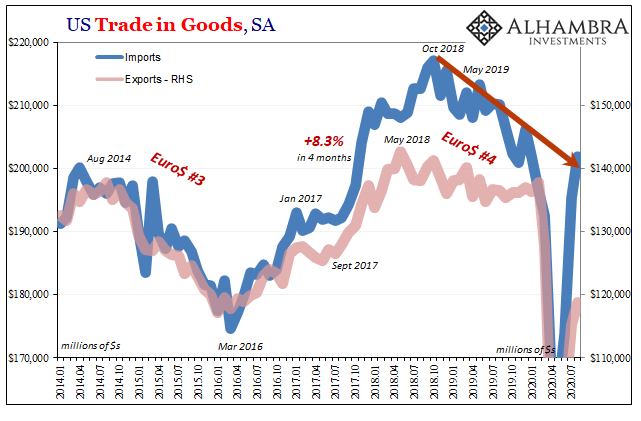

US Trade in Goods, SA 2014-2020 |

| That’s utterly atrocious; it does begin to explain some of the low 50s for manufacturing PMI’s.

Import activity has been somewhat better, thanks to the federal government’s ultra-loose cash payments. Even so, this isn’t anything like a “V”, either. Unadjusted, the total value of goods imported was down just about 6% year-over-year in August, which continues to be more mild recession than converting toward recovery (and the seasonally adjusted estimate was higher, shown below, out of line with the unadjusted but even still seriously depressed). |

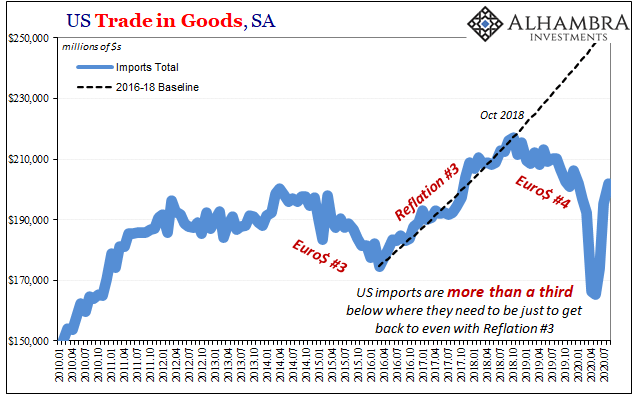

US Trade in Goods, SA 2010-2020 |

| The lack of rebound becomes even more apparent when you take into account how US demand for foreign goods (like global demand for US goods) has been stuck in a downturn for just about two years now. How can it be possible that in August 2020, imports are outrageously less than they were twenty-three months ago – and nowhere near where they should’ve been had globally synchronized growth not turned by Euro$ #4 into this globally synchronized downturn.

Like the PMI’s, these are not robust figures – though they can sound like they are and appear to be optimistic even gigantic at times if we ignore how they got that way. |

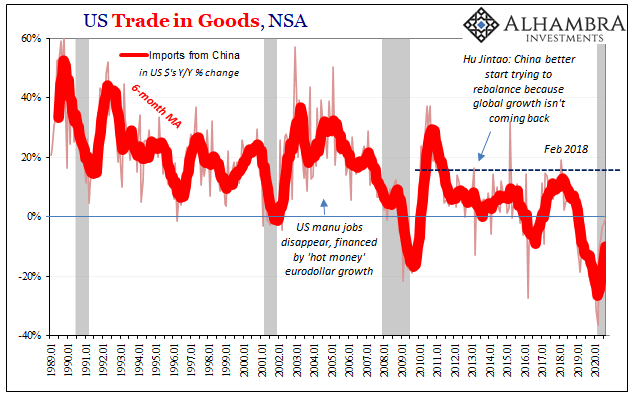

US Trade in Goods, NSA 1989-2020 |

| For instance, US imports from China were nearly flat year-over-year (unadjusted) in August. That’s the best result, the smallest contraction since December 2018. All good, right?

