Seit 2009 haben China und Hongkong den Krypto-Markt bei 19 verschiedenen Gelegenheiten “verboten” oder anderweitig für Aufregung gesorgt, Tendenz steigend. Der Bitcoin-Kurs ist kürzlich um 5 Prozent gefallen, nachdem die People’s Bank of China (PBoC) alle Kryptowährungstransaktionen für illegal erklärt hatte. Vor diesem Hintergrund sollten wir einen nostalgischen Blick auf die letzten 12 Jahre an Schlägen gegen die digitalen Währungen aus China werfen und sehen, ob...

Read More »Monetary Competition: The Best Alternative to Razing Central Banks to the Ground

[Editor’s note: Two interviews from August 1992, given by Murray Rothbard to the Swedish student publication Svensk Linje (continuously published since 1942) were recently discovered in the Rothbard Archives and translated by Sven Thommesen for the first time. In this interview, Anton Wahlman, an economist from Georgetown University School of Foreign Service, interviewed Rothbard about Sweden and European integration with the rise of the ECU (euro). The interview...

Read More »Jeff Snider: The Global Currency System that Really Matters

Tom welcomes an extremely thought provoking guest Jeff Snider to the show. Jeff flips the lid on the global shadow money system and shows us all the mechanisms and leavers that lie in the shadows. To subscribe to our newsletter and get notified of new shows, please visit http://palisadesradio.ca Inflation is understandably an emotional topic and often a difficult conversation to have. Inflation is always and everywhere a monetary phenomenon. It's usually a significant increase in prices...

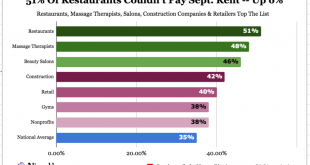

Read More »An Economy Dividing By Inventory And Labor

Is it delta COVID? Or the widely reported labor shortage? Something has created a soft patch in the presumed indestructible US economy still hopped up on Uncle Sam’s deposits made earlier in the year. And yet, there’s a nagging feeling over how this time, like all previous times, just might be too good to be true, too. To start with, the rebound from last year’s recession is decidedly, maybe even uniquely uneven. Not just explosive goods sector vs. moribund...

Read More »Kuba könnte bald Bitcoin akzeptieren

Die kubanische Regierung prüft Berichten zufolge die Anerkennung und Regulierung von Kryptowährungen als Zahlungsmittel. Nachdem El Salvador Anfang des Jahres mit der Anerkennung von Bitcoin als gesetzliches Zahlungsmittel Geschichte geschrieben hat, wächst die Zahl der Länder, die diesen Schritt nachahmen wollen, weiter. Einem kürzlich erschienenen Bericht zufolge will die kubanische Zentralbank Regeln einführen, die es dem Land ermöglichen, digitale Vermögenswerte...

Read More »Swiss health premiums to rise for many in 2022 despite average price fall

© Francisco Javier Zea Lara | Dreamstime.com Compulsory Swiss health insurance premiums are on average set to fall by 0.2% in 2022, announced the Federal Office of Public Health (FOPH) on 28 September 2021. This is the first time since 2008 that average premiums have fallen. Basic health insurance is compulsory in Switzerland and governed by federal law called LAMal. Insurers must offer basic insurance to everyone who applies regardless of their health or habits....

Read More »Analystin der Deutschen Bank: Bitcoin wird “ultra-volatil” sein, aber er ist da, um zu bleiben

Eine Analystin des globalen Bankriesen Deutsche Bank erwartet, dass Bitcoin in absehbarer Zukunft einen “First-Mover-Vorteil” gegenüber anderen Kryptowährungen haben wird. Marion Laboure, Analystin in der Research-Abteilung der Deutschen Bank, sagte, sie könne sich vorstellen, dass Bitcoin in Zukunft die Rolle von digitalem Gold einnehmen wird: jahrhundertelang haltbar und weitgehend nicht von der Regierung kontrolliert. In einem Update auf der Website der Deutschen...

Read More »The 1787 Constitution Was a Radical Assault on the Spirit of the Revolution

It was a bloodless coup d’état against an unresisting Confederation Congress. The original structure of the new Constitution was now complete. The Federalists, by use of propaganda, chicanery, fraud, malapportionment of delegates, blackmail threats of secession, and even coercive laws, had managed to sustain enough delegates to defy the wishes of the majority of the American people and create a new Constitution. The drive was managed by a corps of brilliant members...

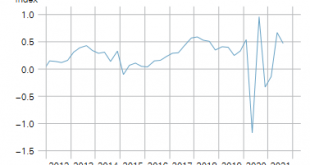

Read More »Making Sense Eurodollar University Episode 108 Part 1

Offshore shadow money funds the global economy, but it lies in the shadows; it's off-balance sheet and off-the-regulatory-radar. A good place to get a sense of offshore shadow money is the Treasury International Capital report. Jeff Snider serves as our guide through July's data - and warnings. Jeff Snider, Head of Global Investment Research for Alhambra Investments and Emil Kalinowski. Follow Twitter: https://twitter.com/JeffSnider_AIP Twitter: https://twitter.com/EmilKalinowski...

Read More »Q3/2021 – Business cycle signals: SNB regional network

The Swiss economy continued to recover in the third quarter. Turnover increased both in the services sector and in manufacturing and construction. • Despite the positive development, infrastructure utilisation remains low, especially in the services sector. The fact that international travel is still subject to major restrictions is having a hindering effect. Utilisation in manufacturing, on the other hand, is slightly higher than average, underpinned by robust...

Read More » SNB & CHF

SNB & CHF