Most economic commentators believe that historical data is the key in assessing the state of the economy. Thus, if a statistic such as real gross domestic product or industrial production displays a visible increase, then the economy is stronger. Conversely, a decline in the growth rate says the economy is weakening. It seems that one can establish the state of economic conditions simply by looking at the data. The so-called data that analysts are examining, however,...

Read More »The Dollar: Was it the ECB and BOJ or the Bounce in Equities?

After extending its recent gains, the dollar fell sharply at the end of last week. Many factors could have sparked the pullback, including the stronger expressions of concern by Japanese officials with an implicit threat of intervention and perceptions of an increased likelihood that the ECB will deliver another 75 bp hike next month. We had anticipated that the dollar bulls would turn cautious after the ECB meeting and before the September 13 US CPI...

Read More »Swiss court gives Nord Stream 2 more time to avoid insolvency

Keystone / Jens Buettner The Swiss company behind the Russian gas pipeline Nord Stream 2 has received a four-month extension to try to repay its debts. The Zug cantonal court in Switzerland, where Nord Stream 2 AG is headquartered, granted the company a second extension, according to an entry in the Swiss Official Gazette of Commerce published on Thursday. The firm has until January 10, 2023 to turn things around and avoid bankruptcy proceedings. In May, the court...

Read More »Inflation, the Price Level, and Economic Growth: Everything the Elites Tell You about It Is Wrong

Fundamentally, inflation is fraud. The central government or bank printing more money lessens the value of the money already in circulation. A truckload of sand isn’t particularly valuable in Saudi Arabia. An increased supply of money means ultimately that prices denominated in that money will go up. Unless you are the one to receive that new money at its point of entry, and thus keep pace with the inflation, the real value of your money holdings will go down. So, in...

Read More »US CPI in Focus

The US dollar rally is of historic proportions. Its climb is relentless, though there was around a 4-7% pullback for a few weeks beginning in mid-July. Since then, the greenback has made up for lost time and appreciated to multiyear highs against most of the major currencies. The first real bout of profit-taking in nearly a month seen in recent days looks corrective in nature. The different performances cannot be entirely traced to monetary policy differences,...

Read More »Dogecoin nicht mehr in Top 10 des Marktes

Diese Woche fiel DOGE aus den Top 10. Zwar konnte der Cryptocoin im Wochenvergleich sogar leicht zulegen, aber da andere Cryptocoins ihn outperformten, liegt Dogecoin nun nur noch auf Platz 11 nach Marktkapitalisierung. Crypto News: Dogecoin nicht mehr in Top 10 des MarktesInzwischen ist der Hype abgeflaut. Nachdem unter anderem Elon Musk versuchte, den Hunde-Coin bis auf einen Dollar zu pushen, ist es mittlerweile ruhiger um DOGE geworden. Im Jahresvergleich verlor...

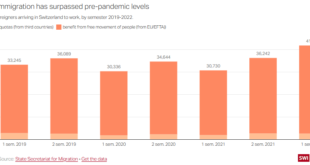

Read More »Migrant workers head back to Switzerland as Covid-19 restrictions end

Switzerland has returned as a popular destination for foreigners looking for work after two years of Covid-19 restrictions. Over 75,000 people have immigrated to Switzerland so far in 2022, driven largely by an economic boom and unemployment levels falling to a 20-year low. Alexander Thoele began working for SWI swissinfo.ch in 2002. He is of German and Brazilian origin. He was born in Rio de Janeiro and completed studies in journalism and computer science in...

Read More »We Didn’t Print Money… Honest We Didn’t And More Baseless ClapTrap from Central Banks

One of the reasons people choose to invest in gold bullion or to buy silver coins is because they are simple and they are finite; basically the opposite of fiat currency. The complexity of fiat-driven markets and infinite possibilities to create money works to the advantage of central banks. . And they particularly like to take advantage when asked by the general public a very obvious question… Central banks are on the defensive over printing too much money during...

Read More »By Compensating Slave Owners, Great Britain Negotiated a Peaceful End to Slavery

The 2018 announcement that the British government completed the payment of a loan that was borrowed to compensate slave owners for the abolition of slavery continues to evoke a flurry of emotions. Many find it outrageous that the British government would contemplate compensating planters rather than the enslaved. Such responses are expected because people are using current moral standards to judge historical realities. But an appreciation of the sociopolitical events...

Read More »BOC’s Rogers: We are not where we were in July, but a long way from where we need to be

Bank of Canada’s Senior Deputy Gov. Carolyn Rogers: We are not where we were in July, but we are a long way from where we need to be Bank has seen early signs monetary policy is working the bank still sees a path to a stop to soft landing, that’s still our objective neutral territory is a range, it’s an estimate, there is no magic formula There has been a lot of central banks speak from the Swiss National Bank to the Federal Reserve to the ECB, and now additional...

Read More » SNB & CHF

SNB & CHF