Overview: Speculation that a midday statement by China's Politburo signals new efforts to support the economy ahead of next week's holiday appears to have stirred the animal spirits. The unusual timing of the statement helped spark a rally in Asia-Pacific that lifted most of the large market by more than 1%. Europe's Stoxx 600 has nearly completed the gap created by Monday's sharply lower opening. It is rising for the third consecutive session. US futures are,...

Read More »Doom Porn and Empty Optimism

If we can’t discern the difference between doom-porn and investing in self-reliance, then solutions will continue to be out of reach. I’m often accused of calling 783 of the last two bubble pops (or was it 789? Forgive the imprecision). Like many others who have publicly explored the notion that the status quo isn’t actually sustainable despite its remarkable tenaciousness, I am pilloried as a doom-and-gloomer (among other things, ahem). Fair enough, and I’m fine...

Read More »The New World Order and Dehumanization on the Left and Right

Bob critiques the economic views of Yuval Harari, who predicts “useless people” because of technological advances. Bob then showcases similar thinking from right-wingers. He ends by addressing a common critique of the Christian God. Mentioned in the Episode and Other Links of Interest: Part 1, Part 2, Part 3, Part 4, and Part 5 of the BMS series on Klaus Schwab and the Great Reset Bob’s book with Silas Barta on Understanding Bitcoin Source for NWO compilation...

Read More »Is Putin Right About a U.S. Proxy War?

On the surface of things, it appears that Russia is at war with Ukraine. But Russian president Vladimir Putin is saying that in actuality it is the United States that is warring against Russia and is simply using Ukraine as a proxy to conduct that war. Putin, therefore, is also saying that given that the United States is waging war against Russia, the possibility of nuclear war continues to rise with each passing day. That raises an important question for the...

Read More »Mass Adoption für Bitcoin in Zentralafrika

Das nächste Land hat Bitcoin als legales Zahlungsmittel anerkannt. Dabei handelt es sich um die Zentralafrikanische Republik. Das dafür notwendige Gesetz wurde gestern, dem 27. April, verabschiedet. Und es betrifft möglicherweise auch anderen Cryptocoins. Bitcoin News: Mass Adoption für Bitcoin in ZentralafrikaAus dem Präsidentenhaus wurde dazu eine offizielle Pressemitteilung veröffentlicht:? Official press release from the Central African Republic states Bitcoin is...

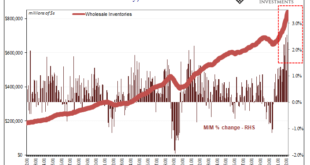

Read More »Historic Inventory Continued In March, But Is It All Price Illusion, Too?

The Census Bureau today released its advanced estimates for March trade. These include, among other accounts like imports and exports, preliminary results reported by retailers and wholesalers. That means, for our purposes, inventories. Oh my, was there ever more inventory. It was, apparently, widely expected that following an avalanche of goods building up over the previous five months the situation might calm down a touch. Analysts had figured wholesale...

Read More »Decentralization and the Rise of the West: The European Miracle Revisited

Decentralization has long been at the forefront of the minds of Austro-libertarians. Hans-Hermann Hoppe, for instance, appeared on Austrian television this month sharing his dream of a Europe “which consists of 1,000 Liechtensteins.” Although principally based on economic reasoning, this policy agenda emerged at least in part out of a celebration of the historiography on the “European miracle,” which posits that the West grew rich because of the existence of...

Read More »Do Conspiracies Really Exist? Murray Rothbard Thought So

The quickest way to discredit an intellectual opponent is to accuse that person of being a “conspiracy theorist.” But what happens when real conspiracies occur? Original Article: “Do Conspiracies Really Exist? Murray Rothbard Thought So” It is also important for the State to inculcate in its subjects an aversion to any “conspiracy theory of history;” for a search for “conspiracies” means a search for motives and an attribution of responsibility for historical...

Read More »Expect the Unexpected from the Fed

It has been a rough week in most markets with both equities and bonds declining sharply. Tech stocks have been pummeled with many ‘big names’ plunging more than 50% (from their 52-week high). Some of the bigger names include Zoom Video -75%, PayPal -73%, Netflix -72%, Meta Platforms (Facebook), -53%. . The equity market decline is coupled with announced layoffs. Robinhood, the popular online trading platform, announced a 9% reduction in full-time staff this week for...

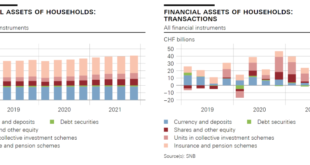

Read More »Swiss Financial Accounts: Household wealth in 2021

The Swiss National Bank is today publishing financial accounts data for Q4 2021. Data on household wealth are thus available for the whole of 2021; a commentary is provided below. This is followed by a detailed look at the development of the financial net worth of the Swiss economy’s institutional sectors since the onset of the coronavirus pandemic. Financial wealth of households increased significantly in 2021 Household financial assets increased by CHF 202 billion...

Read More » SNB & CHF

SNB & CHF