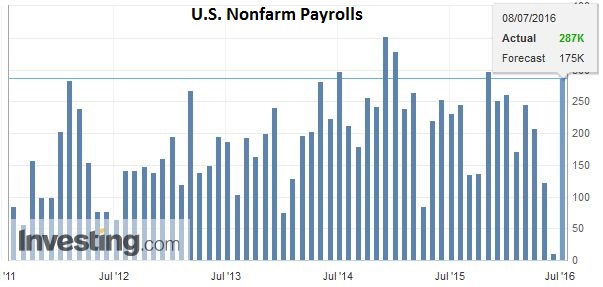

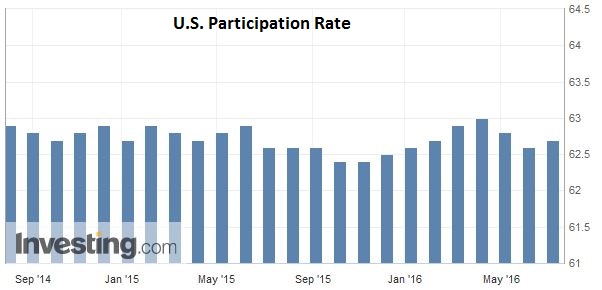

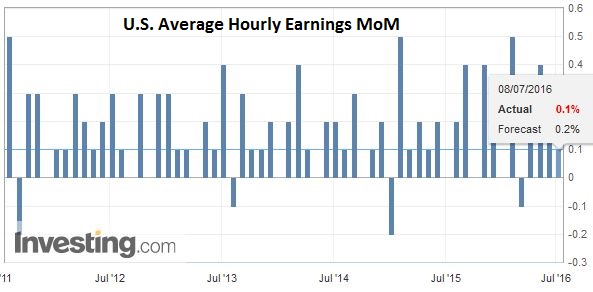

There is something for everyone in today’s US jobs report, and at the end of the day, it is unlikely to sway opinion about the direction and timing of the next Fed move. The greenback itself may remain range bound after the initial flurry. On the other hand, the disappointing but noisy Canadian data underscores the risk of a more dovish slant to the central bank’s neutral stance next week. United States Nonfarm payrolls The 287k nonfarm payroll growth in June (265k private sector) will ease fears that the US is headed for a recession. That type of jobs growth, and the stronger than expected, service sector ISM earlier this week, are not consistent with a contracting economy. The manufacturing sector gained 14k jobs, the most since January, recouping most of the 16k positions lost in May. This bodes well for manufacturing output. Click to enlarge. Participation Rate The participation rate ticked up to 62.7%, but the 0.1% increase translated into a 0.2% increase….. Click to enlarge. Unemployment Rate … in the unemployment rate to 4.9%. The underemployment rate slipped to 9.6%, a new cyclical low. Click to enlarge. Average Hourly Earnings There were a couple of disappointment. Hourly earnings did not rise as much as expected. Still, the 0.

Topics:

Marc Chandler considers the following as important: Average Hourly Earnings, Canada participation rate, Canada unemployment rate, Featured, FX Trends, jobs, newslettersent, Nonfarm payroll, participation rate, US participation rate, US unemployment rate, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

United StatesNonfarm payrollsThe 287k nonfarm payroll growth in June (265k private sector) will ease fears that the US is headed for a recession. That type of jobs growth, and the stronger than expected, service sector ISM earlier this week, are not consistent with a contracting economy. The manufacturing sector gained 14k jobs, the most since January, recouping most of the 16k positions lost in May. This bodes well for manufacturing output. |

|

Participation RateThe participation rate ticked up to 62.7%, but the 0.1% increase translated into a 0.2% increase….. |

|

Unemployment Rate… in the unemployment rate to 4.9%. The underemployment rate slipped to 9.6%, a new cyclical low. |

|

Average Hourly EarningsThere were a couple of disappointment. Hourly earnings did not rise as much as expected. Still, the 0.1% increase was sufficient to lift the year-over-year rate to 2.6%, which matches the cyclical high. We already know that auto sales disappointed in June and this will weigh on retail sales. However, the fact is that more people are working and earning a little bit more. This should help underpin consumption. |

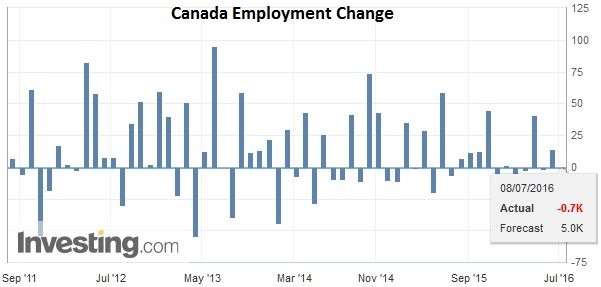

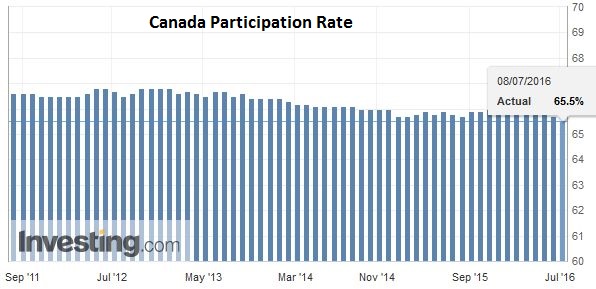

CanadaCanada’s employment report was less robust. It reported a loss of 700 jobs. The job loss was function of a drop of 40.1k full-time positions and a gain of almost as many part-time posts. The participation rate fell 0.2% to 65.5%, helping bring down the unemployment rate to 6.8% from 6.9%.

|

|

|

Seasonal distortions are often blamed for the large month-to-month swings in Canada’s full-time employment. However, a 12-month moving average should smooth it out, and it is still an uninspiring 2.6k, and the six-month average is half of that.

|

|

Canada Participation RateThe Canadian participation is nearly three percent higher than the American one. On the other side, Canadian unemployment is two percent higher. |