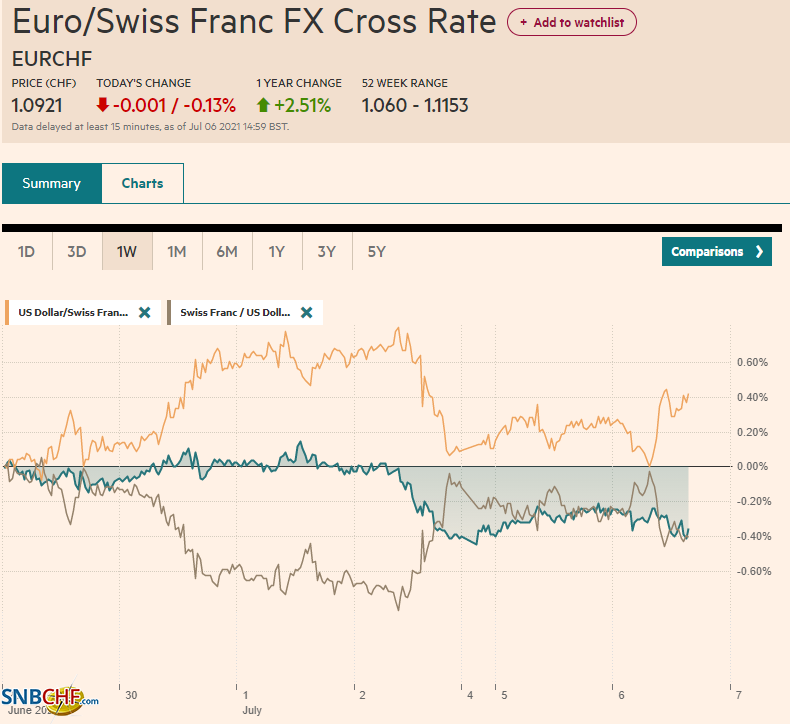

Swiss Franc The Euro has fallen by 0.13% to 1.0921 EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Follow-through dollar selling stalled as key levels were approached, including .19 in the euro, .3900 in sterling, %excerpt%.7600 in the Australian dollar, and CAD1.2300. Sentiment is mixed after the greenback sold-off before last weekend despite the fastest jobs growth in 10-months. Emerging market currencies are mixed, with the JP Morgan Emerging Market Currency Index slipping slightly. The 10-year US Treasury yield is flat near 1.42%, while European yields are 2-3 bp softer. Australian yields are firmer following the RBA decision to taper in Q4 and maintain its target on the April

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, EUR, EUR/CHF, Featured, Markets, newsletter, USD, USD/CHF

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.13% to 1.0921 |

EUR/CHF and USD/CHF, July 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

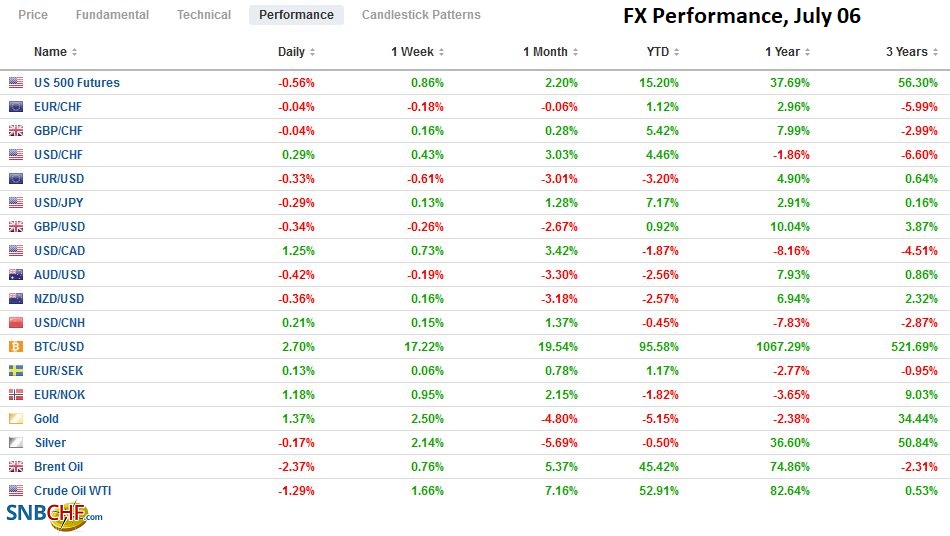

FX RatesOverview: Follow-through dollar selling stalled as key levels were approached, including $1.19 in the euro, $1.3900 in sterling, $0.7600 in the Australian dollar, and CAD1.2300. Sentiment is mixed after the greenback sold-off before last weekend despite the fastest jobs growth in 10-months. Emerging market currencies are mixed, with the JP Morgan Emerging Market Currency Index slipping slightly. The 10-year US Treasury yield is flat near 1.42%, while European yields are 2-3 bp softer. Australian yields are firmer following the RBA decision to taper in Q4 and maintain its target on the April 2024 bond. New Zealand yields are also higher following a strong sentiment survey and calls for a rate hike as early as November. Bourses in the Asia Pacific region were mixed. Some strength was seen in Japan, South Korea, and India, among the larger markets. Europe’s Dow Jones Stoxx 600 is recovering from earlier slippage to post minor gains near midday. and US futures are slightly softer. Gold is extending its recovery into the fifth consecutive session and is trying to sustain a foothold above $1800 for the first time since mid-June. OPEC+ seems to be in disarray, and the initial reaction is to take oil prices higher. August WTI has steadied after approaching $77. Brent is advancing for the sixth consecutive session. Industrial metals, including iron ore and copper, are extending recent gains. |

