In December, euro area business surveys (PMIs and IFO) slightly softened on the back of a weaker services sector, in particular in France, whereas the manufacturing sector held up again. According to Markit’s preliminary estimates, the euro area composite PMI eased slightly from 54.2 in November to 54.0 in December against expectations for no change. December’s decline was due to the services sector (-0.3 point to 53.9), whereas the manufacturing index (+0.3 point to 53.1) edged up for the third month running. The breakdown shows that sub-indices of the survey provided quite positive signals for the coming months, with both the manufacturing new orders and business expectations indices increasing again. On top of that, the services employment index surged up again, suggesting that employment expansion in the services sector is likely to continue. In terms of price dynamics, inflationary pressures are still lacking, with the output prices index still in contraction territory. Overall, the average composite PMI for Q4 (54.0) reached its highest level since Q2 2011 and still remains slightly above Q3’s average (53.9). This suggests a slight acceleration in real GDP growth from 0.3% q-o-q in Q3 to 0.4% q-o-q in Q4, in line with recent hard data and with our forecast. As a result, we continue to forecast an acceleration of GDP growth from an estimated 1.5% in 2015 to 1.

Topics:

Nadia Gharbi considers the following as important: Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

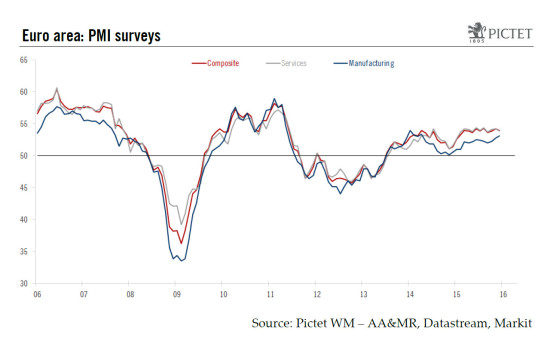

In December, euro area business surveys (PMIs and IFO) slightly softened on the back of a weaker services sector, in particular in France, whereas the manufacturing sector held up again.

According to Markit’s preliminary estimates, the euro area composite PMI eased slightly from 54.2 in November to 54.0 in December against expectations for no change. December’s decline was due to the services sector (-0.3 point to 53.9), whereas the manufacturing index (+0.3 point to 53.1) edged up for the third month running. The breakdown shows that sub-indices of the survey provided quite positive signals for the coming months, with both the manufacturing new orders and business expectations indices increasing again. On top of that, the services employment index surged up again, suggesting that employment expansion in the services sector is likely to continue. In terms of price dynamics, inflationary pressures are still lacking, with the output prices index still in contraction territory.

Overall, the average composite PMI for Q4 (54.0) reached its highest level since Q2 2011 and still remains slightly above Q3’s average (53.9). This suggests a slight acceleration in real GDP growth from 0.3% q-o-q in Q3 to 0.4% q-o-q in Q4, in line with recent hard data and with our forecast. As a result, we continue to forecast an acceleration of GDP growth from an estimated 1.5% in 2015 to 1.8% in 2016, this being mainly domestically driven.

Manufacturing sector surprised on the upside

In Germany, the flash composite PMI decreased by 0.3 point to 54.9 in December, below consensus expectations (55.0). The IFO business survey mirrored the downside surprise in the PMI. Indeed, the headline business climate index surged down from 109.0 in November to 108.7 in December, slightly worse than consensus expectations (109.2). December’s decrease was driven by a drop in the current assessment component (-0.6 point to 112.8) whereas the expectations component remained broadly stable at 104.7, after three consecutive monthly increases. On the sectoral front, the IFO manufacturing index and the flash manufacturing PMI again posted a rise in December, albeit smaller than in November.

Overall, despite this monthly softening in December’s surveys, the average German IFO and PMI for Q4 suggest that German real GDP growth is likely to accelerate in Q4 after a 0.3% q-o-q growth posted in Q3, mainly domestically driven.

In France, indices continue to lag. The flash composite PMI fell to 50.3 in December from 51.0 in November, below consensus expectations (51.0). The drop was essentially due to disappointing flash services PMI (-1.0 point to 50.0). However, as in November, the weakness partly reflects the Paris attacks and the state of emergency that was declared. In contrast, the positive surprise came from the flash manufacturing PMI, which increased up by 1 point to 51.6 in December on the back of a sharp rise in new orders index (+2.1 points to 52.1).

Overall, the average composite PMI for Q4 suggests that French real GDP growth is likely to remain at a similar moderate pace to Q3.

In other euro area countries where no flash estimates are provided, Markit indicated that “growth of business activity picked up to a four-month high, once again exceeding the pace of expansion seen in the two largest 'core countries'”, thus decent GDP growth, in particular in Spain, is likely to continue.

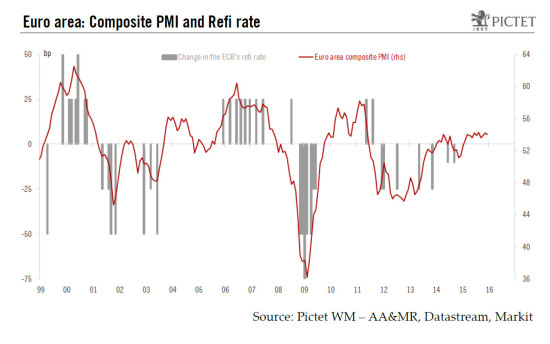

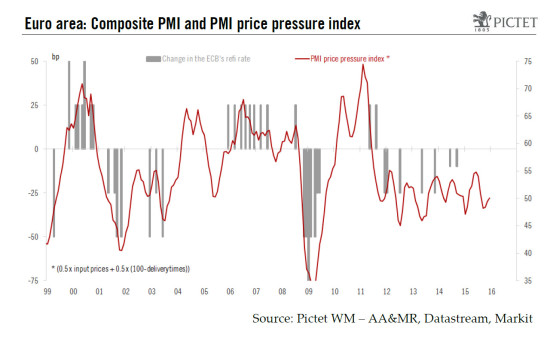

Finally, the last two charts highlight the ECB’s apparent dilemma as far as activity and inflation are concerned: the composite PMI at 54.0 might be consistent with a Refi rate hike (see chart above) whereas inflationary pressures (see chart below) remain subdued and consistent with further easing. We expect the ECB to continue to focus on downside risks to price stability, and thus to maintain a dovish bias in 2016.