Rep. Alex Mooney (R-WV) joined Fox Business in support of H.R. 9157, the Gold Standard Restoration Act. “The Federal Reserve note has lost more than 30 percent of its purchasing power since 2000, and 97 percent of its purchasing power since 1913,” the Congressman from West Virginia told host Kennedy. Economists have observed that the elimination of gold redeemability from the monetary system freed central bankers and federal government officials from accountability...

Read More »The Anti-Communist Interventionist Racket Continues

Nicaraguan President Daniel Ortega New Jersey Congressman Albio Sires is complaining about financial aid that international agencies are providing Nicaragua under what he says is “the pretext of poverty reduction, disaster relief and small business support.” He points to Nicaragua’s dictatorial regime headed by socialist Daniel Ortega as the reason for his complaints. Sires is right to complain about foreign aid to Nicaragua, but why limit a critique of governmental...

Read More »Switzerland Gross domestic product fell in almost all cantons in 2020

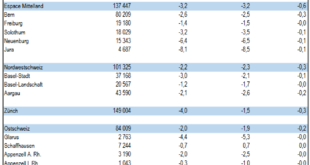

21.10.2022 – 2020 was marked by the COVID-19 pandemic, which affected the entire regional economic fabric in Switzerland. National growth in gross domestic product (GDP) fell to –2.4% at the previous year’s prices and almost all cantons recorded a decline in activity. Jura was the most affected (–8.5%), followed by Neuchâtel (–6.5%), Glarus (–5.3%) and Ticino (–5.2%). Only the cantons of Zug (1.6%) and Schaffhausen (0.7%) recorded an increase. These figures come from...

Read More »Switzerland sets out power contingency plans for winter

Energy Minister Simonetta Sommaruga presents Switzerland’s winter power reserve plans. ©keystone/peter Schneider The Swiss government has put forward plans to create reserve power plants aimed at shoring up the country’s energy supplies during the winter. The proposal to create a network of reserve plants was presented on Wednesday for a period of public consultation that will end on November 23. This follows other measures, such as increasing capacity at...

Read More »Will the FED Save the Stock Market? Jeff Snider Talks Bonds, FED Pivot, Depression, and More

Jeff Snider, EuroDollar University founder and host, and I sat down for a conversation about the FED, interest rates, the dollar crisis, and his outlook on the future of our monetary system. Jeff's work can be seen on YouTube at https://www.youtube.com/channel/UCrXNkk4IESnqU-8GMad2vyA Most notably for me, Jeff Snider told me that we've been in a discussion for the last 15 years, and that it is only getting worse, as the issues that created the 2008 crisis, were never resolved but were...

Read More »Europe’s Energy Crisis Was Created by Political Intervention

An energy policy that bans investment in some technologies based on ideological views and ignores security of supply is doomed to a strepitous failure. The energy crisis in the European Union was not created by market failures or lack of alternatives. It was created by political nudging and imposition. Renewable energies are a positive force within a balanced energy mix, not on their own, due to the volatile and intermittent nature of the technology. Politicians have...

Read More »Jeff Snider LIVE! Swap Line Deep Dive (Is This GFC 2.0?)

Take your investing to the next level. Check out Jeff's Eurodollar University at https://www.eurodollar.university/

Read More »Bitcoin ETF underperformed Year-to-Year

Mit viel Tamtam wurden Bitcoin ETFs diskutiert und eingeführt. Vor einem Jahr war es der BTC futures-based ETF, der als BITO am New York Stock Exchange gelistet wird, der mit großem Medienhype eingeführt wurde. Genau ein Jahr später hat der ETF die Erwartungen nicht erfüllt und sogar gegen den BTC selbst an Wert verloren. Bitcoin News: Bitcoin ETF underperformed Year-to-YearDer Markt hat generell im Jahresvergleich verloren. Daher überrascht es nicht unbedingt, dass...

Read More »SWISS expands capacity for summer flight schedule

Swiss International Air Lines (SWISS) is planning to expand its flight schedule next summer to offer 85% of its pre-pandemic capacity. To this end, it is now busy recruiting flight attendants. In the summer timetable, which runs from March 26 to October 28, 2023, SWISS will serve a total of 112 destinations from Zurich and Geneva, it said in a statement on Tuesday. “On the intercontinental front, the emphasis will be on the destinations in North America which are in...

Read More »Dollar Trades Above JPY150 and Truss Gets No Reprieve

Overview: China and Japan continue to struggle to stabilize their currencies, while global interest rates rise. The offshore yuan has fallen to new lows but in late dealings the onshore and offshore yuan have recovered. The dollar also traded above JPY150 for the first time since 1990 and the market knows it is on thin ice as with the threat of official intervention. A risk-off mood permeates. Equity markets have retreated in the Asia Pacific region and Europe. US...

Read More » SNB & CHF

SNB & CHF