Summary: Some romanticists want to have another Bretton Woods fixed exchange rate regime. Bretton Woods had difficulty from nearly the day it went operational. It is misguided to think a new rigid regime is needed or is appropriate. Today is the anniversary of the final blow to the dollar-gold standard. By August 15, 1971, the exchange of dollars for gold was limited to central banks, and US President...

Read More »FX Weekly Preview: Thoughts on the Significance of Ten Developments

Summary: The GDP deflator may be just as important as overall growth for BOJ considerations and the possibility of fresh action next month. Falling UK rates and a weaker pound are desirable from a policy point of view. Dudley’s press conference may be more important than FOMC minutes. Two German state elections that will be held next month comes as Merkel’s popularity has waned. Japan Japan’s Q2 GDP: The...

Read More »FX Daily, August 12: Summer Markets Grind into the Weekend

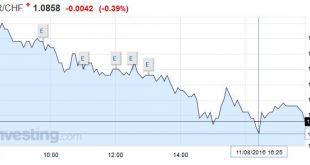

Swiss Franc The weak U.S. Retail Sales report let the euro improve against the dollar. We would have expected a stronger franc, given that the German growth was stronger (see more on the relationship between the German economy and CHF). Some technical movement after yesterday’s strong fall of EUR/CHF may have prevented that. Click to enlarge. United States There is a general consolidative tone in the capital...

Read More »FX Daily, August 11: Sterling Struggles to Find a Bid, While RBNZ Can’t Knock Kiwi Down

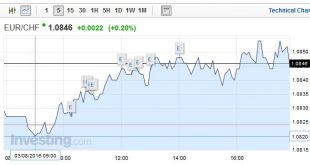

Swiss Franc Once again, EUR/CHF reverses in the middle of the week. A part from technical reasons, the weak French CPI (+0.4% YoY) and Italian CPI (-0.2% YoY) exercised downwards pressure on the euro. Click to enlarge. FX Rates The US dollar has found steadier footing today after trading heavily yesterday. There are two main themes. The first is sterling’s heavy tone. After closing the North American session...

Read More »Two Things I Learned Looking for Something Else

Summary: LIBOR continues to rise. The relative calm of the markets will likely end next month. The last four months of the year are jammed with key events that have potential to disrupt the markets. US LIBOR continues to rise. LIBOR may not be what it was before the Great Financial Crisis, or before the scandalous revelations. However, it remains an important benchmark. Three-month LIBOR rose from around...

Read More »Cool Video: CNBC Asia–Mostly about the Redback and Greenback

Click to see video. I was invited to appear on CNBC Asia Rundown show with Pauline Chiou. We discuss the Chinese yuan on the anniversary of last summer’s unexpected devaluation. I suggest that most of the things that get observers excited, like the internationalization of the yuan, or the Hong Kong-Shanghai link or, perhaps by the end of the year,a Hong Kong-Shenzhen link are really Chinese machinations that...

Read More »FX Daily, August 10: FX Consolidation Resolved in Favor of Weaker US Dollar

Swiss Franc Click to enlarge. FX Rates European bourses are mixed, and this is leaving the Dow Jones Stoxx 600 practically unchanged in late-European morning turnover. Financials are the strongest sector (+0.4%), and within it, the insurance sector is leading with a 0.8% advance and banks are up 0.4%. The FTSE’s Italian bank index is up 1.4% to extend its recovery into a fifth session. Bond markets are broadly...

Read More »FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

Swiss Franc The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak – reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week’s sight deposits. Click to enlarge. Bank of England The Bank of England owns today, though tomorrow will be about the US...

Read More »FX Daily, August 03: Consolidation Featured

Swiss Franc Click to enlarge. FX Rates The US dollar is consolidating yesterday’s losses. The greenback’s upticks have thus far been shallow and unimpressive, except perhaps against the New Zealand dollar, which is off 0.8% ahead of next week’s RBNZ meeting. Softer than expected labor cost increase reinforces the conviction that a 25 bp rate cut will be delivered next week. The asset markets are more...

Read More »Gorilla or Elephant, Chinese Surplus Capacity is the Challenge

Summary: China’s excess capacity is one of the most formidable challenges the China and the world face. Unexpectedly, China’s steel industry reported a profit in H1 16. M&A for industry rationalization and foreign markets seem to be the main ways China is trying to address the excess capacity. Americans have a saying about an 800-pound gorilla in a room. It refers to a person or organization so...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org