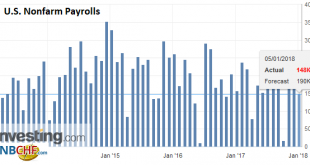

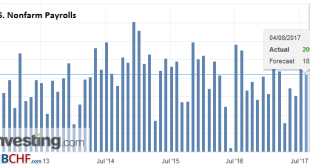

United States The headline US non-farm payrolls disappointed, rising by 148k instead of the consensus of 180k-200k. However, the other details were largely as expected and are unlikely to change views about the trajectory of Fed policy or the general direction of markets. It is a very much steady as she goes story. The headline miss is not really made up for by the upward revision in the November series from 228k to...

Read More »What Central Banks Have Done Is What They’re Actually Good At

As a natural progression from the analysis of one historical bond “bubble” to the latest, it’s statements like the one below that ironically help it continue. One primary manifestation of low Treasury rates is the deepening mistrust constantly fomented in markets by the media equivalent of the boy who cries recovery. That narrative “has ruffled a few feathers,” BMO Capital Markets strategists Ian Lyngen and Aaron Kohli...

Read More »Four Point One

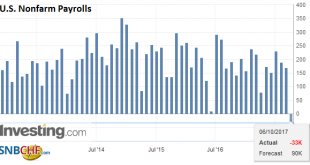

The payroll report for October 2017 was still affected by the summer storms in Texas and Florida. That was expected. The Establishment Survey estimates for August and September were revised higher, the latter from a -33k to +18k. Most economists were expecting a huge gain in October to snapback from that hurricane number, but the latest headline was just +261k. For those two months combined, the headline advanced at an...

Read More »FX Daily, November 03: Dollar Firms Ahead of What is Expected to Be Strong US Jobs Data

Swiss Franc The Euro has fallen by 0.13% to 1.1631 CHF. EUR/CHF and USD/CHF, November 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version...

Read More »US Storm-Skewed Report Means Nothing about Anything

United States US interest rates and the dollar rose in response to the data. It was firm before the report. The US Dollar Index is up for a fourth consecutive week. It is the longest streak since Q1. US 10-year yields are near 2.40%, an area that has blocked stronger gains for nearly six months. Nonfarm payrolls The storms that hit the US had a greater impact on the US labor market than many expected. The recorded a...

Read More »FX Daily, October 6: Look Through the US Jobs Report

Swiss Franc The Euro has risen by 0.27% to 1.1485 CHF. EUR-CHF and USD-CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that...

Read More »FX Daily, September 01: Manufacturing PMIs, US Jobs, and Implications of Harvey

Swiss Franc The Euro has risen by 0.04% to 1.1418 CHF. EUR/CHF and USD/CHF, September 01(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates As the markets head into the weekend, global equities are firmer, benchmark 10-year yields are mostly lower, and the dollar is consolidating after North American pared the greenback’s gains yesterday. Manufacturing PMIs from China, EMU,...

Read More »Great Graphic: Unemployment by Education Level

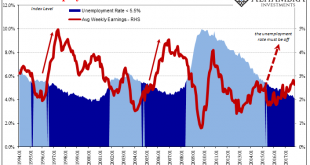

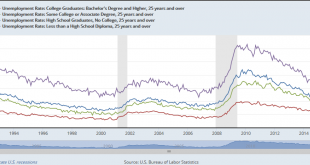

The US reports the monthly jobs data tomorrow. The unemployment rate stood at 4.4% in June, after finishing last year at 4.7%. At the end of 2015 was 5.0%. Some economists expect the unemployment rate to have slipped to 4.3% in July. Recall that this measure (U-3) of unemployment counts those who do not have a job but are looking for one. There are several other measures, and which one is right depends on what question...

Read More »Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. United States Nonfarm payrolls The 287k nonfarm payroll growth in June (265k private sector) will ease fears that the US is headed for a recession. That type of jobs growth, and the stronger than expected, service sector ISM earlier this week, are not consistent with a...

Read More »Drop in the US Unemployment Rate Not Sufficient to Mask Disappointing Report

Summary: Poor jobs growth won’t challenge June hike expectations but September and balance sheet. Little positive in today’s report. Drop in unemployment explained by drop in participation rate. Trade deficit was larger than expected, which may point to slower Q2 growth. United States Unemployment Rate The US unemployment rate unexpectedly fell to 4.3%, a new multi-year low, but it is a misleading optic for...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org