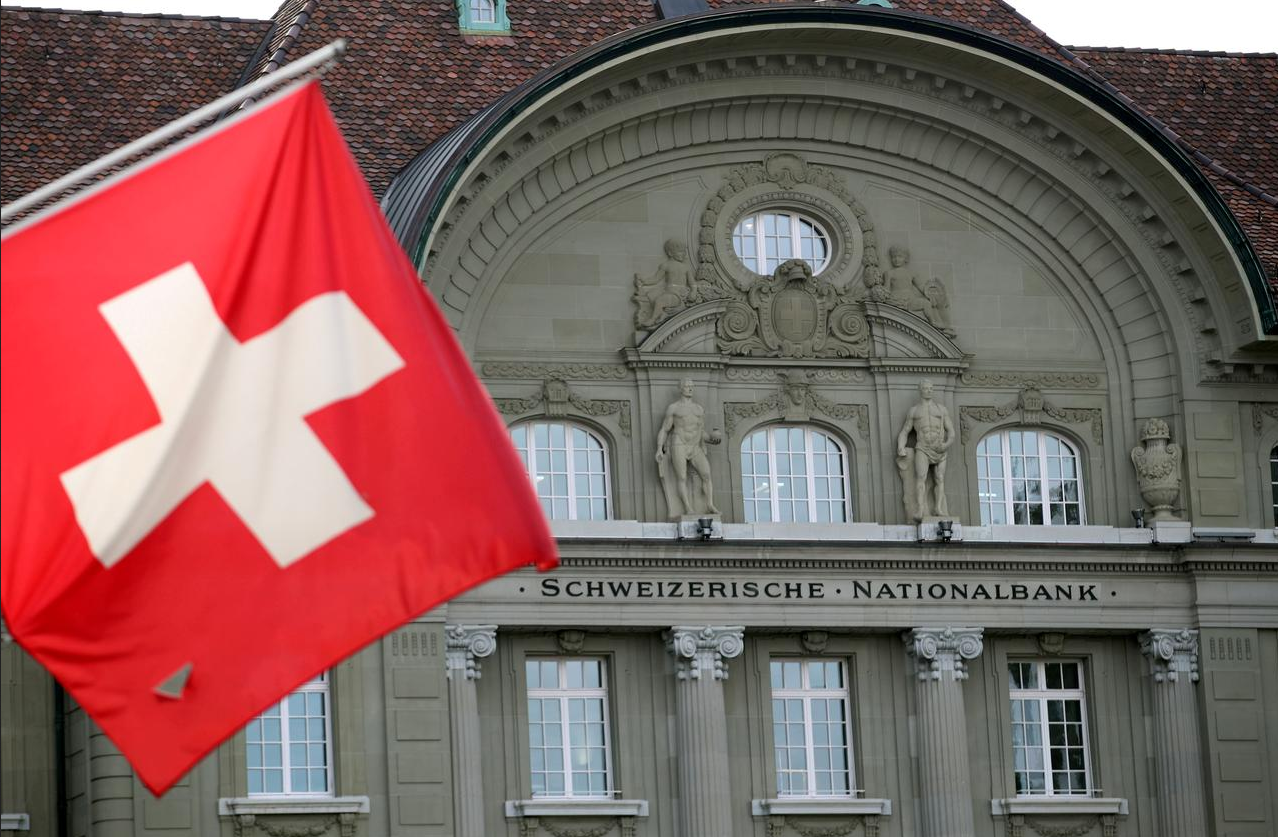

This post is a long excursion to make two simple points: The SNB is IMHO just acting in a passive way as a clearing house for (massive) capital inflows. It is not actively managing the exchange rate. A rate of increase of sight deposits of 2.5bn per week (100bn p.a.) is not extraordinary considering the need to recycle a current account surplus of 80bn p.a. Observing SNB behaviour over time, it looks to me that what the media call “currency interventions” by the SNB are not activist interventions at all, but passive settlement operations in a sense. When Swiss entities stop reinvesting the proceeds of the current account surplus (the flow variable) abroad, or when Swiss entities choose to repatriate a part of the Swiss International Investment Position (the stock

Topics:

wiesenda considers the following as important: 1.) Wiesenda, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

This post is a long excursion to make two simple points:

This post is a long excursion to make two simple points:

- The SNB is IMHO just acting in a passive way as a clearing house for (massive) capital inflows. It is not actively managing the exchange rate.

- A rate of increase of sight deposits of 2.5bn per week (100bn p.a.) is not extraordinary considering the need to recycle a current account surplus of 80bn p.a.

Observing SNB behaviour over time, it looks to me that what the media call “currency interventions” by the SNB are not activist interventions at all, but passive settlement operations in a sense. When Swiss entities stop reinvesting the proceeds of the current account surplus (the flow variable) abroad, or when Swiss entities choose to repatriate a part of the Swiss International Investment Position (the stock variable), an inflow into the CHF results. The SNB simply mirrors these transactions by taking the foreign claims being shed on the asset side of its balance sheet against newly issued CHF on the liabilities side.

As a side-note: of course it is also possible that foreign entities use the CHF and CHF assets as a safe-haven. However I deem it unlikely that there have been large net inflows from foreign entities ever since the crackdown on tax evasion.

Let’s take as an example a Swiss pension fund who during a crisis sells an Italian government bond against EUR and then changes these EUR into CHF at his bank. The bank does not want to increase its EUR exposure, so the SNB steps in to settle the transaction. But why does the SNB do this now and not already earlier?

From bits of information in the financial news, I would assume that because of regulatory change, the ability of the Swiss financial system to buffer inflows into the CHF by taking the counter-position in foreign currency has greatly diminished. This actually increases the sensitivity of the CHF exchange rate to capital inflows. Since the SNB was an instigator of this new regulation (e.g. TBTF), and since acting against imported deflation is also covered by its mandate, it is only fair and right that the SNB settles the transaction by taking on the foreign-currency claim.

This view also sheds a different light on the negative interest the SNB charges on deposits: it is really is an insurance fee for foreign currency risk that the SNB as a public institution takes on in lieu of the private sector.

In the Gold Standard of yore, claims arising from a persistent current account surplus that were not reinvested abroad would have been settled in gold, in the beginning among trading partners, later via banking system interposed and finally with a central bank settling claims between currency domains. In all three cases, the inflow of gold would have increased the local money supply, either as gold (coins) circulating directly, or as notes of deposit of a bank, or as central bank cash (printed notes or electronic currency).

Today, it is assumed that the international banking system would provide the function of settling capital flows, providing liquidity by taking the counter-position (for a risk-adapted fee). The residual of these capital flows not being buffered by the banking system would then be evened out by the floating currencies.

Pre-crisis, the banking system provided this function flawlessly. Since the crisis and, among other things, new regulations, the banks have been reminded by regulators that they have a responsibility to their host nations. An important channel through which the Swiss current account surplus used to be recycled abroad so dried up. Enter the SNB. Just look at the SNB assets over time. The first big expansion coincides with the EUR troubles which resulted in Swiss institutionals and Swiss multinationals fleeing the EUR. At the same time, the banks were forced to deleverage as well as reduce currency mismatches which made the banking system unable to absorb this inflow. The SNB was the only taker remaining lest the CHF skyrocket.

Tags: Featured,newsletter