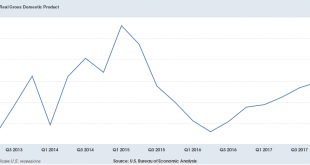

The Q2 GDP report (+4.1% from the previous quarter, annualized) was heralded by the administration as a great achievement and certainly putting a 4 handle on quarter to quarter growth has been rare this cycle, if not unheard of (Q4 ’09, Q4 ’11, Q2 & Q3 ’14). But looking at the GDP change year over year shows a little different picture (2.8%). The US economy is definitely accelerating out of the 2016 slowdown. The...

Read More »Our “Prosperity” Is Now Dependent on Predatory Globalization

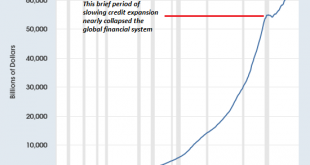

Nowadays, trade and “prosperity” are dependent on currencies that are created out of thin air via borrowing or printing. So here’s the story explaining why “free” trade and globalization create so much wonderful prosperity for all of us: I find a nation with cheap labor and no environmental laws anxious to give me cheap land and tax credits, so I move my factory from my high-cost, highly regulated nation to the low-cost...

Read More »The Fantasy of “Balanced Returns” Funding Retirement

Consider how a “balanced portfolio” yielding “balanced returns” worked out for middle class retirees in Venezuela. The fantasy that a “balanced portfolio” yielding “balanced returns” will fund a stable retirement for decades to come is widely accepted as a sure thing: inflation will stay near-zero essentially forever, assets such as stocks and bonds will continue yielding hefty income and capital gains, and all the...

Read More »Global Asset Allocation Update – (VIDEO)

[embedded content] Economic thoughts and analysis from Alhambra Investments CEO Joe Calhoun. Related posts: Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update Global Asset Allocation Update: Tariffs Don’t Warrant A Change…Yet Global Asset Allocation Update: The Certainty of...

Read More »We’ll Pay All Those Future Obligations by Impoverishing Everyone (How to Destroy Our Currency In One Easy Lesson)

The only way to pay all these future obligations is by creating new money. I’ve been focusing on inflation, which is more properly understood as the loss of purchasing power of a currency, which when taken to extremes destroys the currency and the wealth/income of everyone forced to use that currency. The funny thing about the loss of a currency’s purchasing power is that it wipes out every holder of that currency, rich...

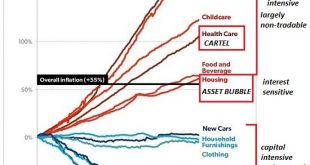

Read More »The 21st Century Misery Index: Labor’s Share of the Economy and Real-World Inflation

Isn’t it obvious that those at the top of the wealth-power pyramid don’t want us to know how much ground we’ve lost while they’ve gorged on immense gains? In the late 1970s and early 1980s, an era of stagflation, the Misery Index was the unemployment rate plus inflation, both of which were running hot. Now those numbers are at 50-year lows: both the unemployment rate and inflation are about as low as they can go,...

Read More »Global Asset Allocation Update

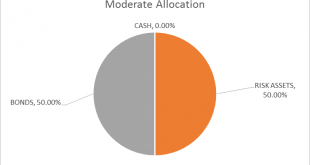

The risk budget is unchanged again this month. For the moderate risk investor, the allocation between bonds and risk assets is evenly split. The only change to the portfolio is the one I wrote about last week, an exchange of TIP for SHY. Interest rates are on the rise again, the 10 year Treasury yield punching through 3% again this morning. That is an indication that growth and/or inflation expectations have risen...

Read More »Russia Sells 80 percent Of Its US Treasuries

Description: In just over 2 months Russia has sold-off over 85% of its holdings of U.S. Treasuries, should the U.S. be concerned? – Russia has liquidated 85% of its US Treasury holdings in just two months – Russia dumps over $90 billion of Treasuries in April and May as holdings collapse from near $100 billion to just $9 billion – Deepening geo-political tensions between Russia and U.S. and Russian concerns about the...

Read More »Here’s What We’ve Lost in the Past Decade

The confidence and hubris of those directing the rest of us to race off the cliff while they watch from a safe distance is off the charts. The past decade of “recovery” and “growth” has actually been a decade of catastrophic losses for our society and nation. Here’s a short list of what we’ve lost: 1. Functioning markets. Free markets discover price and assess risk. What passes for markets now are little more than...

Read More »Here’s How Systems (and Nations) Fail

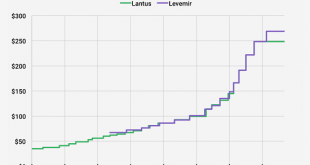

These embedded processes strip away autonomy, equating compliance with effectiveness even as the processes become increasingly counter-productive and wasteful. Would any sane person choose America’s broken healthcare system over a cheaper, more effective alternative? Let’s see: the current system costs twice as much per person as the healthcare systems of our developed-world competitors, a medication to treat infantile...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org