Swiss Franc The Euro has fallen by 0.13% to 1.1631 CHF. EUR/CHF and USD/CHF, November 03(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is firm but is not going anywhere quickly. The lack of fresh interest rate support and uncertainty over the US tax proposals, which the Brady, the Chair of the House Ways and Means Committee hopes to have a revised version...

Read More »US Storm-Skewed Report Means Nothing about Anything

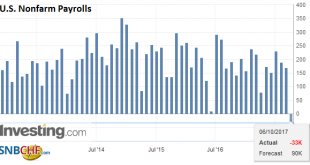

United States US interest rates and the dollar rose in response to the data. It was firm before the report. The US Dollar Index is up for a fourth consecutive week. It is the longest streak since Q1. US 10-year yields are near 2.40%, an area that has blocked stronger gains for nearly six months. Nonfarm payrolls The storms that hit the US had a greater impact on the US labor market than many expected. The recorded a...

Read More »FX Daily, October 6: Look Through the US Jobs Report

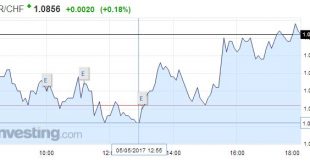

Swiss Franc The Euro has risen by 0.27% to 1.1485 CHF. EUR-CHF and USD-CHF, October 06(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Traders are putting the final touches on another strong weekly performance for the US dollar. Strong economic data, including the PMIs, auto sales, and factory orders have surprised to the market. The ADP report warns that the storms that...

Read More »Constructive US Jobs, but Where Do the Euro Bulls make a Stand?

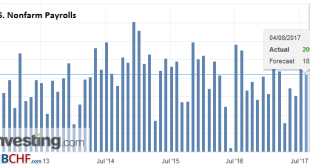

The US created 209k jobs in July and jobs growth in June was revised higher (+9k) to 231k. The underemployment rate was unchanged at 8.6%. United States Nonfarm payrolls The 287k nonfarm payroll growth in June (265k private sector) will ease fears that the US is headed for a recession. That type of jobs growth, and the stronger than expected, service sector ISM earlier this week, are not consistent with a...

Read More »Drop in the US Unemployment Rate Not Sufficient to Mask Disappointing Report

Summary: Poor jobs growth won’t challenge June hike expectations but September and balance sheet. Little positive in today’s report. Drop in unemployment explained by drop in participation rate. Trade deficit was larger than expected, which may point to slower Q2 growth. United States Unemployment Rate The US unemployment rate unexpectedly fell to 4.3%, a new multi-year low, but it is a misleading optic for...

Read More »FX Daily, June 02: Dollar Marks Time Ahead of US Jobs Report

Swiss Franc The euro has depreciated by 0.24% to 1.0868 CHF. EUR/CHF - Euro Swiss Franc, June 02(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The foreign exchange market is becalmed, leaving the US dollar narrowly mixed. The euro has been confined to less than a 20-pip range through the Asian session and most of the European morning. The news stream is light. The US withdrawal from the Paris Accord...

Read More »April Jobs Won’t Change Minds

The US created 211k net new jobs in April, a sharp bounce back from the downwardly revised 79k gain in March. It is the third month this year that the US created more than 200k new jobs. United States Nonfarm payrolls Government payrolls increased by 17k. As we noted with the Administration’s federal hiring freeze, the real growth in government employment is on the state and local level. In April the federal...

Read More »FX Daily, May 05: Mixed Dollar Ahead of US Jobs Data and Fed Talk

Swiss Franc EUR/CHF - Euro Swiss Franc, May 05(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar is narrowing mixed as the employment data, and Fed speeches are awaited. Six Fed officials speak today, including Yellen and Fischer. Regional Presidents Williams, Rosengren Evans and Bullard also speak. It will be the first flurry of speeches since the FOMC meeting. Lastly, we note some chunky...

Read More »US Jobs Growth Disappoints

The US jobs growth slowed considerably more than expected in March and the disappointment pushed the dollar and equities initially lower. United States Nonfarm payrolls The US created 98k jobs in March, well below market expectations for around 175k jobs. Adding insult to injury, revisions to the January and February data took off another 38k job. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm...

Read More »Short Note on US Employment Report

The US jobs data is notoriously difficult to accurately forecast consistently. I do not claim to do so now. My intent is more modest. It is simply to point out why I there is risk that the jobs data is disappointing, especially after the stronger than expected ADP estimate. U.S. Nonfarm Payrolls, March 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: investing.com - Click to enlarge The same forces that...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org