Summary: Our bullish dollar outlook was based on divergence and we judge it to still be intact. The Dollar Index has been trading broadly sideways since March 2015, but never did more than a minimum retacement of its earlier rally. The Dollar index is at it highest level since March today. Our underlying constructive outlook for the US dollar remains intact. It is broadly based on the divergence between the...

Read More »FX Daily, July 18: Coup in Turkey Repulsed, Risk-Appetites Return

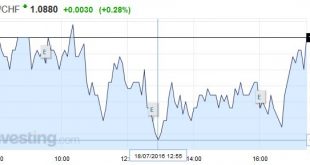

Swiss Franc Continuing risk appetite is positive for the euro (and certainly sterling).At this levels we do not see much SNB intervention. Click to enlarge. FX Rates The US dollar and the yen are trading heavy, while risk assets, including emerging markets, and the Turkish lira, have jumped. Sterling is the strongest of the majors. It is up about 0.5% (~$1.6365), helped by the opportunity of GBP23.4 bln foreign...

Read More »Squaring the Circle: Can Article 7 be Used to Force Article 50?

Summary: Article 7 would suspend the UK’s EU voting rights on grounds it is not negotiating in good faith by delaying the triggering of Article 50. The U.S. debated what “is” means, now investors are trying to figure out what May means. Although sterling has stabilized, interest rate differentials have not. Due to an unlikely string of events, the UK had sorted out its government more than two months...

Read More »FX Weekly Preview: EMU Returns to Center Stage in the Week Ahead

Summary: Key event in Europe is not on many calendars–it is a ruling by the European Court of Justice. UK government and Tory Party stabilizing, leaving the Labour Party in disarray. US economy appears to have accelerated into the end of Q2. BOJ’s meeting at the end of the month. Four large dramas being played out among the major high income countries. The drama in the eurozone moves center stage in the...

Read More »FX Daily, July 11: Dollar Extends Gains

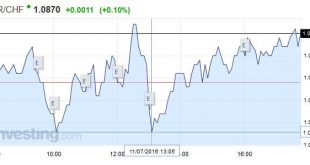

Swiss Franc Improving US job data also helped to increase demand for EUR/CHF long. For last week’s sight deposits see here. Click to enlarge. The combination of the rebounding US job growth and gains in the S&P 500 to near record levels before the weekend is helping boost the US dollar against the major currencies, while the emerging market currencies are mixed. In addition, indications that Japan will put...

Read More »FX Weekly Preview: Sources of Movement

Summary: Electoral politics remains significant. BOE is likely to cut rates, while BoC may tilt more dovishly. US Q2 earnings season formally begins. Investors are under siege. A growing proportion of bonds in Europe and Japan offer negative yields. The German and Japanese curves are negative out 15-years, while one cannot find a positive yield among any tenor of Swiss government bonds. Despite a string of...

Read More »North American Jobs Report and Implications

There is something for everyone in today’s US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank’s neutral stance next week. United States Nonfarm...

Read More »FX Daily, July 06: Dollar and Yen Advance Amid Growing Investor Angst

Swiss Franc Once again the SNB was heavily intervening and the pound fell against both euro and CHF.Thanks to SNB interventions, the Euro did not even dip under 1.08. Click to enlarge. Brexit What a difference a few days make. Many saw last week’s equity market advance a sign that Brexit anxiety was overdone. However, quarter-end position adjustments appear to have been misread. Equity markets are falling now....

Read More »FX Daily, July 05: Sterling Hammered to New Lows, Yen Pops, SNB intervenes

Swiss Franc and SNB interventions It was another day of heavy SNB interventions. The central bank kept the euro nearly stable. As we explained before, she recycled sterling inflows in CHF into euros. Based on the magnitude of the GBP decline against EUR (see below), we estimate 2 to 4 bn CHF interventions. Click to enlarge. Brexit The British pound has been hammered to fresh lows just above $1.3115. The euro is...

Read More »FX Weekly Preview: If No Article 50 Soon, What are the Fundamental Drivers?

Summary Impact of Brexit will take some time to be seen, but the U.K. is already losing influence. U.S. employment data is not sufficient to get the Fed to hike this month. Pressure continues to build on the BOJ to act. There have been two developments that are shaping investment climate. The first was the dramatic rally in equity markets last week, with many recovering nearly all that was lost on the Brexit...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org