Recurring Phenomena Many market participants believe simple phenomena in the stock market are purely random events and cannot recur consistently. Indeed, there is probably no stock market “rule” that will remain valid forever. However, there continue to be certain statistical phenomena in the stock market – even quite simple ones – that have shown a tendency to persist for very long time periods. In today’s report I...

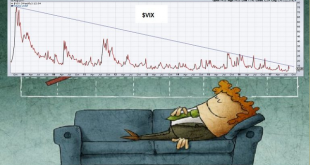

Read More »Is Historically Low Volatility About to Expand?

Suspicion Asleep You have probably noticed it already: stock market volatility has recently all but disappeared. This raises an important question for every investor: Has the market established a permanent plateau of low volatility, or is the current period of low volatility just the calm before the storm? When such questions regarding future market trends arise, it is often worthwhile to examine market history. For...

Read More »Prepare for Another Market Face Pounding

“Better than Goldilocks” “Markets make opinions,” goes the old Wall Street adage. Indeed, this sounds like a nifty thing to say. But what does it really mean? The bears discover Mrs. Locks in their bed and it seems they are less than happy. [PT] Perhaps this means that after a long period of rising stocks prices otherwise intelligent people conceive of clever explanations for why the good times will carry on. ...

Read More »Russell 2000: The Dangerous Season Begins Now

Old Truism Readers are surely aware of the saying “sell in May and go away”. It is one of the best-known and oldest stock market truisms. And the saying is justified. In my article “Sell in May and Go Away – in 9 out of 11 Countries it Makes Sense to Do So” in the May 01 2017 issue of Seasonal Insights I examined the so-called Halloween effect in great detail. The result: in just two out of eleven international stock...

Read More »“Sell in May”: Good Advice – But Is There a Better Way?

Selling in May, With Precision If you “sell in May and go away”, you are definitely on the right side of the trend from a statistical perspective: While gains were achieved in the summer months in three of the eleven largest stock markets in the world, they amounted to less than one percent on average. In six countries stocks even exhibited losses! Only in two countries would an investment represent an interesting...

Read More »“Sell in May and Go Away” – in 9 out of 11 Countries it Makes Sense to Do So

An Old Seasonal Truism Most people are probably aware of the saying “sell in May and go away”. This popular seasonal Wall Street truism implies that the market’s performance is far worse in the six summer months than in the six winter months. Numerous studies have been undertaken particularly with respect to US stock markets, which confirm the relative weakness of the stock market in the summer months. What is the...

Read More »Strange Moves in Gold, Federal Reserve Policy and Fundamentals

Counterintuitive Moves Something odd happened late in the day in Wednesday’s trading session, which prompted a number of people to mail in comments or ask a question or two. Since we have discussed this issue previously, we decided this was a good opportunity to briefly elaborate on the topic again in these pages. A strong ADP jobs report for March was released on Wednesday, and the gold price dutifully declined...

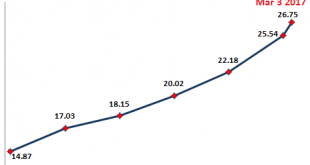

Read More »Boosting Stock Market Returns With A Simple Trick

Systematic Trading Based on Statistics Trading methods based on statistics represent an unusual approach for many investors. Evaluation of a security’s fundamental merits is not of concern, even though it can of course be done additionally. Rather, the only important criterion consists of typical price patterns determined by statistical examination of past trends. Systematic trading on the basis of statistical...

Read More »Speculative Blow-Offs in Stock Markets – Part 2

Blow-Off Pattern Recognition As noted in Part 1, historically, blow-patterns in stock markets share many characteristics. One of them is a shifting monetary backdrop, which becomes more hostile just as prices begin to rise at an accelerated pace, the other is the psychological backdrop to the move, which entails growing pressure on the remaining skeptics and helps investors to rationalize their exposure to...

Read More »Speculative Blow-Offs in Stock Markets – Part 1

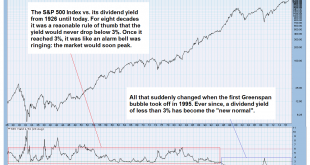

Defying Expectations Why is the stock market seemingly so utterly oblivious to the potential dangers and in some respects quite obvious fundamental problems the global economy faces? Why in particular does this happen at a time when valuations are already extremely stretched? Questions along these lines are raised increasingly often by our correspondents lately. One could be smug about it and say “it’s all...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org