Actions and Reactions Down markets, like up markets, are both dazzling and delightful. The shock and awe of near back-to-back 1,000 point Dow Jones Industrial Average (DJIA) free-falls is indeed spectacular. There are many reasons to revel in it. Today we shall share a few. To begin, losing money in a multi-day stock market dump is no fun at all. We’d rather get our teeth drilled by a dentist. Still, a rapid...

Read More »Seasonality of Individual Stocks – an Update

Well Known Seasonal Trends Readers are very likely aware of the “Halloween effect” or the Santa Claus rally. The former term refers to the fact that stocks on average tend to perform significantly worse in the summer months than in the winter months, the latter term describes the typically very strong advance in stocks just before the turn of the year. Both phenomena apply to the broad stock market, this is to say, to...

Read More »US Stocks – Minor Dip With Potential, Much Consternation

It’s Just a Flesh Wound – But a Sad Day for Vol Sellers On January 31 we wrote about the unprecedented levels – for a stock market index that is – the weekly and monthly RSI of the DJIA had reached (see: “Too Much Bubble Love, Likely to Bring Regret” for the astonishing details – provided you still have some capacity for stock market-related astonishment). We will take the opportunity to toot our horn by reminding...

Read More »How to Buy Low When Everyone Else is Buying High

When to Sell? The common thread running through the collective minds of present U.S. stock market investors goes something like this: A great crash is coming. But first there will be an epic run-up climaxing with a massive parabolic blow off top. Hence, to capitalize on the final blow off, investors must let their stock market holdings ride until the precise moment the market peaks – and not a moment more. That’s...

Read More »Too Much Bubble-Love, Likely to Bring Regret

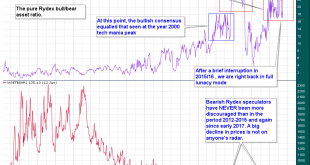

Unprecedented Extremes in Overbought Readings Readers may recall our recent articles on the blow-off move in the stock market, entitled Punch-Drunk Investors and Extinct Bears (see Part 1 & Part 2 for the details). Bears remained firmly extinct as of last week – in fact, some of the sentiment indicators we are keeping tabs on have become even more stretched, as incredible as that may sound. For instance, assets in...

Read More »The FOMC Meeting Strategy: Why It May Be Particularly Promising Right Now

FOMC Strategy Revisited As readers know, investment and trading decisions can be optimized with the help of statistics. One way of doing so is offered by the FOMC meeting strategy. The rate hikes are actually leading somewhere – after the Wile E. Coyote moment, the FOMC meeting strategy is especially useful - Click to enlarge A study published by the Federal Reserve Bank of New York in 2011 examined the effect of...

Read More »Punch-Drunk Investors & Extinct Bears, Part 2

Rydex Ratios Go Bonkers, Bears Are Dying Off For many years we have heard that the poor polar bears were in danger of dying out due to global warming. A fake photograph of one of the magnificent creatures drifting aimlessly in the ocean on a break-away ice floe was reproduced thousands of times all over the internet. In the meantime it has turned out that polar bears are doing so well, they are considered a quite...

Read More »Punch-Drunk Investors & Extinct Bears, Part 1

The Mother of All Blow-Offs We didn’t really plan on writing about investor sentiment again so soon, but last week a few articles in the financial press caught our eye and after reviewing the data, we thought it would be a good idea to post a brief update. When positioning and sentiment reach levels that were never seen before after the market has gone through a blow-off move for more than a year, it may well be that...

Read More »2018: The Weakest Year in the Presidential Election Cycle Has Begun

The Vote Buying Mirror Our readers are probably aware of the influence the US election cycle has on the stock market. After Donald Trump was elected president, a particularly strong rally in stock prices ensued. Contrary to what many market participants seem to believe, trends in the stock market depend only to a negligible extent on whether a Republican or a Democrat wins the presidency. The market was e.g. just as...

Read More »Why Monetary Policy Will Cancel Out Fiscal Policy

Remarkable and Extraordinary Growth Good cheer has arrived at precisely the perfect moment. You can really see it. Record stock prices, stout economic growth, and a GOP tax reform bill to boot. Has there ever been a more flawless week leading up to Christmas? Here’s what really happened: the government’s minions confiscated everything Santa had on him when he crossed the border and then added it to GDP. - Click to...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org