Focused On Strategy - Click to enlarge The dollar continues to benefit despite US political uncertainty President Trump claimed to be getting “closer and closer” to a trade deal with China; we are very skeptical There is a lot of US data to be reported and a heavy slate of Fed speakers today ECB board member Lautenschlaeger has resigned; sterling continues to soften as Brexit optimism fades Netanyahu has been tasked with forming the next Israeli government;...

Read More »Here’s How We Are Silenced by Big Tech

This is how they silence us: your content has been secretly flagged as being “unsafe,” i.e. “guilty of anti-Soviet thoughts;” poof, you’re gone. Big Tech claims it isn’t silencing skeptics, dissenters and critics of the status quo, but it is silencing us. Here’s how it’s done. Let’s start with Twitter. Twitter claims it doesn’t shadow ban (Setting the record straight on shadow banning), which it defines as deliberately making someone’s content undiscoverable to...

Read More »Gold At 3 Week High As Stocks and Dollar Fall On Trump’s Hard Line Stance Against Iran and China

◆ Gold has edged higher to reach three week highs at $1,535/oz today after Trump took a hard-line stance on China and Iran during his U.N. speech ◆ Stocks fell in the U.S. yesterday and today in Europe on increasing political turmoil in the U.S. and the UK; Concerns about the global economy and the outlook for stocks is enhancing gold’s safe haven appeal ◆ Palladium has surged to an all time record high and we expect gold and silver to follow suit in the...

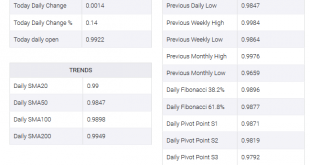

Read More »USD/CHF consolidates gains above 0.9900, limited by 0.9950

US Dollar rises versus Swiss Franc for the second-day in-a-row USD/CHF testing key 200-day simple moving average and 0.9950. The USD/CHF rose on Thursday, holding firm above 0.9900. The pair peaked on European hours at 0.9947 and then pulled back finding support at 0.9900. The bounced back to the upside unable to challenge daily highs and is trading at 0.9930. The move to the upside was not as strong as earlier today amid a deteriorating sentiment in markets that...

Read More »Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing

Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing Click here for the full transcript: http://financialrepressionauthority.com/2019/09/26/the-roundtable-insight-charles-hugh-smith-part-2-millennial-advice-on-jobs-and-affordable-housing/

Read More »Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing

Charles Hugh Smith Part 2 Millennial Advice on Jobs and Affordable Housing Click here for the full transcript: http://financialrepressionauthority.com/2019/09/26/the-roundtable-insight-charles-hugh-smith-part-2-millennial-advice-on-jobs-and-affordable-housing/

Read More »FX Daily, September 26: Greenback Remains Firm

Swiss Franc The Euro has risen by 0.15% to 1.0866 EUR/CHF and USD/CHF, September 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: A compelling narrative for yesterday’s disparate price action is lacking. A flight to safety, which is a leading interpretation, does not explain the weakness in the yen, gold, or US Treasuries. Month- and quarter-end portfolio and hedge adjustments may be at work, but the risk is...

Read More »Number of people with debt problems rises in Switzerland

© Siriporn Kaenseeya | Dreamstime.com The number of people with debts in default continues to rise in Switzerland. At the end of July 2019, 561,000 people, 6.5% of the population, were unable to service their debts according to the price comparison website comparis.ch. The figures, based on data from the credit analysis company CRIF include those who have failed to make repayments and are being pursued by creditors or have declared bankruptcy. The highest rates were...

Read More »USD/CHF technical analysis: 1-week-old resistance-line, 23.6 percent Fibo. limits nearby upside

USD/CHF pulls back from a multi-day high, stays above 200-bar SMA. Trend-positive RSI increases the odds of upside. Despite bouncing off 200-bar simple moving average (SMA), USD/CHF fails to cross near-term key resistances as it trades around 0.9915 while heading into the European session open on Thursday. With this, the quote can witness pullback to 38.2% Fibonacci retracement of August-September upside, at 0.9880, ahead of highlighting the key 200-bar SMA level of...

Read More »The SNB Is a Passive Clearing House Rather Than an Active Currency Manipulator

This post is a long excursion to make two simple points: The SNB is IMHO just acting in a passive way as a clearing house for (massive) capital inflows. It is not actively managing the exchange rate. A rate of increase of sight deposits of 2.5bn per week (100bn p.a.) is not extraordinary considering the need to recycle a current account surplus of 80bn p.a. Observing SNB behaviour over time, it looks to me that what the media call “currency interventions” by the SNB...

Read More » SNB & CHF

SNB & CHF