Submitted by SaxoBank's Dembik Christopher via TradingFloor.com, Currency stability is a prerequisite for China's economic transition Defending the yuan is prohibitively expensive – China cannot beat the market Progressive devaluation managed by PBoC is the most probable scenario for 2016 Remember that the country is on the capitalism learning curve Exchange rates will inevitably be a key discussion point at Shanghai G20 China has moved from being a net importer to a net exporter of capital Shoring up a currency ad infinitum is impossible. The market always wins. The undervalued Chinese yuan is nothing but a bad memory. In the context of competitive devaluations throughout the world, the yuan is now significantly overvalued compared to its main counterparts, primarily the dollar and the euro. If it is to pull off its economic transition, China needs a stable currency, hence its repeated interventions on the exchange markets over the past few months. Over the last year 3 billion was drawn from the foreign exchange reserves without stemming any of the downwards market pressures on the yuan. Over the period is actually lost 5% against the US dollar. This is a significant depreciation for a currency that is used to fluctuating between narrower markers.

Topics:

Tyler Durden considers the following as important: Central Banks, China, Hong Kong, Japan, Monetary Policy, Moral Hazard, Recession, recovery, Swiss National Bank, Trade Balance, Volatility, Yuan, zerohedge

This could be interesting, too:

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes CAPE-5: A Different Measure Of Valuation

Lance Roberts writes Estimates By Analysts Have Gone Parabolic

Lance Roberts writes The Impact Of Tariffs Is Not As Bearish As Predicted

Submitted by SaxoBank's Dembik Christopher via TradingFloor.com,

- Currency stability is a prerequisite for China's economic transition

- Defending the yuan is prohibitively expensive – China cannot beat the market

- Progressive devaluation managed by PBoC is the most probable scenario for 2016

- Remember that the country is on the capitalism learning curve

- Exchange rates will inevitably be a key discussion point at Shanghai G20

- China has moved from being a net importer to a net exporter of capital

Shoring up a currency ad infinitum is impossible. The market always wins.

The undervalued Chinese yuan is nothing but a bad memory. In the context of competitive devaluations throughout the world, the yuan is now significantly overvalued compared to its main counterparts, primarily the dollar and the euro.

If it is to pull off its economic transition, China needs a stable currency, hence its repeated interventions on the exchange markets over the past few months. Over the last year $513 billion was drawn from the foreign exchange reserves without stemming any of the downwards market pressures on the yuan. Over the period is actually lost 5% against the US dollar. This is a significant depreciation for a currency that is used to fluctuating between narrower markers. By way of comparison, the euro, which floats freely on the market, lost almost 6% of its value against the US dollar last year.

The increasingly credible assumption of a devaluation before this summer:

Three possible scenarios exist for the Chinese yuan in 2016:

- The progressive devaluation managed by the People's Bank of China

- Continued defence of the currency on the markets

- New Plaza-type Accord

The progressive devaluation managed by the PBoC is the most probable scenario for 2016. This will not interfere with the process of internationalising the yuan, quite the reverse, since it would make it possible to have an exchange rate that is more in line with Chinese fundamentals. The successive devaluations of last August (1.9% on 11 August, 1.6% on 12 August and 1.1% on 13 August) sent an important signal to the market which will therefore not be taken by complete surprise the next time should China repeat the operation.

If this is to succeed, the PBoC must open communication channels with the market by adopting the methods used by central banks in developed countries. The country is on the capitalism learning curve. Consequently, this revolution will not be without teething problems, but it is certainly a necessary step so that investors can gain a better understanding of China’s monetary policy and its optimal exchange rate.

The G20, due take place in Shanghai on 26 and 27 February, could represent an important step in the yuan’s devaluation. The issue of exchange rates will inevitably be a key discussion point. This forum could be the ideal opportunity to provide China with the necessary expertise and could potentially give it free rein to devalue, as has been the case in the past for Japan. In the short term, the main flaw in this scenario would be an increase in monetary disorder, but the market impact would remain limited and would be nothing like the electric shock precipitated by the Swiss National Bank abandoning the EURCHF ceiling, almost exactly one year ago.

If the yuan is not devalued, the PBoC could be forced to continue to defend the yuan on the markets. This is the counterproductive scenario. The interventions on the forex markets come at a cost that is increasingly prohibitive, given their ineffectiveness in stabilising the yuan. China cannot beat the market. At the current path (close to 100 billion dollars per month), the currency reserves could reach the minimum threshold of 2,800 billion dollars recommended by the IMF by the end of June.