FX Performance, July 06 |

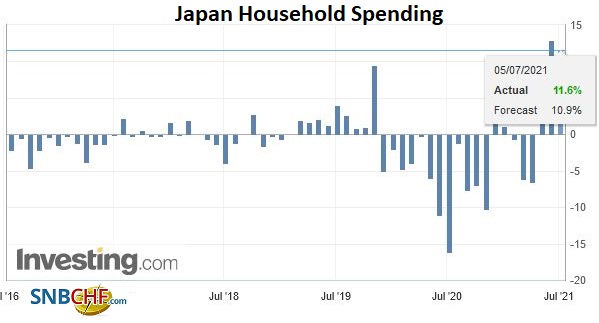

JapanJapan is considering extending the social restrictions in some cities, including Tokyo, even as the Olympics draw near. As a result, spectator attendance is set to be even more limited. Meanwhile, Japan reported stronger than expected household spending (11.6% year-over-year in May), but it was slow than April’s 13.0% rise. This still represents a 2.1% decline month-over-month. Labor cash and real earnings rose faster than the downward revisions to the April series but still missed expectations. Cash earnings rose 1.9% year-over-year in May, after April’s revised 1.4% increase (initially 1.6%). On the month, though, cash earnings fell by 0.9% after rising by 0.4% in April. Real cash earnings were 2% higher than a year ago in May and 1.9% in April. The takeaway is that the Japanese economy likely contracted in Q2. As a result, a supplemental budget is likely in the fall. |

Japan Household Spending YoY, May 2021(see more posts on Japan Household Spending, ) Source: Investing.com - Click to enlarge |

The Reserve Bank of Australia did not disappoint. It will not roll its 3-year target to the November 2024 bond, and once the A$5 bln a week bond-buying program ends in September, it will slow to A$4 bln a week. The next review will be in November. RBA Governor Lowe reiterated that the cash rate target will not be lifted until inflation returns to the 2-3% target in a sustained fashion. This is not expected to be achieved before 2024. The pandemic has restricted temporary workers from abroad, and the restrictions are not expected to ease for a few quarters, which may be helping bolster labor market readings.

A strong quarterly confidence survey and a couple local banks forecasting a hike as early as November helped lift the New Zealand dollar. The market has a 25 bp hike nearly fully discounted here in H2 21. The RBNZ meets on July 13, and it is now seen to be among the front of the queue among central banks from high-income countries. Norway’s Norges Bank is the only other major central bank expected to hike rates this year.

The dollar has held below JPY111.00 today, where a $2.3 bln option is set to expire. The greenback traded to a four-day low near JPY110.75. Support is seen in the JPY110.40-JPY110.50 area.

The Australian dollar was trading near $0.7445 before the US employment data last week and posted a key upside reversal. Follow-through buying lifted it to near $0.7600 today. Resistance is seen in the $0.7600-$0.7620 area. The inability to close above the 200-day moving average (~$0.7575) would be disappointing. The New Zealand dollar has also rallied. Last Friday, it recorded a low near $0.6950, and today, briefly traded above $0.7100. There is a large option (NZ$1.14 bln) at $0.7140 that expires tomorrow. The late-June high was near $0.7095, and the 200-day moving average is closer to $0.7065.

The Chinese yuan is edging higher for the second consecutive session. Recall that it had weakened for the past five weeks. The PBOC set the dollar’s reference rate at CNY6.4613, near the median projection in the Bloomberg survey for CNY6.4616. The dollar-yuan seems to have entered a new range between around CNY6.45 and CNY6.49.

EurozoneGermany’s May factory orders disappointed, and the ZEW survey was mixed. This appeared to help cap the euro in early European turnover. According to the median in the Bloomberg survey, economists had forecast a 0.9% increase in factory orders. Instead, a 3.7% decline was reported. Domestic orders edged up by 0.9%, while foreign orders slumped a sharp 6.7%. The weakness was especially pronounced among capital and intermediate goods. Consumer goods factory orders rose by 7.4%. There is some risk that the unexpected weakness in factory orders weighs on industrial output figures due tomorrow. The median projection is for a 0.5% gain after a 1.0% fall in April. Separately, the expectations component of the ZEW investor survey fell more than expected (63.3 from 79.8), while the assessment of the current situation improved to 21.9 from -9.1. It was the first positive reading since June 2019. |

Eurozone Retail Sales YoY, May 2021(see more posts on Eurozone Retail Sales, ) Source: Investing.com - Click to enlarge |

Yesterday, Spain reported a surge in its composite PMI to 62.4 from 59.2, well above expectations. Today, it is reported that May’s industrial output jumped by 4.3%. The median forecast in Bloomberg’s survey was for a more modest 0.4% rise. In April, Spain’s industrial production rose 1.2%. The European periphery is staging a robust recovery. Italy’s composite PMI also rose more than expected. Yesterday, it was reported that June’s composite PMI stood at 58.3, up from 55.7 in May. It is the highest reading since January 2018. Tomorrow, Italy is expected to report that retail sales rose by 3% in May.

