Switzerland has the densest railway network in the world. The Swiss Federal Railways (SBB) is selling its old locomotives on the Internet. Control cars, rails, switches and a firefighting train with a CHF1 million ($1 million) price tag are among the vintage vehicles on sale. You will be hard pressed to find anything for less than CHF25,000 on SBBresale.ch, according to the Sunday editions of the German-language Blick...

Read More »Competition watchdog fines car leasing companies for collusion

The firms were swapping information on rates for years, COMCO said. The Swiss competition commission (COMCO) has fined eight car leasing firms a total of CHF30 million ($30.4 million) for having swapped information on rates. The fines were announced on Thursday and come after some years of regular and systematic information exchanges between the companies on interest rates, COMCO announcedexternal...

Read More »Number below poverty line rises in Switzerland

© David Carillet | Dreamstime.com In Switzerland, the revenue poverty line is income of CHF 27,108 (US$ 27,490) a year for someone living alone and CHF 47,880 (US$ 48,550) for a family of four. In 2017, the percentage of Switzerland’s population living below the poverty line was 8.2% or 675,000 people. In 2016, the percentage was 7.6%. Those most likely to be below the poverty line are those in single parent families...

Read More »As Chinese Factory Deflation Sets In, A ‘Dovish’ Powell Leans on ‘Uncertainty’

It’s a clever bit of misdirection. In one of the last interviews he gave before passing away, Milton Friedman talked about the true strength of central banks. It wasn’t money and monetary policy, instead he admitted that what they’re really good at is PR. Maybe that’s why you really can’t tell the difference Greenspan to Bernanke to Yellen to Powell no matter what happens. Testifying before Congress today, in prepared...

Read More »WARNING!!! ?Charles Hugh Smith – US Economy Collapse: What Will Happen, How to Prepare

WARNING!!! ?Charles Hugh Smith - US Economy Collapse: What Will Happen, How to Prepare WARNING!!! ?Charles Hugh Smith - US Economy Collapse: What Will Happen, How to Prepare WARNING!!! ?Charles Hugh Smith - US Economy Collapse: What Will Happen, How to Prepare --------------------------------------------------------------------------------------------------------- ? Subscribe To My Chanel: FINANCIAL TIMES https://bitly.vn/h25 ? TAG : x22report, qanon, economic collapse 2019, dollar...

Read More »Half a million Swiss jobs vacancies predicted in 10 years

Healthcare is one of the key job sectors of the future, analysts say. Retiring baby-boomers and a shifting job market could mean a shortfall of up to 500,000 workers in Switzerland over the next decade, UBS forecasts. The bank proposes plugging the hole not only by immigration, but also by boosting more old and female workers. Basing its projections on long-term employment statistics, the bank says that the number of...

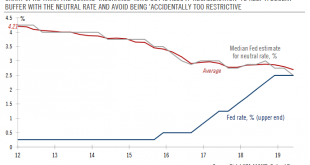

Read More »Powell’s Congressional testimony sets the scene for rate cut

The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September. During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July. Powell’s priority is to preserve the...

Read More »FX Daily, July 12: Greenback Limps into the Weekend

Swiss Franc The Euro has fallen by 0.48% at 1.1086 EUR/CHF and USD/CHF, July 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Higher than expected US CPI and the second tepid reception to a US bond auction this week pushed US yields higher and helped stall the equity momentum. Asia Pacific yields, especially in Australia and New Zealand jumped 8-10 bp in...

Read More »Keith Weiner, PhD, CEO & Founder of Monetary Metals

Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion. [embedded content] Related posts: Keith Weiner Gets Interviewed Is Keith Weiner an Iconoclast? Report 28 Apr Monetary Metals Leases Silver to Money Metals Exchange Monetary Metals...

Read More »“Alexa, How Do We Subvert Big Tech’s Orwellian Internet-of-Things Surveillance?”

Convenience is the sales pitch, but the real goal is control in service of maximizing profits and extending state power. When every device in your life is connected to the Internet (the Internet of Things), your refrigerator will schedule an oil change for your car–or something like that–and it will be amazingly wunnerful. You’ll be able to lower the temperature of your home office while you’re stuck in a traffic jam,...

Read More » SNB & CHF

SNB & CHF