But being slightly less than August 2019 which had been a massive 14% less than August 2018, somehow the US is buying 15% fewer goods from China this summer than it did two summers ago even though the Chinese economy had reopened back in March after an enormous collapse, and the US economy supposedly roaring its way toward full recovery since then. These figures just don’t square with that. And China’s the best case where US imports/demand are concerned. |

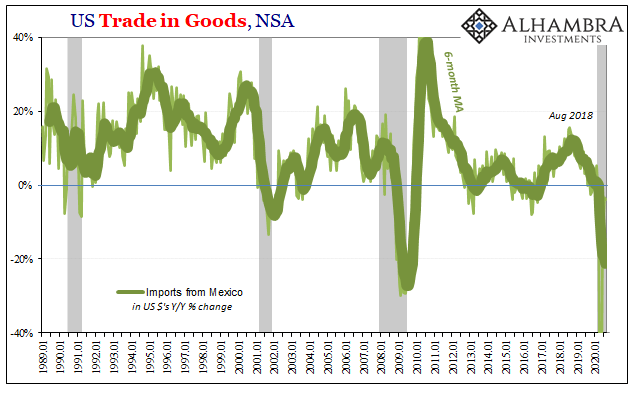

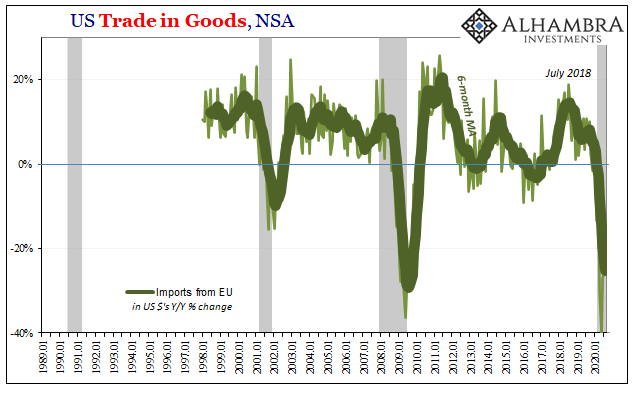

US Trade in Goods, NSA 1989-2020 |

| Those coming from Mexico are still dropping this late into the summer, while inbound trade from Europe was down more than 20% year-over-year in August. No wonder Christine Lagarde is pleading for more coordinated Continental action as well as hinting at playing around with NIRP again (as if that would do anything).

Officials’ lack of ideas is an outgrowth of what really is a lack of return to growth. |

US Trade in Goods, NSA 1989-2020 |

| Things are getting better, that much is clear and that’s not really the problem. We’ve already suffered the recession, and the world remains stuck inside of it. The original “V” scenario has already been tossed by the wayside; the idea that since this had been a non-economic shutdown, turning everything off at the flip of a (government) switch it would be just as easy to turn everything right back on.

Well, that didn’t happen. But even now as the “V” has been bent downward more on its right, what does that actually mean? For one, turning everything back on hasn’t been so easy; there are, obviously, things standing in the way. |

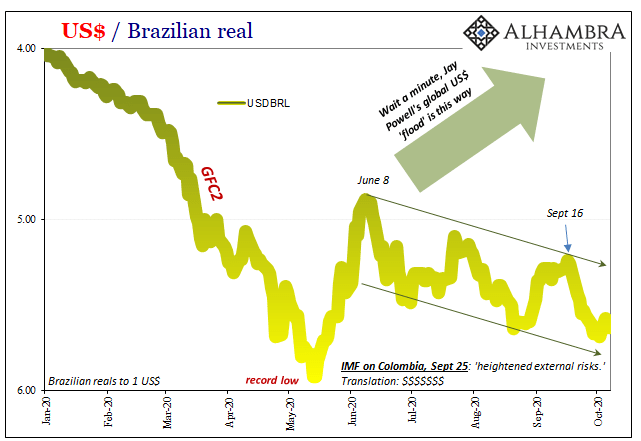

US Dollar / Brazilian Real |

| COVID, yes, but also changed behavior as well as the same stupid global dollar shortage hardly anyone accounts for given Jay Powell’s outrageous public behavior (as an outright liar). Why is global trade, especially US exports, the ultimate laggard here? That’s one key reason, the biggest. |

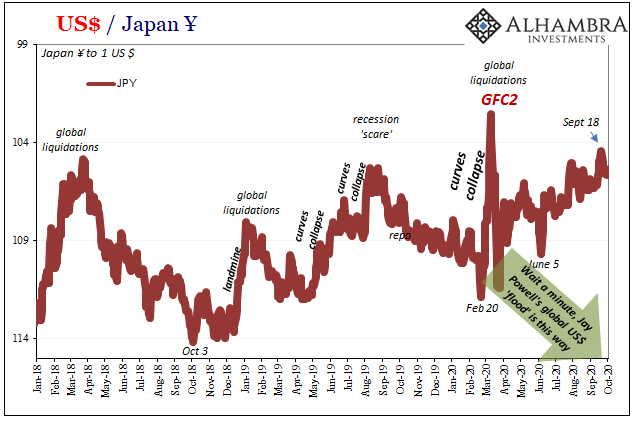

US Dollar / Japan Yen, 2018-2020 |

|

|

| But the effects of global monetary problems are not strictly for the rest of the world to sort out. As we’ve seen and documented countless times, the US economy suffers these ill-effects, too, if not always quite to the same degree nor under the same timing as everyone else.

