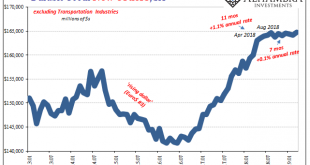

Next month, in the durable goods series, the Census Bureau will release the results of its annual benchmark changes. In May 2019, the agency will revise the seasonal adjustments going back to January 2002. Unadjusted data will not be, well, further adjusted. None of this, apparently, will include any information gleaned from the comprehensive 2017 Economic Census. I haven’t closely followed the progress of the latter,...

Read More »Push Them Hard Enough and the Productive Class Will Opt Out of Servitude

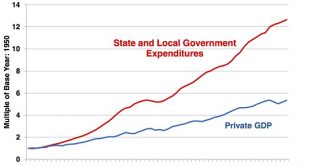

People love their big paychecks, but they also value their sanity. One of the most astonishing manifestations of disconnected-from-reality hubris is public authorities’ sublime confidence that employers and entrepreneurs will continue starting and operating enterprises no matter how difficult and costly it becomes to keep the doors open, much less net a profit. The average employee / state dependent reckons that the...

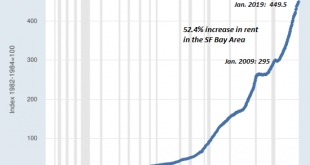

Read More »The Feedback Loop of Doom: When Mobile Creatives and Capital Abandon Unaffordable, Dysfunctional Cities

When the 4% who generate the jobs and tax revenues have had enough and leave, the effects quickly impact the 64%. At the end of any trend, everyone’s a true believer: this trend is so enduring, so broad-based, so based on unchanging fundamentals that it will never ever reverse. One such trend is the white-hot growth of housing, employment, tax revenues, etc. in major urban magnets for global capital and talent: you know...

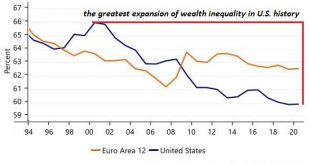

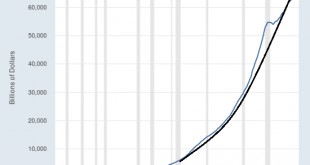

Read More »If “Getting Ahead” Depends on Asset Bubbles, It’s Not “Getting Ahead,” It’s Gambling

Given that the economy is now totally and completely dependent on inflating asset bubbles, it makes no sense to invest for the long-term. Beneath the endlessly hyped expansion in gross domestic product (GDP) of the past two decades, the economy has changed dramatically. The American Dream boils down to social and economic mobility, a.k.a. getting ahead through hard work, merit and wise investments in oneself and one’s...

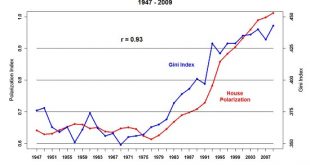

Read More »How Empires Fall: Moral Decay

There is a name for this institutionalized, commoditized fraud: moral decay. Moral decay is an interesting phenomenon: we spot it easily in our partisan-politics opponents and BAU (business as usual) government/private-sector dealings (are those $3,000 Pentagon hammers now $5,000 each or $10,000 each? It’s hard to keep current…), and we’re suitably indignant when non-partisan corruption is discovered in supposed...

Read More »America’s Forced Financial Flight: Fleeing Unaffordable and Dysfunctional Cities

The forced flight from unaffordable and dysfunctional urban regions is as yet a trickle, but watch what happens when a recession causes widespread layoffs in high-wage sectors. For hundreds of years, rural poverty has driven people to urban areas: cities offer paying work and abundant opportunities to get ahead, and these financial incentives have transformed the human populace from largely rural to largely urban in the...

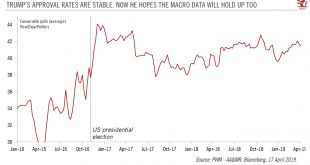

Read More »Business cycle could define Trump’s re-election chances

President Trump’s focus on getting re-elected in November 2020 may have implications for his economic policy choices. As we move closer to the 2020 presidential election, Trump has been blatantly leaning on the Federal Reserve to be more accommodative and has been trying to appoint nominees who share his preference for loose monetary policy to the Fed board. The countdown to the 2020 elections also seems to be prompting...

Read More »The Next Financial Crisis Won’t Be Caused by Fraud: This Time Will Be Different

Extreme levels of debt and overvaluation characterize the entire global economy, and are not limited to any one nation or sector. Financial crises come in two flavors: fraud and credit-valuation over-reach.Fraud-based financial crises may differ in particulars, but they share many traits: perverse incentives are institutionalized; the perverse incentives reward figuring out how to evade oversight via fraud,...

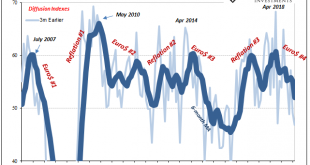

Read More »Green Shoot or Domestic Stall?

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it...

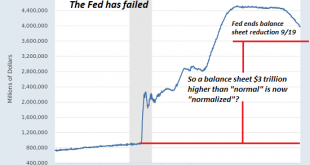

Read More »No Fix for Recession: Without a Financial Crisis, There’s No Central Bank Policy Fix

There are no extreme “fixes” to secular declines in sales, profits, employment, tax revenues and asset prices. The saying “never let a crisis go to waste” embodies several truths worth pondering as the stock market nears new highs. One truth is that extreme policies that would raise objections in typical times can be swept into law in the “we have to do something” panic of a crisis. Thus wily insiders await (or trigger)...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org