Swiss Franc The euro has depreciated by 0.24% to 1.0868 CHF. EUR/CHF - Euro Swiss Franc, June 02(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord...

Read More »April Jobs Won’t Change Minds

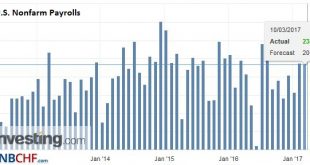

The US created 211k net new jobs in April, a sharp bounce back from the downwardly revised 79k gain in March. It is the third month this year that the US created more than 200k new jobs. United States Nonfarm payrolls Government payrolls increased by 17k. As we noted with the Administration’s federal hiring freeze, the real growth in government employment is on the state and local level. In April the federal...

Read More »FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

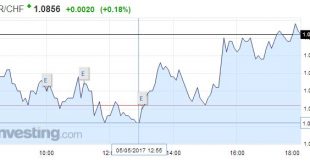

Swiss Franc EUR/CHF - Euro Swiss Franc, May 05(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting. Lastly, we note some chunky...

Read More »Optimal Lunacy

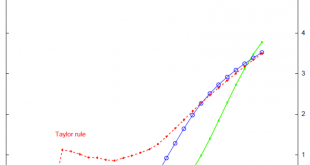

In June 2012, Janet Yellen, then the Vice Chairman of the Federal Reserve, addressed an audience in Boston with what for the time seemed like a radical departure. It was the latest in a string of them, for conditions throughout the “recovery” period never did quite seem to hit the recovery stride. Because of that, there was constant stream of trial balloons suggesting how the Federal Reserve might try to overcome this...

Read More »It Was And Still Is The Wrong Horse To Bet

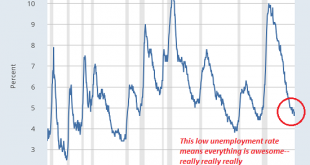

The payroll report disappointed again, though it was deficient in ways other than are commonly described. The monthly change is never a solid indication, good or bad, as the BLS’ statistical processes can only get it down to a 90% confidence interval, and a wide one at that. It means that any particular month by itself specifies very little, except under certain circumstances. This month just happens to be one,...

Read More »US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. United States Nonfarm payrolls The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm...

Read More »Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge The same forces that...

Read More »Solid US Jobs Report in line with Expectations

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. United States Nonfarm payrolls It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k). U.S. Nonfarm Payrolls, February 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to...

Read More »There’s a Difference: Fake News and Junk News

Media junkies on the tragic path to extinction believe the junk news, non-junkies see through the manipulation. The mainstream media continues peddling its “fake news” narrative like a desperate pusher whose junkies are dying from his toxic dope. It’s slowly dawning on the media-consuming public that the MSM is the primary purveyor of “fake news”– self-referential narratives that support a blatantly slanted agenda with...

Read More »US Jobs Details Better than the Headline

United States The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area. The Canadian dollar is struggle to sustain it upward momentum. A US dollar...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org