Positive numbers, or those above 50 in the case of PMI’s, they are certainly better than alternative of negatives or sub-50. But are they enough positive and better? As of late summer, August and September, they wouldn’t even be enough if Euro$ #4 had produced a “normal” downturn and recession – let alone something like March. |

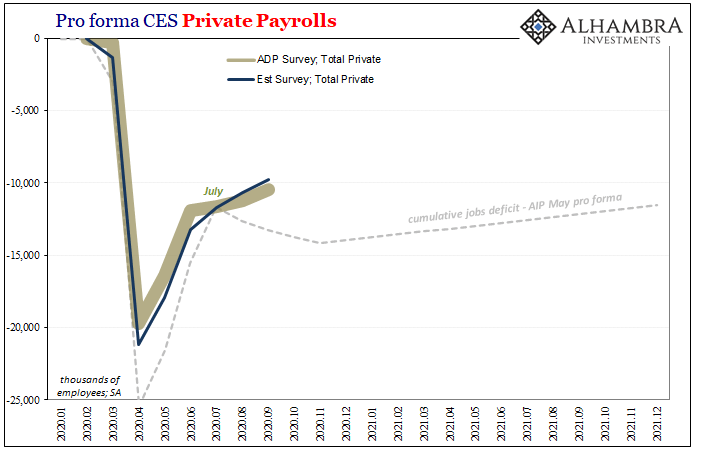

Pro forma CES Private Payrolls, 2020-2021 |

| That’s why the economy remains in a ten-figure jobs deficit after this many months with a growing list of evidence suggesting whatever momentum there had been from reopening alone it just wasn’t ever going to be enough to overcome all these other (and unnecessary) negative factors. |

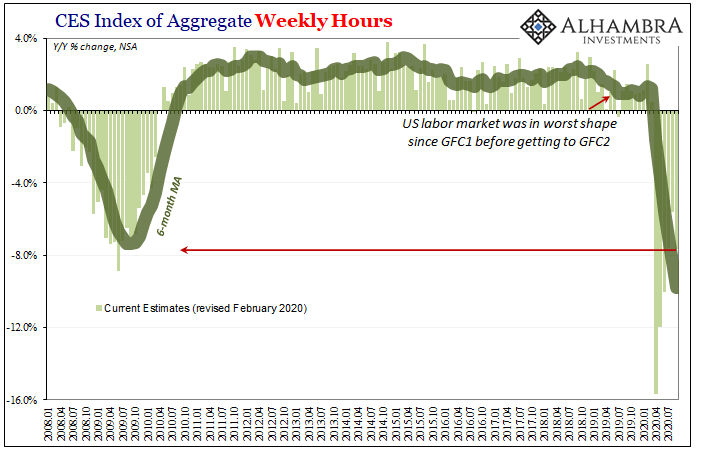

CES Index of Aggregate Weekly Hours, 2008-2020 |

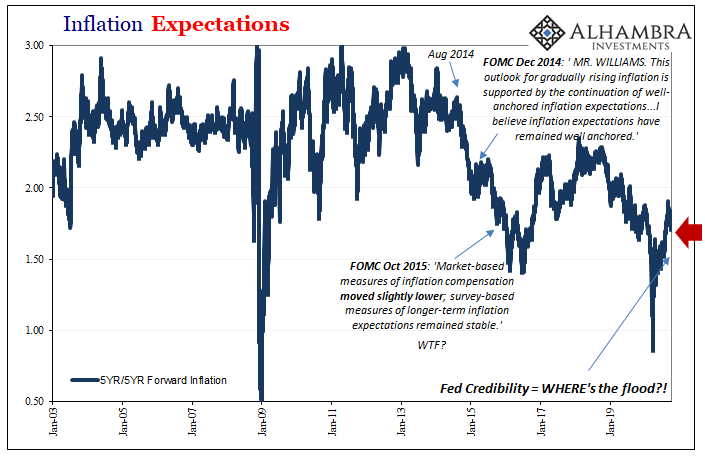

Inflation Expectations, 2003-2019 |

Tags: