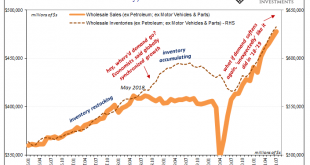

The inventory saga, planetary in its reach. As you’ve heard, American demand for goods supercharged by the federal government’s helicopter combined with a much more limited capacity to rebound in the logistics of the goods economy left a nightmare for supply chains. As we’ve been writing lately, a highly unusual maybe unprecedented inventory cycle resulted (creating “inflation”). The worse the shipping snafus, the more was ordered and piled into it – if for no...

Read More »Dubai: Krypto-Handel nach Zustimmung der Regulierungsbehörden offiziell zugelassen

Dubais Behörden haben sich zusammengetan, um die Ausgabe und den Handel von Kryptowährungen in der DWTCA-Freezone zu legalisieren. Die Dubai World Trade Center Authority (DWTCA) gab kürzlich bekannt, dass sie mit der Securities and Commodities Authority (SCA) der VAE zusammengearbeitet hat, um den Handel, die Ausgabe und die Regulierung von Kryptowährungen innerhalb ihres Zuständigkeitsbereichs – der DWTCA-Freezone – vollständig zu legalisieren. l1 DWTCA...

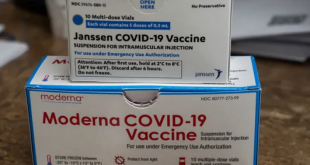

Read More »Covid: non-mRNA vaccine soon available in Switzerland

© Zhukovsky | Dreamstime.com On 29 September 2021, Switzerland’s government announced it had signed a contract with Johnson & Johnson to receive 150,000 doses of its Covid-19 vaccine. The delivery of the doses is expected next week. The viral vector vaccine will be used primarily on people who cannot receive mRNA vaccines for medical reasons. However, it will also be made available to those who prefer such vaccines, said the Federal Office of Public Health...

Read More »Chinesische Regulierungsbehörden gehen mit vereinten Kräften gegen Kryptowährungen vor

Die chinesische Zentralbank richtet einen “Koordinierungsmechanismus” mit staatlichen Behörden ein, um den Kampf gegen Kryptowährungen fortzusetzen. Die chinesische Regierung geht mit größerer Ernsthaftigkeit gegen die Kryptowährungsindustrie vor, da die staatlichen Behörden ihre Kräfte bündeln, um Kryptooperationen im Land zu bekämpfen. Die People’s Bank of China (PBoC) kündigte am Freitag offiziell eine Reihe neuer Maßnahmen zur Bekämpfung der Krypto-Adoption in...

Read More »Yes, the US Government Has Defaulted Before

The regime is trying to whip up maximum hysteria or the chances that the US government could default on its debts if the debt ceiling is not raised. So far, the financial markets don’t seem to care that much, as ten-year Treasurys over the past week have barely risen above 1.5 percent, and not even matched last March’s recent high. Investors seem pretty confident that the world will still exist, even after default. But the media and Democratic politicians assure us...

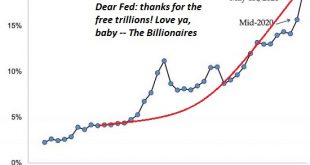

Read More »The Market Crash Nobody Thinks Is Possible Is Coming

The banquet of consequences is being served, and risk-off crashes are, like revenge, best served cold. The ideal setup for a crash is a consensus that a crash is impossible–in other words, just like the present: sure, there are carefully measured murmurings about a “correction” but nobody with anything to lose in the way of public credibility is calling for an honest-to-goodness crash, a real crash, not a wimpy, limp-wristed dip that will immediately be bought. What...

Read More »The Fed’s ‘Dangerous’ Path Toward Debt Monetization

A prominent U.S. Senator just called the head of the nation’s central bank “dangerous.” Unfortunately, the true dangers of U.S. monetary and fiscal policy were lost on everyone involved. On Tuesday, Federal Reserve Chairman Jerome Powell testified before the Senate banking committee, where Senator Elizabeth Warren led the left wing of the Democratic Party’s attack. “Over and over, you have acted to make our banking system less safe. And that makes you a dangerous man...

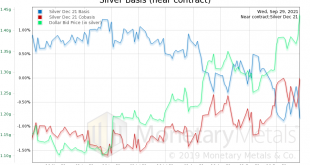

Read More »Silver Crash Makes Silver Trash?

The price of silver dropped a dollar, or over 4% on Wednesday. Some voices in the precious metals press want you to think that there is only one conceivable cause. We should coin a term for this form of logical fallacy: argumentum ad ignorantia. This is an argument of the form: “the cause must be XYZ, as I cannot conceive of anything else.” The Same Old Song and Dance In this case, XYZ is that the alleged cartel, the bullion banks and/or central banks, sold silver...

Read More »US charges Swiss finance firm and six people with tax evasion

The US still suspects some elements of the Swiss financial centre of helping tax evaders. © Keystone / Ti-press / Alessandro Crinari Six people and a Swiss financial services firm have been charged in the United States with helping clients evade taxes on $60 million (CHF56 million) of assets. They are accused of setting up an elaborate scheme, known as the “Singapore Solution”, to funnel money out of Switzerland, through structures in Hong Kong and Singapore, and...

Read More »Tom Brady will einen Teil seines Gehalts in Kryptos erhalten

Der siebenfache Super-Bowl-Sieger Tom Brady glaubt, dass die Zukunft der digitalen Technologie gehört. Der legendäre Football-Spieler Tom Brady hat einmal mehr seine Unterstützung für die digitale Asset-Industrie demonstriert. Er sagte, er würde einen Teil seiner Einnahmen gerne in Bitcoin (BTC), Ethereum (ETH) oder Solana (SOL) Token erhalten. l1 Das digitale Zeitalter ist da Tom Brady – der siebenfache Super-Bowl-Champion und wohl einer der größten...

Read More » SNB & CHF

SNB & CHF