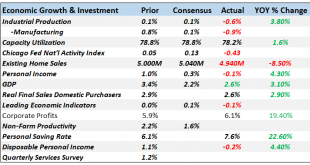

We’re changing the format on our Macro updates, breaking the report into two parts. This is part one, a review of the data released the previous month with charts to highlight the ones we deem important. We’ll post another one next week that will be more commentary and the market based indicators we use to monitor recession risk. We are still playing catch up on the economic data releases due to the government...

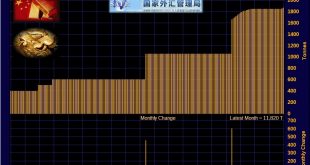

Read More »China Gold Reserves Rise To 60.26 Million Ounces Worth Just $79.5 Billion

China increased its gold reserves for a third straight month in February, data from the People’s Bank of China (PBOC) showed this morning. The value of China’s gold reserves rose slightly to $79.498 billion in February from $79.319 billion at the end of January, as the central bank increased the total amount of gold reserves to 60.260 million fine troy ounces from 59.940 million troy ounces. The People’s Bank of China...

Read More »FX Daily, March 07: EMU Looks to ECB

Swiss Franc The Euro has fallen by 0.31% at 1.1324 EUR/CHF and USD/CHF, March 07(see more posts on EUR/CHF and USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ECB meeting is today’s highlight. A dovish signal is expected. The euro remains pinned near its lows ahead it. The global equity market rally in January and February is faltering this week. Asian equities were mixed, but the...

Read More »App to help Swiss army recruits get fit

Having fit soldiers is important for the Swiss army – it means fewer injuries and fewer people dropping out. That’s why it has launched an app to get young people ready for military service. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel:...

Read More »App to help Swiss army recruits get fit

Having fit soldiers is important for the Swiss army – it means fewer injuries and fewer people dropping out. That’s why it has launched an app to get young people ready for military service. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

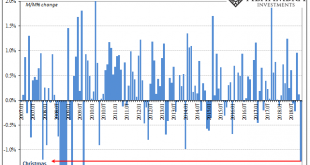

Read More »Labor Shortage America has been Canceled

The holiday season was shaping up to be a good one, perhaps a very good one. All the signs seemed to be pointing in that direction, especially if you were a worker. All throughout last year, beginning partway through 2017, there wasn’t a day that went by without some mainstream story “reporting” on America’s labor shortage. It was so ubiquitous, this economic boom idea, the media created several spinoffs. The...

Read More »Swiss National Bank releases new 1000-franc note

Fifth banknote in latest series showcases Switzerland’s communicative flair The Swiss National Bank (SNB) will begin issuing the new 1000-franc note on 13 March 2019. Following the 50, 20, 10 and 200-franc notes, this is the fifth of six denominations in the new banknote series to be released. The current eighth-series banknotes remain legal tender until further notice. The inspiration behind the new banknote series is...

Read More »Charles Hugh Smith On Debt & Demographics Leading To Government Crisis and Financial Repression

Click here for the full transcript: http://financialrepressionauthority.com/2019/03/01/the-roundtable-insight-charles-hugh-smith-on-debt-demographics-leading-to-government-crisis-and-financial-repression/

Read More »FX Daily, March 6: The Dollar Index Extends Gains into the Sixth Consecutive Session

Swiss Franc The Euro has risen by 0.02% at 1.1353 EUR/CHF and USD/CHF, March 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The capital markets are on edge. The week’s big events lie ahead. The Bank of Canada meets today and the ECB tomorrow, followed by US (and Canada) employment data on Friday. The equity markets are mixed. While Japan and Korean equities...

Read More »Going shopping with the 1,000-franc note

What happens when you try to buy a coffee, some flowers or a book with the newly designed 1,000-franc note, Switzerland's largest-denomination currency? --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website: http://www.swissinfo.ch Channel:...

Read More » SNB & CHF

SNB & CHF