CEO Keith Weiner returns to popular radio show Turning Hard Times into Good Times hosted by Jay Taylor. Jay argues that the U.S. government hates gold because its rising price shines the light on the destruction of the dollar caused by the Federal Reserve’s printing press used to finance massive government deficits. The detractors of gold have long suggested that owning gold doesn’t make sense because it doesn’t pay interest. Keith and Jay discuss why...

Read More »SWIFT Isn’t The ‘Nuclear Option’ For Russia, Because Russia can sell the dollars elsewhere and NOT via Swift

As everyone “knows”, the US dollar is the world’s reserve currency which can only leave the US government in control of it. Participation is both required and at the pleasure of American authorities. If you don’t accept their terms, you risk the death penalty: exile from the privilege of the US dollar’s essential business. From what little most people know about that essential business, it seems like it has something to do with that thing called SWIFT. Thus,...

Read More »Liquidity Premia on Treasuries?

In an NBER working paper, Matthias Fleckenstein and Francis Longstaff argue that Treasuries do not trade at a premium: It is widely believed that Treasuries trade at premium prices because of their safety and money-like properties. In reality, this is only true on a relative basis when compared to other bonds, but is often not true on an absolute basis. Many Treasuries have repeatedly traded at substantial discounts to their intrinsic fair values for extended periods during the past...

Read More »FX Daily, April 12: Capital Markets Look for Direction

Swiss Franc The Euro has fallen by 0.07% to 1.0997 EUR/CHF and USD/CHF, April 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Risk appetites have not returned from the weekend. Equities are heavy, and bond yields softer. The dollar is drifting lower in Europe. China’s unusually candid admission of the shortcomings of its vaccine and record new cases in India saw all the equity markets in the region fall. Only...

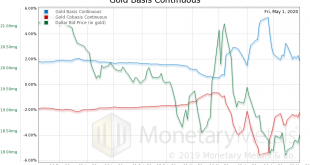

Read More »Gold and Silver Markets Start to Normalize, Report 4 May

The price of gold dropped $29 and the price of silver dropped $0.27. We’ll get back to where we think the prices are likely to go in a bit. In recent Reports, we’ve looked at the elevated bid-ask spread in gold (though not nearly as elevated as some goldbugs would have you believe) and the elevated gold basis. As an aside, we continue to see articles that get the high gold basis exactly backwards, the way John Maynard Keynes got commodity markets backwards. A high...

Read More »Silver Backwardation Returns, Gold and Silver Market Report 2 March

The big news this week was the drop in the prices of the metals (though we believe that it is the dollar which is going up), $57 and $1.81 respectively. Of course, when the price drops the injured goldbugs come out. We have written the authoritative debunking of the gold and silver price suppression conspiracy here. We provide both the scientific theory and the data. So we won’t say anything more about it today. On 17 Feb, we wrote about the widening bid-ask spread...

Read More »Treasury Direct

A common argument against retail central bank digital currency (CBDC) is that CBDC would undermine financial stability by allowing the general public to swiftly move funds from banks to a government account. But in several countries such swift transfers are possible already today—in the US through Treasury Direct. (The argument also has conceptual flaws, see the paper On the Equivalence of Public and Private Money with Markus Brunnermeier.)

Read More »Irredeemable Currency Is a Roach Motel, Report 9 June

In what has become a four-part series, we are looking at the monetary science of China’s potential strategy to nuke the Treasury bond market. In Part I, we gave a list of reasons why selling dollars would hurt China. In Part II we showed that interest rates, being that the dollar is irredeemable, are not subject to bond vigilantes. In Part III, we took on the Quantity Theory of Money head-on, and showed the...

Read More »Financial Sanctions, the USD, and the EUR

On Moneyness, JP Koning discusses the ability or not of the U.S. treasury to enforce financial sanctions overseas. Focusing on the Iran sanctions that ran from 2010 to 2015 (with strong international support) and are scheduled to be reimposed soon (without such support) Koning compares the U.S. sanctions regime to an exclusivity agreement that a large retailer imposes on a manufacturer. Foreign banks in places like Europe were free to continue providing transactions services to Iran, but...

Read More »How Problematic Is a Large Central Bank Balance Sheet?

On his blog, John Cochrane reports about a Hoover panel including him, Charles Plosser, and John Taylor. Cochrane focuses on the liability side. He favors a large quantity of (possibly interest bearing) reserves for financial stability reasons. Plosser focuses on the asset side and is worried about credit allocation by the Fed, for political economy reasons. Taylor favors a small balance sheet. Cochrane also talks about reserves for everyone, but issued by the Treasury.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org