Two bears transferred from a small zoo in Albania are adjusting to their new home in eastern Switzerland – the Arosa Bear Sanctuaryexternal link – after a road trip through four countries. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel:...

Read More »Albanian bears explore new Swiss sanctuary

Two bears transferred from a small zoo in Albania are adjusting to their new home in eastern Switzerland – the Arosa Bear Sanctuaryexternal link – after a road trip through four countries. --- swissinfo.ch is the international branch of the Swiss Broadcasting Corporation (SBC). Its role is to report on Switzerland and to provide a Swiss perspective on international events. For more articles, interviews and videos visit swissinfo.ch or subscribe to our YouTube channel: Website:...

Read More »FX Daily, February 05: Greenback Remains Firm

Swiss Franc The Euro has fallen by 0.04% at 1.1407 EUR/CHF and USD/CHF, February 05(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is little firmer against most of the major currencies. Despite some disappointing data (retail sales, trade, PMI), the Australian dollar has recovered from initial losses below $0.7200 on the back of the central bank’s...

Read More »Swiss firms increase EU lobbying

Uncertainty about Switzerland’s framework agreement with the EU is fueling more company lobbying in Brussels. (Keystone) Swiss companies have sharply increased their lobbying in Brussels in the face of uncertain relations with the European Union. Switzerland has more companies lobbying in Brussels than many other European countries, writes the SonntagsBlick newspaper, citing the EU’s latest transparency registerexternal...

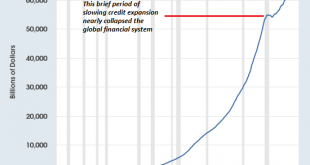

Read More »The Coming Global Financial Crisis: Debt Exhaustion

The global economy is way past the point of maximum debt saturation, and so the next stop is debt exhaustion. Just as generals fight the last war, central banks always fight the last financial crisis. The Global Financial Crisis (GFC) of 2008-09 was primarily one of liquidity as markets froze up as a result of the collapse of the highly leveraged subprime mortgage sector that had commoditized fraud (hat tip to Manoj S.)...

Read More »Tennessee Considers Removing Tax on Gold and Silver

Several bills introduced in the Tennessee legislature would eliminate sales and use tax against gold, silver, platinum, and palladium. Introduced by Representative Ron Gant (R-Rossville), House Bill 212 removes sales and use tax against platinum, gold and silver bullion, some numismatic coins, and numismatic coins sold at trade show. Senator Delores (R-Somerville) has introduced a bill, Senate Bill 333, identical to...

Read More »Who Knows the Right Interest Rate, Report 3 Feb 2019

On January 6, we wrote the Surest Way to Overthrow Capitalism. We said: “In a future article, we will expand on why these two statements are true principles: (1) there is no way a central planner could set the right rate, even if he knew and (2) only a free market can know the right rate.” Today’s article is part I that promised article. Let’s consider how to know the right rate, first. It should not be controversial to...

Read More »FX Daily, February 04: Subdued Start to Quiet Week

Swiss Franc The Euro has risen by 0.07% at 1.1411 EUR/CHF and USD/CHF, February 04(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The Lunar New Year celebration made for a quiet Asian session while a light diary in Europe saw subdued turnover. Equity markets are narrowly mixed. Among the three large markets open in Asia Pacific, Australia and Japanese equities...

Read More »Chaos-Politik der SNB mobilisiert SVP und SP: Milliarden für Vorsorge

Mit „links und rechts“ hat unsere Schweizerischen Nationalbank (SNB) ihre grosse Mühe. Da ist zunächst ihre Bilanz, bei der sie unfähig ist, „links und rechts“ voneinander zu unterscheiden. Unverstanden gerät sie nun folgerichtig auch politisch immer mehr unter Druck: konsequenterweisee von „links und rechts“. Von „links und rechts“ wird nämlich endlich gefordert, dass die SNB ihre Überschüsse aus dem Negativzins den...

Read More »No Swiss exemption from EU steel import cap

A Volkswagen employee maneuvers a steel coil in a factory in Emden, Germany The European Union is imposing limits on steel coming into the bloc from Saturday in response to US President Donald Trump’s metals tariffs. The measures will also affect Swiss steel exports to the EU. The EU said on Fridayexternal link that it is introducing new measures to prevent steel produced for the US market from flooding into Europe...

Read More » SNB & CHF

SNB & CHF