Interview Recorded - 06/09/2022 On todays episode of the WTFinance podcast I had the pleasure speaking with Jeff Snider - Co-host of the Eurodollar University podcast, Chief Strategist at Atlas Financial and one of the foremost experts on the global monetary system. During the episode we talked about misconceptions most have about the monetary system, why central banks do not make money, the Eurodollar system and what Jeff would do if he became Fed Chair. I hope you enjoy! 0:00 -...

Read More »The Worst of the Eurodollar Downturn is Still Ahead [Ep. 286, Eurodollar University]

Economic accounts are bad, worldwide. The worst is ahead of us. ****EP. 286 REFERENCES**** RealClear Markets Essays: https://bit.ly/38tL5a7 Epoch Times Columns: https://bit.ly/39ESkRf ****THE EPISODES**** YouTube: https://bit.ly/310yisL Vurbl: https://bit.ly/3rq4dPn Apple: https://apple.co/3czMcWN Deezer: https://bit.ly/3ndoVPE iHeart: https://ihr.fm/31jq7cI TuneIn: http://tun.in/pjT2Z Castro: https://bit.ly/30DMYza Google: https://bit.ly/3e2Z48M Reason: https://bit.ly/3lt5NiH Spotify:...

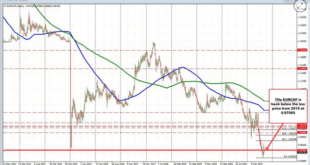

Read More »Sharp Dollar Setback may offer Bulls a Bargain

Overview: The dollar is having one of the largest setbacks in recent weeks. We expected the dollar to soften ahead of next week’s CPI, which may fan ideas/hopes of a peak in US price pressures, but the magnitude and speed of the move is surprising, and likely speaks to the extreme positioning. Still, we caution that the intraday momentum indicators are stretched, and the underlying bullish sentiment, may see North American operators take advantage of the dollar’s...

Read More »Too soon to say inflation has peaked, says SNB boss

“You cannot say we have passed the zenith and now it is certainly heading lower,” Swiss National Bank President Thomas Jordan told a Finanz and Wirtschaft financial conference on Thursday. © Keystone / Anthony Anex The president of the Swiss National Bank (SNB), Thomas Jordan, says the inflation outlook is more uncertain than normal and it is premature to say prices have peaked. “You cannot say we have passed the zenith and now it is certainly heading lower,”...

Read More »The EU’s Crisis Is Global

The EU’s crisis isn’t limited to energy. It is a manifestation of the global breakdown of Neocolonialism, Financialization and Globalization. The European Union (EU) was seen as the culmination of a centuries-long process of integration that would finally put an end to the ceaseless conflicts that had led to disastrous wars in the 20th century that had knocked Europe from global preeminence. Wary of the predations of the U.S. and rising Asian powers, European nations...

Read More »Be Sure to Read the Medicare Fine Print

Medicare. The government defines it as “The federal health insurance program for people 65 and older.” That seems simple enough. But there’s more to it than meets the eye because Medicare, like so many other things, has fine print that could end up costing you a lot of money if you don’t know about it. Since Medicare began in 1965, a myth has developed that Medicare pays for all your healthcare costs. Absolutely not true! The Medicare website says, “Original...

Read More »Inflation: State-Sponsored Terrorism

I. Introduction Remember the quaint old days of 2019? We were told the US economy was in great shape. Inflation was low, jobs were plentiful, GDP was growing. And frankly, if covid had not come along, there is a pretty good chance Donald Trump would have been reelected. At an event in 2019, my friend and economist Dr. Bob Murphy said something very interesting about the political schism in this country. He said: If you think America is divided now, what would things...

Read More »More from SNB’s Jordan: No comment on currency invention. We don’t rule anything out

Looks at series of models to gauge Swiss francs value; market has to live with some volatility no comment on currency intervention. We don’t rule anything out monetary policy cannot influence explosion and prices in case of a severe shortage the longer inflation last, the greater the risk of a 2nd round of facts having a negative impact central banks need to watch out that fiscal policy does not dictate monetary policy Meanwhile SNB’s Maechler is now joining in...

Read More »SNB’s Jordan: We must ensure price stability over medium-term

SNB’s Jordan is on the wires after the ECB hike rates by 75 basis points today: ECB 75 basis point rate hike not fully surprising We must ensure price stability over medium-term Gas or power stoppages would have devastating impact on economy’s Exchange rates play a role in inflation , when big central banks act this helps us You should not be surprised that SNB acts independently It is positive for SNB of major central banks normalize It would not create difficulty...

Read More »Social security

© Keystone / Gaetan Bally Switzerland has a social security network that covers risks in many areas – work, health, family and old age. The Swiss social security system cannot be easily compared with that found in other countries, as it comprises a variety of insurance schemes with very different mechanisms. Its funding is characterised by a relatively low use of tax revenues, a focus on individual pension plans, and the influence of private institutions....

Read More » SNB & CHF

SNB & CHF