It would be very irritating to have a rally suck in all the bears salivating for a crash from a bear-market rally peak and then decimate the shorts with a rally that soars rather than collapses to new lows. As a contrarian, I’m always squinting at the consensus and wondering if it is really that easy to be right.Now that everyone is bearish for reasons we all know–global recession, a hot war, energy scarcities and stagflation– I’m thinking, you know what would be...

Read More »Nearly 1 in 6 lives in a household with outstanding debts in Switzerland

Even before high inflation hit people’s pockets many Swiss households were over extended. In 2020, almost one in six residents lived in a household with debt arrears, according to data released this week by the Federal Statistical Office (FSO). Photo by Pixabay on Pexels.com The most common overdue payments were taxes (7.5%), health insurance premiums (5.5%), phone bills (4.1%), utility bills (3.4%), credit cards and other loans (2.7%) and rent or mortgage payments...

Read More »Gas industry head warns winter supplies could be tight

Authorities have raised the spectre of winter rationing, should supplies be disrupted. © Keystone / Christian Beutler The president of the Swissgas industry platform says Switzerland is not aware of how fragile the situation is and that “it would not take much” to lead to a winter shortage. André Dosé told the External linkNeue Zürcher ZeitungExternal link (NZZ) newspaper on Thursday that looming gas shortages elsewhere in Europe and exploding prices amounted to a...

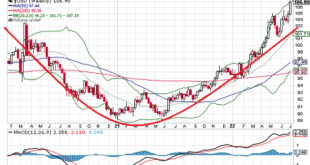

Read More »MacroVoices #331 Jeff Snider: The Eurodollar Curve Says Deflation Not Inflation

MacroVoices Erik Townsend and Patrick Ceresna welcome Jeff Snider to the show. Jeff says that monetary inflation is NOT the cause of out-of-control consumer prices, and he doesn’t see stagflation as a big risk. They discuss all of that and much more in this week’s feature interview. 00:00:00 Intro 00:17:43 Feature Interview with Jeff Snider 01:08:17 Postgame – Summer Doldrums? Download Jeff's Charts ?? https://bit.ly/3c1vHrD Download Big Picture Trading Chartbook ??...

Read More »The Market Is Playing Tug of War With the Fed

On the eve of one of the most consequential Jobs Fridays maybe ever, Jeffrey Snider says markets reflect an ongoing struggle between central bankers and investors. The former believe they must continue on their rate-hiking path. The latter, particularly bond investors, are showing far greater concern about economic growth. Snider, the chief strategist for Atlas Financial and the co-host of the popular Eurodollar University podcast, notes that multiple indicators, including eurodollar...

Read More »The Precarious State of the Economy — Are we in Recession? Feat Marc Chandler

Marc Chandler, chief market strategist at Bannock Burn Global FX, joined the Contrarian Investor Podcast to discuss the precarious state of markets. Here he answers the question on whether we are in a recession at present. Recorded July 5, 2022 and made available to premium subscribers that same day. Become a premium subscriber here: https://contrarianpod.substack.com Listen to the full podcast here:...

Read More »Auszahlungsschwierigkeiten bei Crypto.com verneint

Crypto.com ist in den letzten Monaten nicht mehr aus den Schlagzeilen gekommen. Nachdem die großzügigen Zinsen und Cashback-Angebote viele Nutzer zur Plattform brachten, startete Crypto.com auch eine intensive Marketingkampagne, die unter anderem zur Umbenennung der Sporthalle der L.A. Lakers in Crypto.com Arena führte. Doch zuletzt waren es vor allem negative Schlagzeilen, die im Zusammenhang mit dem Anbieter die Medien dominierten. Crypto News:...

Read More »Johnson Resigns, but Still not Clear if He Controls the Timing

Overview: The resignation of a UK prime minister makes for high political drama, but the markets hardly moved on it. Sterling, like most of the major currencies, are recovering against the dollar today. UK equities are higher but are not really outperforming their peers. Asia Pacific bourses rallied, with Taiwan leading the way with a 2.5% surge. Europe’s Stoxx 600 is up 1.4% after yesterday’s 1.65% gain. US futures are around 0.25%-0.35% better. Benchmark bond...

Read More »Swiss inflation up again in June 2022

Photo by Ahmed Muntasir on Pexels.com On 4 July 2022, Switzerland’s Federal Statistical Office (FSO) published June inflation data, which show prices 3.4% higher than one year ago, well above the Swiss National Bank target of 2.0%. Switzerland’s consumer price index (CPI) increased by 0.5% in June 2022, less than the 0.7% rise in May 2022. At the end of May 2022, annual inflation was 2.9%. By the end of June 2022 it was 3.4%, the highest since 1993. Big drivers of...

Read More »Wasting Money on Medicare

How would you like to waste a lot of the money you spend on Medicare coverage and miss a bunch of the benefits Medicare provides? Crazy question. But that’s exactly what’s happening to millions of Medicare beneficiaries. In October 2021, the insurance website MedicareAdvantage.com published the results of its most recent survey of Medicare beneficiaries. What it found was disturbing. Three out of four Medicare beneficiaries describe the program as “confusing and...

Read More » SNB & CHF

SNB & CHF