See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. “On résiste à l’invasion des armées; on ne résiste pas à l’invasion des idées.” These are the actual words written by Victor Hugo in Histoire d’un Crime (History of a Crime).Translated literally, it means an invasion of armies can be resisted; an invasion of ideas cannot be resisted. However, there are many alternative...

Read More »Is This The Best Way To Bet On The Fed Losing Control Of The Bond Market?

Lately, one of my biggest duds of a call has been for the yield curve to steepen. Sure, I have all sorts of fancy reasons why it should steepen, but reality glares back at me in black and white on my P&L run. Sometimes fighting with the market is an exercise in futility. Now I know many of your eyes glaze over when I start talking about different parts of the yield curve flattening or steepening, but I urge you to...

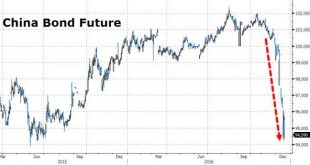

Read More »Bonds Have Best Day In Over 3 Months Amid China Carnage, Turkey Terror, & Berlin Bloodbath

Despite considerably weaker than expected Services PMI, an assassination in Turkey, a terrorist attack in Zurich, and a bloodbath in Berlin, stocks rallied... As a reminder - Chinese bonds crashed overnight again.. Hong Kong stocks tumbled into correction (red for 2016)... And Italian banks all crashed (led by BMPS)... First things first in The US - the market broke today and stocks loved it... The Dow still has not had two down days in a row since before the...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »666: The Number Of Rate Cuts Since Lehman

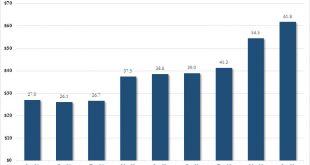

BofA’s Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, “global central banks have now cut rates 666 times since Lehman.” One would think this attempt by central banks to push everyone into risk assets, certainly the Swiss National Bank which as we showed yesterday has increased its US equity holdings by 50% in the first half of 2016 … …...

Read More »With Daily Record Lows: Chart of German Bund Yields Since 1977

The German Bund chart is very important for us, because the Swiss franc is negatively correlated to German government bond yields. The lower Bund yields, the stronger the Swiss Franc. When European governments and the ECB are ready to pay higher interest rates, then CHF depreciates. 10-year Gilt yield, Close on 06/12 Whether it is due to rising, or receding, fears of Brexit, earlier today UK Gilts joined the global...

Read More »MLPs: Challenged, but Cheap

Energy master limited partnerships, most of which are in the business of storing and transporting oil and natural gas, have had a rough time of it since energy prices started falling in mid-2014. The Alerian MLP index has fallen 38 percent since its August 2014 peak and is down 27 percent year to date. The 22 percent loss in the third quarter is the worst quarterly decline since the index’s inception in 1998. In September, the asset class was down 15 percent, though it regained all of that...

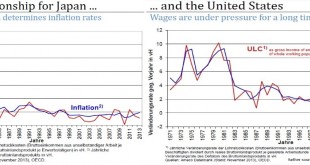

Read More »What Drives Government Bond Yields?

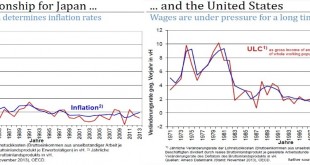

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More »What Drives Government Bond Yields?

For us the five major drivers of government bond yields are: Inflation expectations and inflation: The by far most important criterion. High inflation expectations must be compensated via higher bond yields. The main driver behind inflation expectations is the wage development, this is the form of inflation that typically persists. Price inflation follows inflation expectations with a certain lag. Wealth: The higher the wealth of a country, the lower the bond yields. Wealth is typically...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org