On bankunderground, Michael Kumhof, Phurichai Rungcharoenkitkul, and Andrej Sokol question that foreign savings is an important driver of US current account deficits: Consider how US imports can be paid for in the real world: first, by transferring existing domestic or foreign bank balances to foreigners, which involves no new financing. Second, by borrowing from domestic banks and transferring the resulting bank balances to foreign households, which involves domestic but not foreign...

Read More »Determinants of (Low) Real Interest Rates

On his blog, James Hamilton summarizes a Bank of England working paper by Lukasz Rachel and Thomas Smith on the determinants of low real interest rates.

Read More »The Euro Glut: The Summer 2015 Update

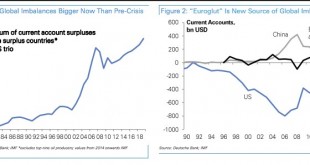

One of the first to use the word “euro glut” was Deutsche Bank’s George Saravelos. His idea of the euro glut is that European banks and investors drive the euro down despite the massive European current account surplus and the high European household savings rates of 12% compared to 4% in the US. Saravelos argues that ECB easing will lead to some of the “largest capital outflows in the history of financial markets”. This would counter the “European savings glut” created by savings and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org