The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September. During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July. Powell’s priority is to preserve the economic expansion, now 10 years old: the coming monetary easing is about “managing risks”, he said, especially those coming from weakening global growth and President Trump’s trade policies. In other words, the coming cuts are simply ‘insurance’ rate cuts and not designed to counter an imminent

Topics:

Thomas Costerg considers the following as important: 5) Global Macro, Featured, Macroview, newsletter, Pictet Macro Analysis

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

|

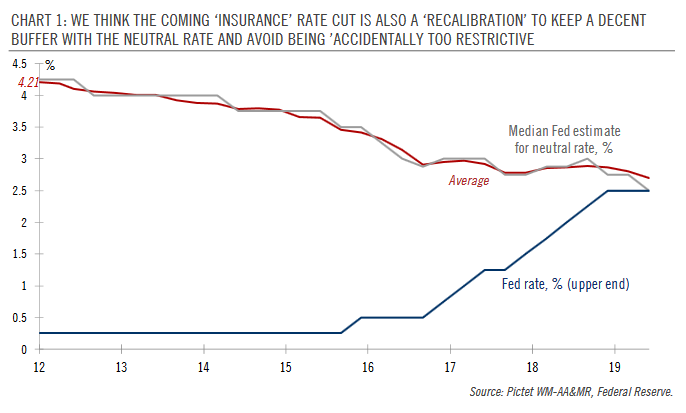

The Fed will likely cut rates by 25 basis points on 31 July, with a similar cut possible as early as September. During his testimony before the House of Representatives on Wednesday, Federal Reserve Chairman Jerome Powell repeated the dovish signals he gave at the Fed press conference in June, hinting at a rate cut at the next Federal Open Market Committee (FOMC) meeting on 31 July. Powell’s priority is to preserve the economic expansion, now 10 years old: the coming monetary easing is about “managing risks”, he said, especially those coming from weakening global growth and President Trump’s trade policies. In other words, the coming cuts are simply ‘insurance’ rate cuts and not designed to counter an imminent economic recession (although Powell did not say how many such ‘insurance’ cuts might be warranted). Powell’s testimony was a reminder of the structurally dovish tenets of the Fed’s philosophy, including its belief in the benefits of letting the labour market and the economy run hot for a while (as well as benign neglect when it comes to asset prices), while it also betrayed the Fed’s hyper-sensitivity about continued undershooting of the Fed’s 2% inflation target. Powell also stressed his political independence from the Trump administration although one might detect a slight Trump ‘flavour’ to the coming rate cut. |

Median Fed estimate for neutral rate, Fed rate |

Taking a step back, our view is that we’re in a ‘debt dominance’ monetary regime, with the sheer amount of outstanding debt putting constraints on the Fed’s future actions and monetary policy, leading to a reinforcement of its dovish tilt. The minutes of the June FOMC meeting, also released on Wednesday, alluded to this, with some committee members noting the “significant debt burdens for many firms”.

Our central scenario still calls for a 25 basis points (bps) ‘insurance’ rate cut on 31 July, followed by another cut in September. Looking further ahead, the risks to Fed rates are mostly to the downside. Our alternative scenario (35% probability) sees 150bps of easing if trade tensions escalate sharply and/or if recession risks become more acute.

Tags: Featured,Macroview,newsletter