The Sharp Move in the VIX Accelerates In Monday’s trading session, the upward move in the volatility index VIX (which measures the implied volatility of SPX options) continued unabated, vastly out of proportion with the move in the underlying stock index. “Brexit” fears continue to grow, which has apparently been the driving force behind this move. The “Brexiteers” are gaining support as the referendum date draws...

Read More »Stocks Set Another Valuation Record

Believe It Or Not… There Actually Is Some Downside Risk BALTIMORE – Not much action in the stock market last week. A few little steps ahead to over the 18,000 line for the Dow. Then a few little steps back. Currently the index sits at 17,732. DJIA, daily Fed chief Janet Yellen has made it clear she won’t do anything to disturb investors’ sleep. But that doesn’t mean they won’t have nightmares. Our research department...

Read More »Twitter’s Other Growing Problem – A Surging Share Count

Home of the Anti-Bubble It seems like almost everybody has an opinion about Twitter (TWTR) – both the company and the stock. As for the company it seems that their “window of opportunity” to massively succeed has essentially closed as user growth and revenue have both slowed, quite dramatically, over the past 18 months. Plus management turnover is clicking at a rapid pace. Company executives typically do not leave if the firm’s future seems bright. Even the ubiquitous Co-Founder/CEO,...

Read More »Pareto’s Wily Foxes

Smart Money Fleeing Stocks DUBLIN – The Dow dropped 180 points on Tuesday – or about 1%. And another clever billionaire says he is looking elsewhere for profits. Reuters: “Activist investor Carl Icahn on Monday said there was a chance the stock market could suffer a big decline, saying valuations are rich and earnings at many companies are fueled more by low borrowing costs than management’s efforts to boost results. “I am very cautious on equities today. This market could easily have...

Read More »Share buybacks and dividends with borrowed money: Cure Worse than the Disease

A Week to Remember Today we look back to the recent past with singleness of purpose. Context and edification for the present economy is what we’re after. We have questions… How come the recovery has been so weak? Why is it that, nearly seven years after the official end of the Great Recession, the economy’s still mired in a soft muddy quagmire? Squinting, focusing, and refocusing, there’s one particular week that rises above all others. Photo credit: Talks at Google Hank the...

Read More »Corporate Tax Receipts Reflect Economic Slowdown

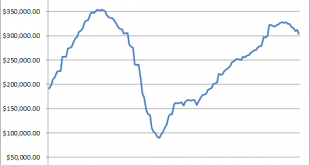

Tax Receipts vs. the Stock Market Following the US Treasury’s update of April tax receipts, our friend Mac mailed us a few charts showing the trend in corporate tax payments. Not surprisingly, corporate tax payments and refunds mirror the many signs of a slowing economy that have recently emerged. An overview in chart form follows below. First up, corporate tax receipts in absolute figures. Corporate Tax Receipts Corporate tax receipts in absolute dollars and cents – this is quite...

Read More »Gold and Gold Stocks – Is the Correction Finally Beginning?

Triangle Thrust and Reversal In mid April, we discussed weekly resistance levels in the HUI Index. Given the recent almost blow-off like move in the index and its subsequent reversal, we decided to provide a brief update on the situation. First, here is a daily chart comparing the HUI, the HUI-gold ratio and gold: After building another triangle, the HUI has delivered an upside thrust in the direction of the preceding trend. This is quite normal, and so is the subsequent move back to its...

Read More »Gold Stampede

Better get out of the way… stampeding bisons Stampeding Animals The mass impulse of a cattle stampede can be triggered by something as innocuous as a blowing tumbleweed. A sudden startle, or a perceived threat, is all it takes to it set off. Once the herd collectively begins charging in one direction it will eliminate everything in its path. The only chance a rancher has is to fire off a pistol with the hope that the shot turns the herd onto itself. If the rancher is successful, it...

Read More »The “Canary in the Coal Mine” for Chinese Stocks

The Largest Online Marketplace in the World This company is twice the size of Enron at its peak ($100 billion). Pharmaceutical giant Valeant, which blew up in the last year, was only $90 billion at its peak. Before I get to what the stock is, let me tell you where it is: China. CEO Jack Ma, wagging a finger (bad sign) Photo credit: Kiyoshi Ota / Bloomberg I recently heard an excellent presentation by Anne Stevenson-Yang at Grant’s Spring Investment conference. Stevenson-Yang is the...

Read More »A Historic Rally in Gold Stocks – and Most Investors Missed It

Buy Low, Sell High? It is an old truism and everybody has surely heard it more than once. If you want to make money in the stock market, you’re supposed to buy low and sell high. Simple, right? As Bill Bonner once related, this is how a stock market advisor in Germany explained the process to him: Thirty years ago, at an investment conference, there was a scalawag analyst from Germany. He showed a chart where a stock had gone up steadily for 10 years. He pointed to the bottom, left...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org