Despite considerably weaker than expected Services PMI, an assassination in Turkey, a terrorist attack in Zurich, and a bloodbath in Berlin, stocks rallied... As a reminder - Chinese bonds crashed overnight again.. Hong Kong stocks tumbled into correction (red for 2016)... And Italian banks all crashed (led by BMPS)... First things first in The US - the market broke today and stocks loved it... The Dow still has not had two down days in a row since before the election (7 weeks)... despite all the turmoil today... (and of course the standard panic-buying into the close) Dow failed its 20k mission again... Leaving all sectors red post-Fed (Energy laggard) Treasury yields tumbled across the curve with the long-end's biggest yield drop since August... (The Turkey headlines and Berlin bloodbath sparked safe-haven buying) Best day for the long-bond since August... Bond yields suddenly seem attractive to stocks... Post-Fed, the long-end is now down 2bps (with the rest of the curve notably higher in yield... And the yield curve continues to flatten "policy-error-like"... But it appears financial stocks love flatter yield curves... The USD Index ended the day unchanged (rallying back on the Turkey-Russia headlines)... Gold was the only major that managed gains today as copper crumbled amid China fears...

Topics:

Tyler Durden considers the following as important: Across the Curve, Bond, Business, China, Commercial Paper, Copper, Dow 30, economy, Finance, financial markets, Fixed income analysis, Fixed income market, headlines, Hong Kong, Money, Turkey, US Federal Reserve, yield, Yield Curve, Zurich

This could be interesting, too:

Claudio Grass writes The Case Against Fordism

Claudio Grass writes “Does The West Have Any Hope? What Can We All Do?”

Claudio Grass writes Predictions vs. Convictions

Claudio Grass writes Swissgrams: the natural progression of the Krugerrand in the digital age

Despite considerably weaker than expected Services PMI, an assassination in Turkey, a terrorist attack in Zurich, and a bloodbath in Berlin, stocks rallied...

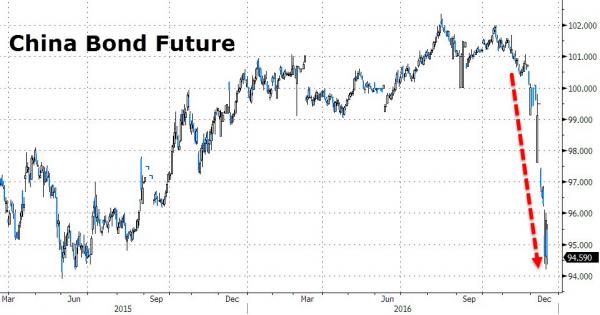

As a reminder - Chinese bonds crashed overnight again..

Hong Kong stocks tumbled into correction (red for 2016)...

And Italian banks all crashed (led by BMPS)...

First things first in The US - the market broke today and stocks loved it...

The Dow still has not had two down days in a row since before the election (7 weeks)... despite all the turmoil today... (and of course the standard panic-buying into the close)

Dow failed its 20k mission again...

Leaving all sectors red post-Fed (Energy laggard)

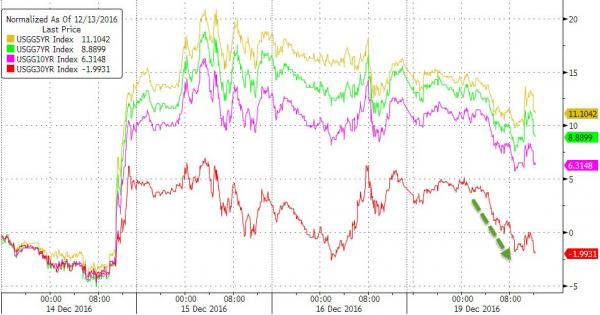

Treasury yields tumbled across the curve with the long-end's biggest yield drop since August... (The Turkey headlines and Berlin bloodbath sparked safe-haven buying)

Best day for the long-bond since August...

Bond yields suddenly seem attractive to stocks...

Post-Fed, the long-end is now down 2bps (with the rest of the curve notably higher in yield...

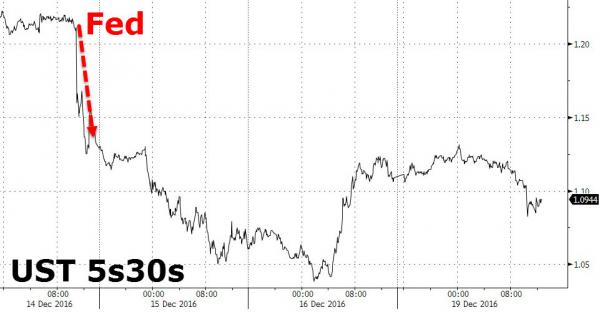

And the yield curve continues to flatten "policy-error-like"...

But it appears financial stocks love flatter yield curves...

The USD Index ended the day unchanged (rallying back on the Turkey-Russia headlines)...

Gold was the only major that managed gains today as copper crumbled amid China fears...

Gold prices rose for the 2nd day in a row - the first time since the election...

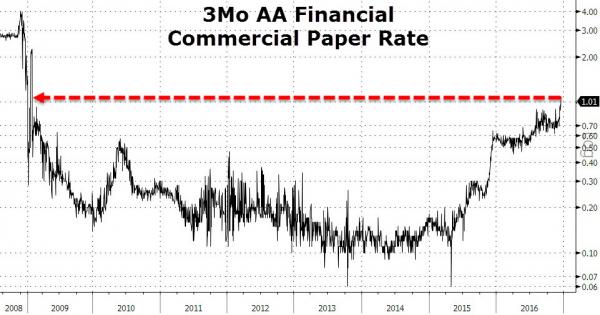

Financial Conditions are worsening once again...

And Commercial Paper market yields are at their highest since Jan 2009...