As tumultuous as last year was from a global political perspective on the back of a rocky start market-wise, 2017 will be much more so. The central bank subsidization of the financial system (especially in the US and Europe) that began with the Fed invoking zero interest rate policy in 2008, gave way to international distrust of the enabling status quo that unfolded in different ways across the planet. My prognosis is...

Read More »Money, Markets, & Mayhem – What To Expect In The Year Ahead

If you thought 2016 was full of market maelstroms and geopolitical gotchas, 2017’s ‘known unknowns’ suggest a year of more mayhem awaits… Here’s a selection of key events in the year ahead (and links to Bloomberg’s quick-takes on each). January Donald Trump will be sworn in as U.S. president on Jan. 20.QuickTakes: Immigration Reform, Free Trade and Its Foes, Supreme Court, Oil Sands, Confronting Coal, Climate Change,...

Read More »A Biased 2017 Forecast, Part 1

“The idea that the future is unpredictable is undermined every day by the ease with which the past is explained.” – Daniel Kahneman, Thinking, Fast and Slow A couple weeks ago I was lucky enough to see a live one hour interview with Michael Lewis at the Annenberg Center about his new book The Undoing Project. Everyone attending the lecture received a complimentary copy of the book. Being a huge fan of Lewis after...

Read More »Frontrunning: December 20

Trump wins Electoral College vote; a few electors break ranks (Reuters) European Stocks Head for a One-Year High (BBG) Japan's Central Bank Keeps Policy Unchanged, Upgrades Economic Outlook (BBG) Russia and Turkey vow to keep detente on track after murder (FT) The Political Implications of Events in Ankara and Berlin (BBG) Trump condemns Berlin attack, says things 'only getting worse' (Reuters) Merkel: "No Doubt Berlin Crash Was a Terror Attack" (BBG) Gunman in Zurich mosque shooting is dead...

Read More »S&P Futures Rise Propelled By Stronger Dollar; Europe At 1 Year High As Yen, Bonds Drop

It appears nothing can stop the upward moment of equities heading into the year end, and as has been the case for the past few weeks, US traders walk in with futures higher, propelled by European stocks which climbed to their highest in almost a year, while the dollar rose and bonds and gold fell, failing again to respond to a series of geopolitical shocks following terrorist attacks in Ankara, Berlin and Zurich. The yen tumbled after the Bank of Japan maintained its stimulus plan even as the...

Read More »Bonds Have Best Day In Over 3 Months Amid China Carnage, Turkey Terror, & Berlin Bloodbath

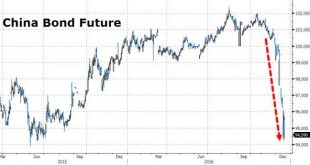

Despite considerably weaker than expected Services PMI, an assassination in Turkey, a terrorist attack in Zurich, and a bloodbath in Berlin, stocks rallied... As a reminder - Chinese bonds crashed overnight again.. Hong Kong stocks tumbled into correction (red for 2016)... And Italian banks all crashed (led by BMPS)... First things first in The US - the market broke today and stocks loved it... The Dow still has not had two down days in a row since before the...

Read More »WTI Crude tumbles To $49 Handle, Erases OPEC/NOPEC Deal Gains

But, but, but… growth, and inflation, and supply cuts, and growth again… Well that de-escalated quickly… As Libya restarts exports and The Fed sends the dollar soaring so WTI crude prices just broke back to a $49 handle for the first time since Dec 8th. WTI CrudeWTI Crude - Click to enlarge “The OPEC cuts are going to prevent some of the mega-glut,” said Olivier Jakob, managing director at Petromatrix GmbH in Zug,...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »Swiss 10 year bond yields still negative, but approaching zero.

The global bond rout returned with a bang, sending 10Y US Treasury yields as much as six basis points higher to 2.53%, the highest level in over two years. The selloff happened as oil prices surged by more than 5% following Saturday’s agreement by NOPEC nations agreed to slash production, leading to rising inflation pressures. At last check, the 10Y was trading at 2.505%, up from 2.462% at Friday and on track for its...

Read More »The War On Cash Is Happening Faster Than We Could Have Imagined

Submitted by Simon Black via SovereignMan.com, It’s happening faster than we could have ever imagined. Every time we turn around, it seems, there’s another major assault in the War on Cash. India is the most notable recent example– the embarrassing debacle a few weeks ago in which the government, overnight, “demonetized” its two largest denominations of cash, leaving an entire nation in chaos. But there have been...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org