Although a final decision will not be made until next week, the UK government seems committed to ending social distancing and capacity limits in England on July 19. According to some studies in Israel, the Delta mutation is growing rapidly, and the efficacy of the Pfizer vaccine is somewhat less (64% over the past month vs. 94% in the previous month), but still strongly prevents hospitalization (93% vs. 98%).

The euro is reversing lower after approaching $1.19 in late Asian turnover. An option for about 870 mln euros struck there expires today. Another one for around 930 mln euros at $1.1870 also will be cut. It has already been sold below yesterday’s low (~$1.1850). A break of $1.1830 will re-target the $1.1800 area.

Sterling is also reversing after stalling near $1.3900. Yesterday’s low slightly above $1.3810 may offer nearby support. Recall that it recorded a two-month low near $1.3735 at the end of last week, before the US jobs data.

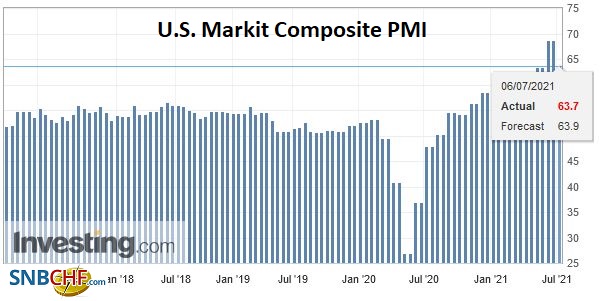

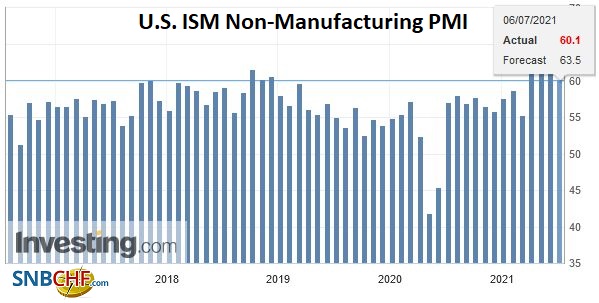

United StatesThe US sees the final Markit PMI today, but the new news will be the June ISM Services Index, which is expected to have softened. It was at a record high of 64 in May and may have slipped to a still lofty 63.5 in June. |

U.S. Markit Composite PMI, June 2021(see more posts on U.S. Markit Composite PMI, ) Source: Investing.com - Click to enlarge |

| Recall that the preliminary Markit PMI composite fell to 63.9 from the blowout 68.7 reading in May (from 63.5 in April). Tomorrow’s FOMC minutes are the highlight of the week. We have suggested that the minutes are unlikely to be hawkish as the economic projections by the individual officials, which were not even discussed at the meeting. |

U.S. ISM Non-Manufacturing PMI, June 2021(see more posts on U.S. ISM Non-Manufacturing PMI, ) Source: Investing.com - Click to enlarge |

Canada’s IVEY survey is out tomorrow, but the highlight of the week is Friday’s employment data. After two months of losses, June employment is expected to have jumped back by 195k. This would be a good down-payment to the 275k jobs lost in April and May. According to the Bloomberg survey, the unemployment rate may have fallen back to 7.7% from 8.2%. The pandemic low was in March at 7.5%. A strong rebound in jobs could see the Bank of Canada extend its tapering when it meets on July 14.

This week’s highlight for Mexico is Thursday’s June CPI report. The month-over-month rate is expected to have risen by around 0.5%, and the year-over-year rate will likely remain near 6%. Last month’s unexpected rate hike is fueling expectations that a tightening sequence has begun that could include 50 bp here in Q3. Banxico meets next on August 12. Brazil reports its June inflation figures this week and May retail sales tomorrow. The market continues to price in aggressive rate hikes this year, though the central bank has already hiked rates by 75 bp three times this year. The central bank meets next on August 4, and another 75 bp hike has been tipped.

The US dollar fell to CAD1.2300 earlier today before recovering to almost CAD1.2365. Yesterday’s high was near CAD1.2370. Resistance is seen in the CAD1.2375-CAD1.2400 band. There is an option for about $340 mln at CAD1.2400 that expires today. The intraday technicals are stretched, suggesting that the bulk of the greenback’s bounce is likely behind it.

The US dollar is trading quietly against the Mexican peso, just inside yesterday’s ~MXN19.77-MXN19.87 range. Here too, the intraday momentum indicators are stretched in favor of the greenback. Slumping support for Brazil’s president appears to be tempering the enthusiasm for the Brazilian real. It was the best performing currency in June, rising 5% against the US dollar. It has given back half of that so far here in early July.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$EUR,EUR/CHF,Featured,Markets,newsletter,USD/CHF