Pictet Wealth Management’s view on prospects for Japanese growth, for the yen, and for Japanese bonds and equities.Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11-year high in Q4 2017. The Japanese economy may have expanded by 1.8% in 2017, up from 0.9% in 2016. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s long-term potential. Inflation remains sluggish, and we expect the Bank of Japan (BoJ) to keep monetary easing largely intact throughout 2018. In particular, we expect the central bank to maintain its yield curve control (YCC) framework, keeping the 10-year Japanese government bond (JGB) yield target at around 0%—although the amount

Topics:

Team Asset Allocation and Macro Research considers the following as important: Japan outlook, Japanese growth, Macroview

This could be interesting, too:

Cesar Perez Ruiz writes Weekly View – Big Splits

Cesar Perez Ruiz writes Weekly View – Central Bank Halloween

Cesar Perez Ruiz writes Weekly View – Widening bottlenecks

Cesar Perez Ruiz writes Weekly View – Debt ceiling deadline postponed

Pictet Wealth Management’s view on prospects for Japanese growth, for the yen, and for Japanese bonds and equities.

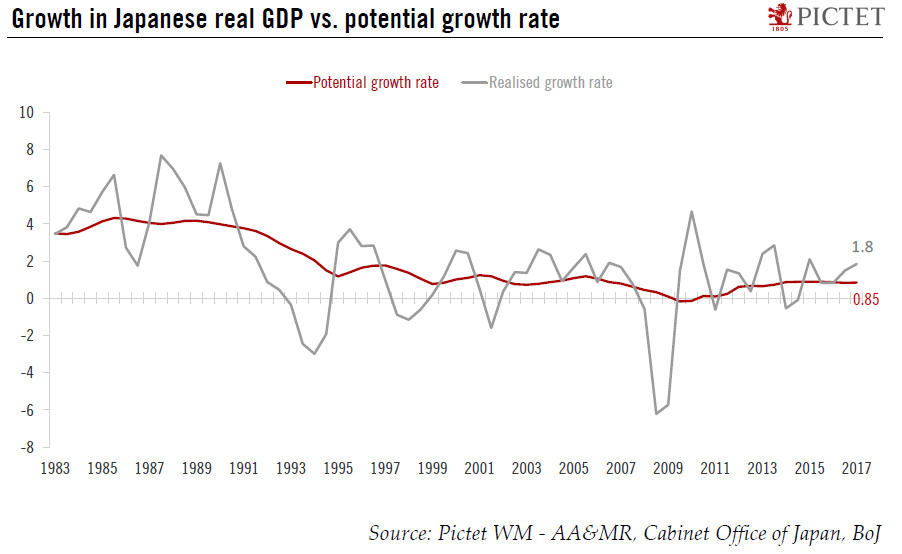

Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11-year high in Q4 2017. The Japanese economy may have expanded by 1.8% in 2017, up from 0.9% in 2016. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s long-term potential. Inflation remains sluggish, and we expect the Bank of Japan (BoJ) to keep monetary easing largely intact throughout 2018. In particular, we expect the central bank to maintain its yield curve control (YCC) framework, keeping the 10-year Japanese government bond (JGB) yield target at around 0%—although the amount of JGBs purchases required to achieve that target has fallen.

The 10-year Japanese government bond yield has been evolving in a tight channel around 0% since the BoJ implemented its YCC programme in late 2016. A rise in inflation expectations should be compensated by falling real yields due to the BoJ’s massive purchases of JGBs. Over 2018, we believe the 10-year JGB yield will remain around 0%.

The yen is likely to remain a funding currency in carry trades. Since we expect a more hawkish Fed over 2018 and a very accommodative BoJ, real rate differentials between the US and Japan should increase and favour a weaker yen against the US dollar. Consequently, we expect the USD/JPY rate to reach JPY119 per USD in 2018. Yen downside should be limited by its deep undervaluation and extreme net short positioning.

Japanese equity markets remain buoyant. The BoJ is the sole central bank directly buying equities as part of its monetary framework. As a result, the BoJ now owns about 4% of the TOPIX’s market capitalisation and 60% of Japanese equity ETFs. The BoJ’s activity is even more impressive in terms of equity inflows. The earnings outlook and valuations in Japan are in line with European levels and offer some more upside. The latest fiscal reforms in Japan could boost 2018 earnings expectations further, although corporate tax cuts that are much less extensive than in the US.