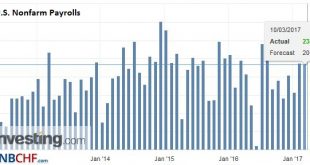

The US jobs report was largely in line with expectations. February was the second consecutive month that the US economy created more than 200k jobs. United States Nonfarm payrolls It is the first time since last June and July. The 235k is just below the revised January 238k gain (initially 227k). U.S. Nonfarm Payrolls, February 2017(see more posts on U.S. Nonfarm Payrolls, ) Source: Investing.com - Click to...

Read More »US Jobs Details Better than the Headline

United States The dollar and US yields are recouping more of yesterday’s decline. A break of $1.0480-$1.05 would suggest the euro’s upside bounce is exhausted. A dollar move above JPY116.80-JPY117.25 would also hint that the greenback was going to make an other run toward JPY118.30-JPY118.60. Sterling support is seen in the $1.2285-$1.2310 area. The Canadian dollar is struggle to sustain it upward momentum. A US dollar...

Read More »Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

United States The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. U.S. Nonfarm Payrolls, November 2016(see more posts on U.S. Nonfarm Payrolls, ) Source:...

Read More »Mixed Jobs Report, but Unlikely to Deter Expectations for Fed Hike

United States The US dollar has slipped lower in response to the jobs data, but quickly recovered. The details are mixed, but is unlikely to change views on the outlook for Fed policy. The headline job creation was in line with expectations at 178k. Job growth of the back two months were shaved by 2k, concentrated in October. U.S. Nonfarm Payrolls, November 2016(see more posts on U.S. Nonfarm Payrolls, ) Source:...

Read More »FX Daily, November 04: US Jobs Figures: Another Time the Swiss Franc Strengthens

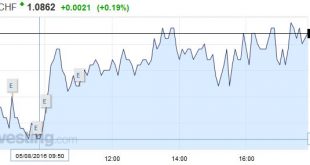

Comment on Swiss Franc by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Swiss Franc With the not convincing U.S. jobs number, both the EUR and, in particular, the Swiss Franc could improve. With continuing political uncertainty in the U.S., more speculators closed their short CHF positions. Moreover, I expect significant...

Read More »FX Daily, October 07: Sterling Stabilizes After Harrowing Drop, Now Jobs

Swiss Franc EUR/CHF - Euro Swiss Franc, October 07 2016. - Click to enlarge FX Rates Sterling again steals the limelight. In early Asia, sterling inexplicably dropped nearly eight cents in minutes (to ~$1840), and on some platforms, may have traded below $1.1380. It almost immediately rebounded but has not resurfaced above $1.2480. Over the last couple of years,there have been a number of sudden dramatic moves...

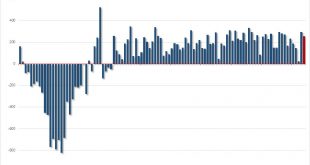

Read More »US Jobs Disappoint, Risk of Sept Hike Recedes, Dollar Falls

[unable to retrieve full-text content]Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged.

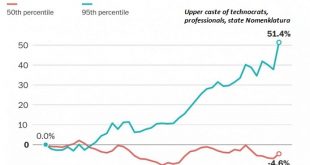

Read More »Why Wages Have Stagnated–and Will Continue to Stagnate

The only way to reverse declines in labor participation and stagnation in wages and demand is to make it easier to start enterprises and hire people. Mainstream economists are mystified why wages/salaries are still stagnant after 7+ years of growth / “recovery.” The conventional view is that wages should be rising as the labor market tightens (i.e. the unemployment rate is low) and demand for workers increases in an...

Read More »US Jobs Surprise, Canada Disappoints

Summary: Underlying concerns about US labor market ease after two robust reports. Sept Fed views will not change much. Canada’s data is disappointing, BOC optimism may be challenged. United States Nonfarm payrolls The market’s angst over the underlying trend in the US labor market eases with the help of the second consecutive robust report. The 255k rise in non-farm payrolls was well above expectations, and...

Read More »FX Daily, August 05: US Jobs Data on Tap, but Don’t Expect Miracles

Swiss Franc As usual, when U.S. data is good, then the EUR/CHF appreciates. Click to enlarge. FX Rates The focus is squarely on the US employment data today, ahead of which the capital markets are mostly consolidating yesterday’s Bank of England inspired moved. The Australian and New Zealand dollars, alongside sterling, which is up about half a cent after losing two yesterday. The RBA’s monetary policy statement...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org