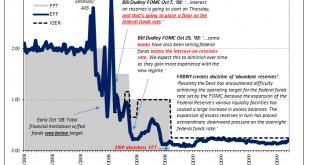

A momentous day, for sure, but one lost in what would turn out to be a seemingly endless sea of them. October 8, 2008, right in the thick of the world’s first global financial crisis (how could it have been global, surely not subprime mortgages?) the Federal Reserve took center stage; or tried to. Having bungled Lehman, botched AIG, and then surrendered to Treasury which then screwed up TARP, the world’s entire financial edifice was burning down while US...

Read More »Golden Collateral Checking

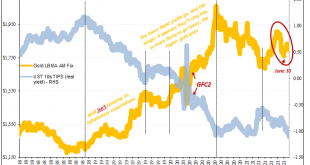

Searching for clues or even small collateral indications, you can’t leave out the gold market. We’ve been on the lookout for scarcity primarily via the T-bill market, and that’s a good place to start, yet looking back to last March the relationship between bills and bullion was uniquely strong. It’s therefore a persuasive pattern if or when it turns up again. To recap the main push of last year’s acute dollar shortage: Over the past several dreadful weeks of...

Read More »Lower Yields And (fewer) Bills

Back on February 23, Federal Reserve Chairman Jay Powell stopped by (in a virtual, Zoom sense) the Senate Banking Committee to testify as required by law. In the Q&A portion, he was asked the following by Montana’s Senator Steve Daines: SENATOR DAINES. I just was looking at the T bill chart and noticing since the 1st of February, the one month rates have dropped in half from 0.06 to today 0.03, two months went from 0.07, to 0.02. We’re starting to get into that...

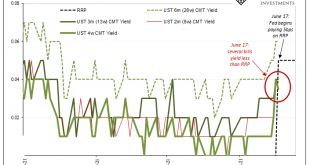

Read More »The FOMC Accidentally Exposes Itself (Reverse Repo-style)

Initially, the dots got all the attention. Though these things are beyond hopeless, the media needs them to write up its account of a more fruitful monetary policy outcome because markets continue to discount that entirely. Dots look like inflationary success if possibly even now more likely, whereas yields and especially bills have (re)taken a more skeptical approach pricing almost no chance for it. Buried in the FOMC minutiae on Wednesday was an upward adjustment...

Read More »FX Daily, May 18: Risk Appetites Return Bigly

Swiss Franc The Euro has fallen by 0.22% to 1.0951 EUR/CHF and USD/CHF, May 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: In Asia, equities markets rallied strongly, led by the more than 5% gain in Taiwan, the most in over a year as Monday’s 3% drop was more than overcome. The Nikkei gained more than 2% despite the deeper than expected contraction in Q1 GDP. Hong Kong, South Korea, and India also rose...

Read More »What Might Be In *Another* Market-based Yield Curve Twist?

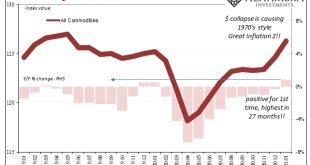

With the UST yield curve currently undergoing its own market-based twist, it’s worth investigating a couple potential reasons for it. On the one hand, the long end, clear cut reflation: markets are not, as is commonly told right now, pricing 1979 Great Inflation #2, rather how the next few years may not be as bad (deflationary) as once thought a few months ago. On the other hand, over at the short end, yields are dropping toward zero again. This steepening isn’t...

Read More »Two Seemingly Opposite Ends Of The Inflation Debate Come Together

It’s worth taking a look at a couple of extremes, and the putting each into wider context of inflation/deflation. As you no doubt surmise, only one is receiving much mainstream attention. The other continues to be overshadowed by…anything else. To begin with, the US Bureau of Labor Statistics reported today that US import prices were up on annual basis for the first time in some time. Rising in January 2021 by 0.9% year-over-year, this was actually the fastest...

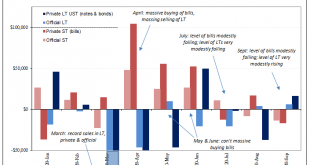

Read More »Just Who Is, And Who Is Not, Selling T-Bills

Are foreigners selling Treasury bills? If they are, this would seem to merit consideration for the reflation argument. After all, the paramount monetary deficiency exposed by March’s GFC2 (and the Fed’s blatant role in making it worse) was the dangerous degree of shortage over the best collateral. Best collateral means OTR, and for standard practice this had always meant Treasury bills (as well as, noted yesterday, bonds and notes just auctioned off). According to...

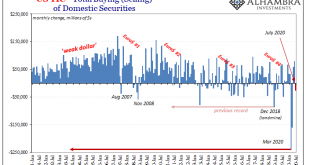

Read More »If Dollar Is Fixed By Jay’s Flood, Why So Many TIC-ked At Corporates in July?

When the eurodollar system worked, or at least appeared to, not only did the overflow of real effective (if virtual and confusing) currency “weaken” the US dollar’s exchange value, its enormous excess showed up as more and more foreign holdings of US$ assets. Mostly US Treasuries, especially in official hands, but not entirely those. That much is perfectly clear; you can actually see the difference on every chart despite all the QE’s and trillions in bank reserves...

Read More »Banks Or (euro)Dollars? That Is The (only) Question

It used to be that at each quarter’s end the repo rate would rise often quite far. You may recall the end of 2018, following a wave of global liquidations and curve collapsing when the GC rate (UST) skyrocketed to 5.149%, nearly 300 bps above the RRP “floor.” Chalked up to nothing more than 2a7 or “too many” Treasuries, it was to be ignored as the Fed at that point was still forecasting inflation and rate hikes. Total financial resilience otherwise. Yesterday was,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org