The country cannot afford to let its reserves fall much below this ceiling since it provides PBoC with real flexibility to intervene in the event of an external crisis. Were this to happen, China would sooner or later be forced to throw in the towel and let market forces decide the exchange rate of the yuan. PBoC’s credibility would be permanently damaged. China is therefore aware that such an eventuality is unthinkable, which seems to give even more credence to the scenario of the progressive devaluation of the yuan by this summer.

A new Plaza Accord. This is the dream scenario for economists, but certainly the least likely in the medium term, given the lack of monetary policy coordination between developed and emerging countries. Starting from the premise that exchange rate volatility is too high and competitive devaluations that are not signed off at the global level have recessionary effects on economic activity, new Plaza accords could be signed under the auspices of the G20. These would aim to counter the major problems of the world economy: high exchange rate volatility, overvaluation of the yuan and the strength of the American dollar which heightens the risk of recession due to the debt explosion of market players in USD since 2008.

Following the example of 1985, signatory countries could accept to intervene on the currency markets to depreciate the market price of the dollar and the yuan. Swap agreements between the Fed and the central banks of emerging countries could also be set up, as was the case in 2008, between the main central banks of developed countries, in order to ease tensions on the financial markets. However, for such a scenario to be possible, the countries in question must recognise that they have convergent interests and accept the need to act in concert, which is not yet the case.

The thorny problem of capital outflows:

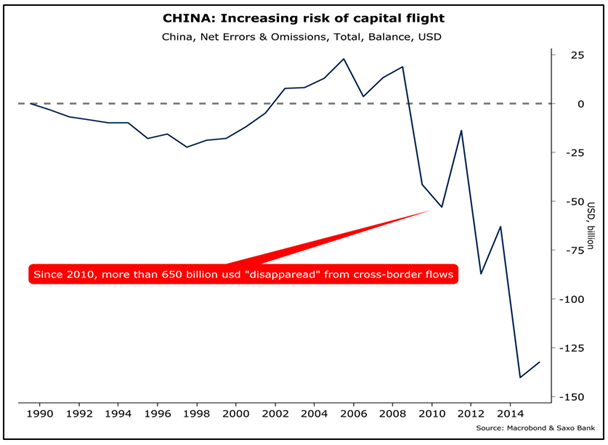

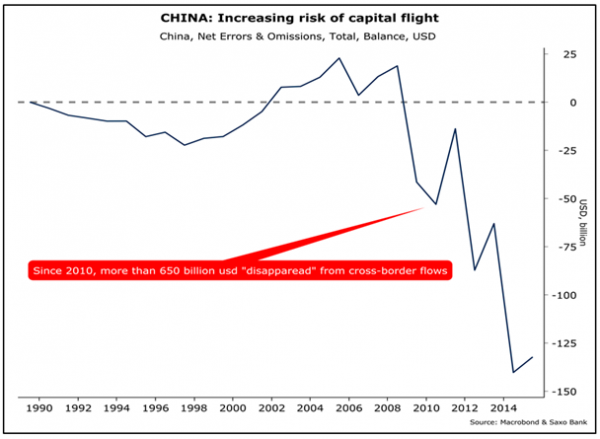

The fall of the yuan is closely correlated with capital outflows. This is difficult to measure precisely given the opaque way in which Chinese statistics are calculated. Our low estimate leads us to conclude that almost 650 million dollars in capital have flowed out of the economy since 2010, based on the change in the "net errors and omissions" in the trade balance. The actual total amount is certainly much higher, but this estimate confirms that contrary to what was commonly admitted, China has moved from being a net importer to net exporter of capital. Despite the 4,000 billion yuan recovery plan presented at the end of 2008, China has not managed to sufficiently strengthen its economy. Regardless of which is PBoC's preferred scenario, when it comes to stabilising the exchange rate for the yuan, capital outflows must inevitably be restricted.

It would not be a good idea to implement the capital controls alluded to, since this would send a very negative message to foreign investors at the worst possible time. In addition, past experience shows that gaps can always be found in such measures in order to transit capital out of the country through indirect means, such as via Hong Kong, in China's case. For true effectiveness, strict controls are required which would result in the economy being completely stifled. This makes absolutely no sense in this case. China will have no other choice in the years to come, but to offer liberalisation guarantees to foreigners for the domestic capital market and strengthen its financial regulations, which are still very inadequate.

This long process does not exclude new significant corrections on the Chinese stock market or even business bankruptcies that will result in reducing the moral hazard. Nevertheless, what is certain is that a stable exchange for the yuan after devaluation could help reassure market players. This is after all, the simplest and quickest way to proceed. China does not have any other credible, effective levers to restore balance to its economy in the short-term.

Curiously, progressive devaluation would actually aid the internationalisation of the yuan.