John Rubino and Patrick Highsmith of Firefox Gold return as guests on this week’s program.

The Swiss National Bank (SNB) loaded up on some of the largest cap stocks in the world like MSFT, GOOG, AMZN, TSLA, XOM and many more in order to weaken the Swiss francs vis-a-vis the Euro and the Dollar. But these purchases have now resulted in a 132 billion Swiss francs loss in 2022, the biggest annual loss in the SNB’s history. The total amount of “Foreign currency investments” on its balance sheet, including its U.S. stock holdings, by the end of December 2022 had plunged by 176 billion CHF, or 18%, to CHF 801 billion from the peak in February 2022, the lowest since October 2019 and just a hair above December 2017. But the SNB is not alone.

The Fed, the European Central

Articles by Jay Taylor

Evidence Of A Declining Economy

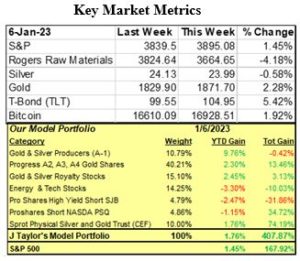

January 10, 2023The first week of 2023 was a “bad news is good news” from the Wall St. perspective. Evidence of a declining economy should drive stock prices lower, but since markets are so distorted by counterfeit money rather than wages and profits, stocks and bonds can’t wait to cheer until those less fortunate are in a world of hurt!

.

Here are several headlines just today that suggest the global economy is heading into the soup!

“Samsung Profits Plunge 69% as Global Chip Demand in ‘Full-fledged Ice Age.” Global demand for chips is down sharply as businesses are fearing a global recession. Sales were down US$55 billion for the quarter for this, the largest chip maker in the world, with sales falling US$55 billion in the quarter.

“ISM Services Slumps into Contraction.”

Why Invest in Gold if the Dollar is Strong?

December 15, 2022Keith Weiner, Quinton Hennigh and Chen Lin return.

Keith Weiner’s Monetary Metals encourages investors to lease or lend their gold or silver to Monetary Metals’ clients in exchange for interest payable in kind. At the same time, Keith makes a very strong case that the dollar will continue to get stronger relative to the Euro, Swiss franc, Japanese yen, Canadian dollar, British pound and Swedish krona. Generally, a strong dollar is viewed as bearish for gold. So why is Keith touting gold ownership at the same time that he takes an exceptionally bullish view on the dollar?

We asked him to explain that as well as why the economics of leasing or lending precious metals work to the advantage of gold borrowers and lessees and what the risk/reward tradeoffs for owners of

Gold Beats Inflation & Treasury Yields Too!

September 1, 2022Keith Weiner and Michael Oliver return as guests on this week’s program.

The U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits. The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. They can’t say that any longer because Monetary Metals now pays interest rates to small investors and large investors at rates that compete with U.S. Treasury rates with interest paid in gold, not increasingly worthless dollars.

Keith explains how leasing or lending your gold brings yields comparable to U.S. Treasuries while avoiding purchasing power losses inherent in owning U.S.

Keith Weiner, PhD, CEO & Founder of Monetary Metals

July 12, 2019Keith Weiner, PhD, CEO & Founder of Monetary Metals, believes interest rates must go lower to keep interest expense under control and result in a deflationary credit implosion.

[embedded content]

Related posts: Keith Weiner Gets Interviewed

Is Keith Weiner an Iconoclast? Report 28 Apr

Monetary Metals Leases Silver to Money Metals Exchange

Monetary Metals Leases Gold to Quantum Metal

The Monetary Cause of Lower Prices, Report 12 May

How dovish can Swiss monetary policy go?

Modern Monetary Theory: A Cargo Cult, Report 20 Jan 2019

Tags: Featured,newsletter

Read More »