Swiss Franc Click to enlarge. FX Rates What promises to be a busy week has begun off slowly. The US dollar has been largely confined to its pre-weekend ranges against most of the major currencies. Equity markets are mostly firmer following the new record highs on Wall Street. The MSCI Asia Pacific Index eked out a small gain (0.1%), with losses in Japan, Taiwan, and Singapore offsetting gains elsewhere. ...

Read More »Great Graphic: OIl Breaks Down Further

Summary: With today’s losses the Sept contract has retraced 50% of this year’s rally. The oil glut has partly been transformed into a gasoline glut. US rig count is rising and output has increased two weeks in a row. Oil Future Today’s 2.5% fall in the September light sweet crude oil futures contract extends the decline that began on June 9. It is the third consecutive loss and the fifth loss in the past six...

Read More »FX Weekly Preview: BOJ and FOMC Meetings Featured in the Last Week of July

Summary: FOMC statement will not likely close door on September hike, though economists are more inclined for a December move. There is great uncertainty surrounding the BOJ’s outlook. We suspect odds favor tweaking assets being purchased rather than cutting rates further or dramatically increasing JPY80 trillion balance sheet expansion. European bank stress test results due at the end of the week. Contrary to...

Read More »Weekly Speculation Positions: Bullish on Dollar and Dollar-Bloc

Speculators made several significant position adjustments in the CFTC reporting period ending 19 July. Swiss Franc Speculators reduced their long Swiss Franc position from 6.7K contracts to 4.7K contracts (against USD). The 2K was certainly smaller than the increase of 15K shorts in the euro (against USD) Euro The euro bears added to their gross short position for the fourth consecutive week and for...

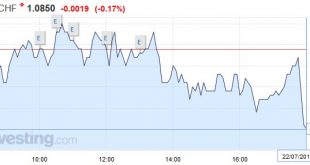

Read More »FX Daily, July 22: Flash PMIs Show Brexit Impact Localized

Swiss Franc The EUR/CHF ended lower today. Today’s data showed that Germany has stronger growth than the rest of the Eurozone. Given the strong Swiss trade ties with Germany, the Swiss franc appreciated. See more in Correlation between CHF and the German Economy Click to enlarge. FX Rates As the week draws to a close, there are three main developments in the capital markets. First, the profit-taking seen in US...

Read More »FX Daily, July 21: Monetary Policy Expectations are Driving Foreign Exchange

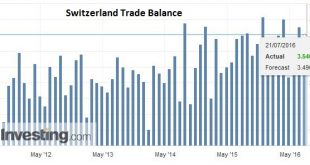

Swiss Franc The Swiss trade balance was published today, and once again, it remained close to record-high. For us, the trade balance is the most important indicator if a currency is fairly valued. Over the long-term the Swiss trade surplus must adjust towards zero, while the currency must appreciate. The consequence of the stronger currency is a higher purchasing power which leads to more spending and finally more...

Read More »Effective Fed Funds and Money Markets

Summary: Fed funds have been trading firmly. There are several reasons and one of them is the shift that is taking place in the US money markets. Still the risk of a Fed hike has increased, just as speculation increases of easing in other major centers. The weighted average of the Fed funds rate has edged higher. Following the Fed hike in December 2015, the Fed funds average around 36 bp in January before...

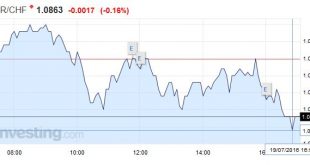

Read More »FX Daily, July 20: Sterling’s Jump Slows Dollar’s Ascent

Swiss Franc The euro Swiss remains at relatively low levels, compared to the ones achieved in the recent risk-on enviornment. Click to enlarge. It is a bizarre turn of events. Just like the Game of Throne’s Westeros is a map of the UK put on top of an inverted Ireland, so too do UK events seem to be a strange permutation of the pre-referendum views. Although sterling and interest rates have not fully recovered...

Read More »Great Graphic: Aussie Approaches Two-Month Uptrend

Summary: Australian dollar is the second heaviest currency this week after a key downside reversal at the end of last week. It is approaching an uptrend line near $0.7450. Many perceive an increased likelihood that the RBA eases and many are reassessing chance of a Fed hike later this year. Australian dollar The Australian dollar recorded a key downside reversal last Friday (July 15) and had seen follow...

Read More »FX Daily, July 19: Dollar-Bloc Tumbles, but Euro and Yen Little Changed

Swiss Franc Click to enlarge. FX Rates The US dollar is sporting a firmer profile today, but it is not the driver. Heightened speculation that Australia and New Zealand may cut interest rates next month is pushing those respective currencies more than 1% lower today. The Canadian dollar is being dragged lower (~).5%0 in what looks to be primarily sympathy, but it had seemed vulnerable to us in any event....

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org