The highlights of September include continued substantial rate hikes by the major central banks, save Japan. The Tories will pick a new leader, who will become the next prime minister of the UK. Italy looks determined to have a right-wing government. Sweden goes to the polls in mid-September. The price of defeating the Social Democrats, who have governed since 2014, maybe for the center-right to form an alliance with the nationalist Sweden Democrats. Like Brother of...

Read More »“War on cash” update: A brighter outlook

Part II of II, by Claudio Grass, Switzerland Finally, a victory for the State Central planners and paper pushers of all stripes are not generally known for their acumen or their ability to recognize and successfully seize opportunities in time. They always tend to lag behind more or less every other member of society: from the innovators and entrepreneurs, to the criminal masterminds, which is why all upstanding citizens still...

Read More »Börse – Zinsen, Dividenden, Wachstum: Diese Schweizer Bank-Aktien ziehen starkes Interesse auf sich

Als Dividendenzahlerin weiterhin beliebt: Die Waadtländer Kantonalbank. Die beste Jahresperformance der Schweizer Banken hat die Waadtländer Kantonalbank. Vor allem hohe Dividendenrenditen machen auch andere Schweizer Banken interessant – solange man bereit ist, auch Risiken zu tragen. Die Chefs von Schweizer Banken dürften am 16. Juni aufgeatmet haben. Was auch immer über die Pros und Cons von Zinserhöhungen gesagt wird, der Zinsschritt der Schweizerischen...

Read More »New Lockdown in China and the First Drop in South Korea’s Chip Exports in 2 years Euthanizes Animal Spirits

Overview: The precipitous fall in equities continues while the dollar remains buoyant. Nvidia’s warnings about US curbs on sales to China and the first drop in South Korea’s chip exports in two years, coupled with the largest lockdown in China since Shanghai encouraged investors to move to the sidelines. Most of the major equity markets in the Asia Pacific region were off 1-2%. The Stoxx 600 is off for the fifth consecutive session and the second session of more than...

Read More »PODCAST: Das Märchen von den begrenzten Ressourcen – von Rainer Zitelmann

Nachdem das U.S. Geological Survey nichts aus seinen früheren falschen Behauptungen gelernt hatte, sagte es 1974, dass die USA nur noch über einen 10-jährigen Vorrat an Erdgas verfügten. … Nicht nur beim Erdöl, bei fast allen relevanten Rohstoffen taxierte der Bericht des „Club of Rome“ den Zeitpunkt ihrer Erschöpfung völlig falsch ein. Erdgas, Kupfer, Blei, Aluminium, Wolfram: Nichts davon würde man – weiteres Wirtschaftswachstum vorausgesetzt – nach den damaligen...

Read More »Swiss population urged to save energy to mitigate winter shortages

Turning down heating in households could help stave off energy rationing, the government says. © Keystone / Gaetan Bally The Swiss government has appealed to the population to save on household energy ahead of anticipated electricity and gas shortages this winter. On Wednesday, the government launched a campaign entitled “Energy is scare, let’s not waste it” along with the formation of an Energy Saving Alliance. The plans are backed by cantons, business associations,...

Read More »Gold Beats Inflation & Treasury Yields Too!

Keith Weiner and Michael Oliver return as guests on this week’s program. The U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits. The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. They can’t say that any longer because Monetary Metals now pays interest rates to small...

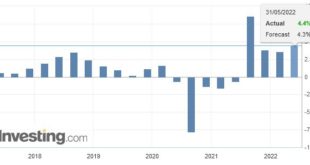

Read More »Sustained increase in Switzerland’s GDP in 2021

30.08.2022 – Switzerland’s gross domestic product (GDP) increased by 4.2% in 2021 at the previous year’s prices. This marked increase follows the decline seen in 2020 (-2.4%) due to the start of the COVID-19 pandemic. Thanks to this recovery, the GDP is above the 2019 level, although parts of the Swiss economy continued to be affected by the pandemic situation. Gross national income (GNI) at current prices increased by 5.4%. These initial estimates for 2021 from the...

Read More »Swiss Consumer Price Index in August 2022: +3.5 percent YoY, +0.3 percent MoM

01.09.2022 – The consumer price index (CPI) increased by +0.3% in August 2022 compared with the previous month, reaching 104.8 points (December 2020 = 100). Inflation was +3.5% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO).The 0.3% increase compared with the previous month can be explained by several factors including rising prices for in-patient hospital services, social protection services and...

Read More »Why I Love “Price Discrimination”

Last week, I went to a vision center to get my new eyeglass prescription filled. Because I wear progressive lenses with antireflective coating and do not have vision insurance, I anticipated that the out-of-pocket cost of the glasses would be quite high. When I entered the shop and stated my business, the manager immediately asked if I had vision insurance, and I responded that I did not. The manager consulted with a saleswoman and sent her to assist me in choosing...

Read More » SNB & CHF

SNB & CHF